Your Beginner’s guide to Cryptocurrencies

Disclaimer: This article serves as a general guide to educate and provides some insight from my personal experience of investing in cryptocurrencies. It does not constitute financial advice. You should always seek your own professional financial advisor and do your own research before investing or trading.

The parabolic rise of Cryptocurrency market in later part of 2017 & the much-needed correction at the start of 2018.

If you’ve heard about cryptocurrencies & blockchains on the news or all over your news feeds in social media and now you’re either looking to start or have already started investing, you’re at the right place! The crypto market grew to slightly over $800 billion USD back in 8 January 2018, corrected drastically to a low of $297 billion USD, and is now currently at slightly below $300 billion USD (27/3/2018), newcomers are still streaming in and it’s getting adopted by many businesses as well.

So where do newbies start? There’s a total of 1589 cryptocurrency listed on coinmarketcap.com and dozens of exchanges currently. The world of cryptocurrencies can be quite overwhelming for newcomers, it takes plenty of time to understand on how to get started.

In this article, I’m going to summarize the basics and the essentials that all newcomers should know. This includes crypto wallets and how to use them, how to trade, where to trade, what to look for in a good project, and tips that I’ve personally learned from my experience since 2017.

Content

Here are the topics I’m going through in this article:

Wallets

Wallets are like digital storage for your tokens — think of it like how you would with your own physical wallet

Exchanges

How to buy and sell tokens on exchanges

Trading Cryptocurrencies

How to trade, and things to know about the crypto market

Security & Safety

Tips on maximising security for your assets and how to avoid phishing scams, etc.

General tips & Advice

Advice that I’ve found helpful from my own experiences, from trading, to research, etc.

Resources

Useful resources to learn more about blockchain technology behind cryptocurrencies, keep up with crypto news, communities to engage in, and more.

Wallets

Wallets are like your digital storage; different wallets store different tokens.

To trade any crypto, you first need a wallet to store them, eg: Bitcoin needs to be kept in a Bitcoin wallet, Ethereum in an Ethereum wallet. Wallets are exactly like they sound, they’re like a digital storage.

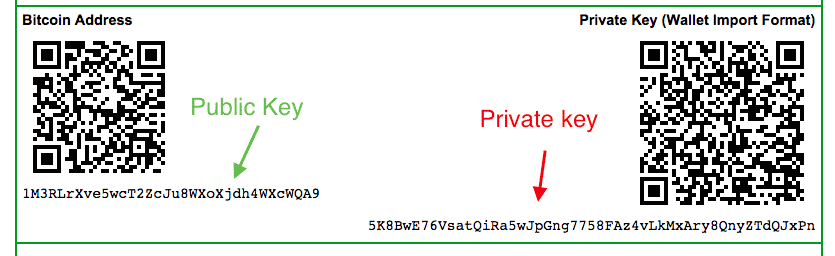

Unlike physical wallets, your crypto wallets have a ‘name’ — which is what we commonly refer to as the public address/key. In order for you to receive tokens in your wallet, you will need to provide your public address in order for the sender to send the tokens.

Your crypto wallets have an inbuilt password protecting it as well — you will need it to unlock your wallet in order to send tokens to other public addresses. This password is known as the private key. Never let anyone get their hands on this!

How your public key and private key would look like (note that it’s common to have QR codes, which are included for convenience — otherwise you would have to take forever to key your keys one by one)

Types of Wallets

Although online wallets are the most convenient for trading, they are also often regarded as the least safe. If you have your tokens on an exchange, you can trade with them immediately. However, there are a few main types of wallets:

Online Wallets

All exchanges offer online wallets, to allow you to send and receive tokens. For example, Coinbase or MyEtherWallet.com. It is highly recommended to store tokens offline to reduce risks of hacks, phishing attempts, and also the collapse of exchanges.

Desktop Wallets

Desktop wallets are computer programs that store your tokens locally on your PC or laptop. One of the primary advantages of the desktop wallet is that it offers complete control of the currency to the users, without having to rely on any third party interface.

Mobile wallets

These are app-based wallets that you can download and install on your smartphones, examples include Eidoo for both Android & iOS. The primary advantage of mobile wallets is that it allows users to quickly access and easily use their coins in a physical retail store.

Paper Wallets

Paper wallets are basically a print out of your wallet’s public and private keys, along with a QR code you can scan. A private key is basically a sequence of letters and numbers (much like a long password), that you, and ONLY you should know, in order to unlock your wallet and access your tokens. Coindesk has a guide on how to create a paper wallet.

Hardware wallets

These are the most secure way to store your tokens. Hardware wallets are completely offline (often referred to as cold storage). Hardware wallets do not support every token out there, so you will need to find out if the tokens you want to store are supported by the hardware wallet. Popular options are the Ledger Nano S and the Trezor Hardware Wallet. To learn more about wallets, click here.

Exchanges

Unlike other markets (Stocks, Forex, etc.), crypto exchanges are global and are 24/7.

To start trading, there are a few key points to take note:

- Only a few exchanges allow you to buy Bitcoin with Fiat currency (your domestic currency, such as SGD, USD).

- Bitcoin & Ethereum are the most common trading pair, meaning in order to invest in other tokens or projects, you’ll most likely only be able to trade/buy it against Bitcoin or Ethereum. Thus, you will need to hold Bitcoin or Ethereum to make most trades.

- In a situation where the token you’re buying is in an exchange that only offers Crypto-to-Crypto pairings, you will need to buy Bitcoin with Fiat currency on a platform that provides Fiat-to-Crypto pairings. After doing so, send your Bitcoin to the particular platform to trade.

Eg. VeChain is listed on Binance. Firstly, I would have to deposit SGD or USD in Coinbase to buy Bitcoin. Next, send my Bitcoin to my Binance’s wallet. Lastly from Binance I would use the Bitcoins I have to purchase Vechain. - Most exchanges are not regulated, invest at your own risk.

- Unlike the stock exchanges, crypto exchanges have no opening and closing hours, they are always open, 24/7, 365 days, globally.

Popular Exchanges

Based in the United States, Coinbase is one of the largest Bitcoin exchanges in the world. Coinbase currently only allows you to buy four cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. You can buy them directly with your credit card with a $250 weekly limit. This limit can be increased if you complete some identity verification requirements. They charge a 3.99% processing fee.

Click here to register now! (Registration is free)

PROS

- High liquidity and buying limits

- An easy way for newcomers to get bitcoins

- “Instant Buy” option available with credit card or debit card

CONS

- Purchases made with bank transfer can take up to 5 days to complete

- Coinbase may track how and where you spend your bitcoins

CoinHako is a Bitcoin broker based in Singapore, backed by investors from the USA. They accept bank transfers from Singapore or Malaysia and international bank wires. You can also top up your CoinHako account using Xfers, which allows you to buy bitcoins within 10 minutes.

Click here to register now! (Registration is free)

PROS

- Super fast way to purchase bitcoins in Singapore

- Fees are reasonable at 1%

- Verification

- Trusted and established exchange

CONS

- Not private for larger amounts since identity verification is required

- Other payment methods have a limit of 200 SGD without verification

Launched in 2015, Gemini is a respected exchange platform which allows traders to trade Bitcoins, Ethereum, and USD. This platform not only allows the users to buy and sell Bitcoins and Ethereum but also is also popular for its two-sided auctions. This auction facilitates all the Gemini customers an exact time and platform to trade the bitcoins. Gemini is supported in the USA, Singapore, Canada, UK, Hong Kong, South Korea and Puerto Rico.

Click here to register now! (Registration is free)

PROS

- Trustworthy & Secure

- Transparent & Reasonable Fees

- High Volume Exchange

- Fiat Deposits & Withdrawals

- Easy to Use

CONS

- Limited Currencies Available

- No Phone Support

- No Margin Trading

- Only US Dollar Transfers

Based in Hong Kong, Binance was only launched in early 2017, however, they quickly pivoted their platform to open up to the western part of the world and they’ve catapulted to become one of the largest exchanges by volume. I personally recommend Binance because of their superior user interface, ease of use, lower fees (with the use of their Binance token to facilitate trades), and the selection of alt coins they trade.

Click here to register now! (Registration is free)

PROS

- Support for close to 100 cryptocurrencies

- Offers the Binance in-house BNB token for reduced trading fees

- High liquidity

- Capable of processing 1.4 million transactions per second

- Backed by an established team with a proven track record in crypto and finance

- Bounty and reward programs for the community

CONS

- Some users have reported difficulty with the Android version of the mobile app.

- Some users have reported delays when withdrawing certain coins from Binance.

*Because it’s a new platform, it’s hard to assess its long-term viability.

Trading Cryptocurrencies

Now that you understand how wallets work and you’ve discovered the exchanges you can trade on, it’s time to learn how the trading mechanics work in the crypto world.

Trading pairs — In BTC or ETH values

Most trading interfaces are similar across all exchanges, there’s a few main concepts to understand, which are quite similar to Forex. The only key difference, is that most tokens are traded against Bitcoin, or Ethereum instead of SGD or USD. Eg. BTC/USD, VEN/BTC, VEN/ETH

It’ll take a bit getting used to, but it’s a good habit to conduct your trades referencing not just your native Fiat currency, but also the value against Bitcoin or Ethereum. Here’s a full chart breaking down the units.

Making a Trade

- Limit Order

This allows you to set a price you want to buy/sell a token at, and specify the quantity you want. This is a good way to automatically fill a buy/sell order at a future time when the price hits your profit target. - Market Order

This is the quickest way to buy/sell a token in the market at the current rate. It’s commonly used to buy/sell a token immediately. - Stop Limit

This basically allows you to automatically trigger an order at a set price. It’s commonly used for setting stop loss for your trades.

Security & Safety

I’m sure many of you may have heard stories of lost private keys, stolen Bitcoins, hacked exchanges, etc. When there are so many assets at stake, it’s important to take every security measure possible, even if it may add some additional inconvenience. The peace of mind that your investment and hard-earned money is kept safe and secure is invaluable.

Enable two-factor authentication (2FA)

This is the first thing anyone investing should immediately enable after you register on an exchange or any location where you store your tokens. All exchanges have this option, so enable it! 2FA ensures that even if your login ID and password are compromised, hackers cannot get into your account unless they also enter a time-sensitive 6-digit code, that only you can access on your phone.

To set up two-factor authentication:

- Download Google Authenticator, both Android & iOS are supported.

- Navigate to where you can enable 2FA for your account on the exchange/website/ app.

- You should see a QR code, simple scan it with the Google Authenticator app or you can just input the key.

- Take down the key on hard copy as back up. That’s it!

After activating, every time you login to your account, it will additionally ask you for a 6-digit, time-sensitive code as an extra security, before access to your account is granted.

Other than Google Authenticator, Authy can manage your 2FA as well with the similar methods above, it can sync with multiple devices, in case you change or lose your phone/device, you can always recover your 2FA codes.

Use long & secure passwords or a password manager

It might be a hassle to dig it up every time you want to login to trade or check your balances, but that process is much more seamless if you take advantage of secure, password managers that help you generate and remember every login ID/password for all exchanges you trade on.

I recommend either 1Password or LastPass.

General tips & advice

Common mistakes to avoid

Sending tokens to the wrong wallet address — Once you send your coins to an incorrect address, it is irrecoverable. Always ensure you double checked the send/receive address.Invest what you can afford to lose — Cryptocurrency is an ultra-high-risk investment, similar to traditional investment you should invest what you can afford to lose as the money you put in could very well be worthless one day.

Think Smart — Don’t be fooled by the price. Just because the token is cheap doesn’t mean it has a lot of upside potential. Supply & market cap MATTERS. Eg. It is impossible to Ripple or XRP to reach $100–200 due to the enormous supply.

FOMO (Fear of missing out) — Quite often, when a coin is surging in price or making a bull run, 20–30% gain is common, it’s tempting to want to buy in and catch the wave. I strongly suggest avoiding rushing in to buy a trade, as most likely, by the time you buy in, the price will start to correct and you’ll be stuck holding at a loss.

HODL (Hold on for dear life) — The more you trade cryptocurrencies, the more you’ll notice people say “Just HODL.”. Originally a typo on a Bitcoin forum, it’s now become a meme and a general trading strategy that means to hold long term. It’s sensible advice and one that I personally follow and found effective. Simply hold onto your investments throughout the highs and the lows. Avoid day trading. As the markets grow, so will your investments.

Buy the dips — Over time, you’ll start to notice cycle in the crypto market, and there are usually periods of bull runs (strong rise in pricing), followed by a correction. These corrections (or dips) are the perfect time to add to your position and inject more money into your portfolio.

Dollar cost averaging — Since not everyone can time the market perfectly, investors buy a fixed dollar amount of a particular investment on a regular schedule, regardless of the price. The investor purchases more when prices are low and fewer when prices are high.

Diversify your portfolio — There are a few categories of projects that have a natural synergy and near-term applications with blockchain technology and others that are more long-term potentials or moonshots. Other than reducing risk, it’s also important to diversify your portfolio to ensure you cast a wider net to bet on different categories to ensure you don’t miss out on any opportunities. I personally suggest looking at the following categories: Currencies (BTC, VTC), Platforms (ETH, NEO), Supply-chain (VEN, WTC, Wabi), Privacy focused (ZCash, XVG).

Always do your own research — Since the crypto-market is currently unregulated, there are a lot of scam projects/ ICOs or simply money-grabs out there. Hence, you should always, do your own due diligence before investing your hard-earned money.

There are lots of factors that you should consider when judging if a project is a good investment, here’s a few of them:

- Team — Is the team experienced, do they have a reputable background? Are they real, verified identities?

- Technology — Are they building real tech that contributes to a need or solves a problem? Are they in active development?

- Token — While some projects may have a good concept, it doesn’t necessarily mean it will be a good investment. It’s important to understand whether the token you are purchasing will have properties that will make it increase in value over time. You’re investing in hopes that the price will go up, so the token should have incentives for it to do so, with real utility.

- Timeline — Does the project have a roadmap? Do they have real, clearly defined goals? What kind of goals have they set and when will they be launched? Understanding the timeline is important to know whether it’s the right time to invest. If there are no foreseeable milestones until a year later, it would be wiser to invest elsewhere in the short term.

- Product — Do they already have a working product? The fact that there is a working product/prototype would reduce the risk significantly. Most of the coins in coinmarketcap.com are ERC20 tokens which have zero utility, so do take note!

Resources

DataDash, a YouTuber that provides great insights in regards to the Crypto world, he’s a one-stop shop for all things related to cryptocurrencies, data analytic & science:

https://www.youtube.com/channel/UCCatR7nWbYrkVXdxXb4cGXw

Philakone, a Crypto trader that provides tutorials to educate the community:

Zenith Crypto Signals, an All-in-One free crypto channel that provides accurate news & signals and educational materials for the community:

https://t.me/zenithcryptosignals

Conclusion

Blockchain technology and cryptocurrencies, as of today, are still in its infancy, and there’s a bit of a learning curve to fully understand the space. I personally find it quite fascinating to witness this explosion of wealth, innovation, and technology. It’s reminiscent of the early days of the internet, and there’s no better time than now to invest in projects you believe in, for potentially life-changing returns on investment.

So buckle up, place your bets, learn about all the various projects, and watch as the industry reaches mainstream adoption in the years to come. Good luck!

Thanks for reading!

What should I cover next? Leave a comment below!

Found this post helpful? Clap!

Want to see more posts like this? You can help by donating:

BTC: 1GA5RaMX8t4Cxw789GBrrGDR52xFDaxu61

ETH: 0x1c7ec692baeda9126b9ba3730b5c0b6da787cd23

LTC: LXAZdw5Wc8bLTFkfULjCSEHoGE9vDoWmTG

Or signup with my referral links:

Coinbase:

https://www.coinbase.com/join/59df9453e12b510111d60839

CoinHako:

https://www.coinhako.com/referrals/sign_up/CHIAYAOHU_468687

Binance:

www.binance.com/?ref=11511637

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/a-beginners-guide-to-getting-started-with-cryptocurrencies-76027bebb1b1

Congratulations @alsonchia, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps that have been worked out by experts?