Distributed Credit Chain(DCC) improving the Blockchain Ecosystem Technology

Pertaining in distribution, decentralization is a way in which breaking up of original excessive premiums that may result from important data asymmetry among committees and also returning such premiums to Credit chain participants. When this is done the achievements of redistribution of ecosystem value as well fair distribution among participants through digital consensus algorithm is profited.

The foundation, Distributed Credit Chain (DCC) will launch a main blockchain to establish business standards, reach consensus on the books, deploy business contracts, implement liquidation and settlement services and so on for a variety of distributed financial business. The fact that all records registered in the blockchain cannot be tampered will enable regulators to penetrate into the underlying assets in real time. It will be possible to develop a new BASEL ACCORD on the management system of blockchain – distributed banks. Establishing a distributed banking system will require up to 5 or maybe 10 years’ process; hoping that offer a period of construction, the distributed bank can become an important node of new finance and traditional credit business.

A credit business is where in the holder of certain currency positions temporarily gives an agreed-upon amount of money at an agreed-upon interest rate to a borrower, who will later pay the principal and the interest according to terms and period as agreed. This is one of the most important activities in the financial market, and it is orderly managed and has a huge development in the society. The history of the credit business goes back to the very beginning of human civilization when there was demonstration and praticalisation of economic activity.

In addition, credit is necessary, that is there is a possibility of massive expansion and progress of human civilization.

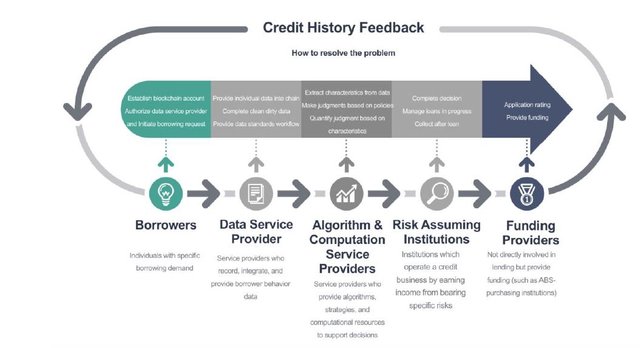

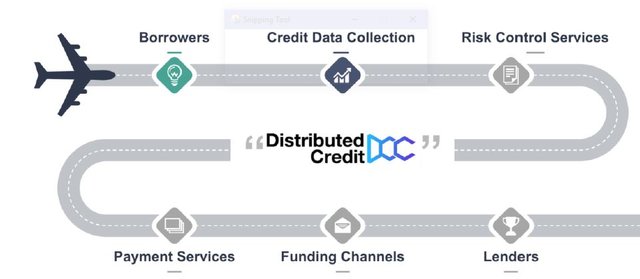

The Distributed Credit Chain is used to centralize financial intermediary and its aimed to provide the average Americans with savings and loans resources. The Distributed Credit Chain applies some solutions with the block chain technology in real business scenarios and develop a new super credit ecosystem that benefits the world. These solutions are the traditional credit business, centralized credit service, credit Dilemma brought by centralized service which emphasizes on cost, efficiency, Borrower’s interest, Joint Debt and profiteering. More solutions are value of decentralized block chain to credit business; Eliminating Monopoly and profiteering; protecting privacy reasonably, eliminating data monopolies, improving data validation Efficiency and reducing Data use cost; creating Data marketplace, A1 Risk control, Disclosing lending behavior’s and positive data feedback.

The Distributed Credit Chain solves the centralized credit problem by using user Account Identification System, Distributed Credit Maintenance System, Blockchain-based Lending Business which focuses on the data entry, Lending process, credit report, Non-Cooperative Game between participants, and Advantages of Ecosystem which are Efficient, low cost credit business system Cross entity permanent data storage and shared Creditor’s rights record, uniqueness and tamper-proof identity system. The credit reporting system without data island or data monopoly and Asset Securitization with excellent asset liquidity.

Product scenarios also helps the Distributed Credit in the Loan Registration Service and Facilitating Asset Securitization.

The Loan registration service is intended for loans among individuals and is generally divided into 2 types which are the directional loans and non-directional loans. The directional occur when two parties reach an agreement on the loan office, then download the loan receipt software and add each other’s certificate respectively and eventually complete the signing of an electronic loan contract on distributed credit chain where payment partners complete the capital transfer simultaneously. The non-directional loans, the borrowers initiate a loan application through DAPP on Distributed credit chain when the lender is not designated. The application will include the amount, duration, interest rates, repayment methods of the loan the tamper-proof personal data integrated and stored on the chain by data service providers for the borrower.

The Facilitating Asset Securitization is also divided into 2 parts which are the mortgage claims Registration and The ABS Asset Distribution. The Facilitating Assets Securitization, since the fund provider is not the owner of the asset, it will have a natural distrust in the authenticity of assets’ historical performance, which results in its excessive costs in hiring external agencies for verification.

In the Distributed Credit Chain, the usefulness of SWIM as the network layer protocol is needed. SWIM is an acronym for scalable, Weakly, Consistent, infection-style and process group membership protocol. Its purpose are as follows: Scalable means it can be used to build tens of thousands of large-scale P2P Networks-Weekly-Consistent means it doesn’t emphasize strong consistency for the member relation view of the nodes. Infection style means it Disseminate information fast through the gossip style message exchange protocol.

More features of SWIM in distribution credit chain are the core layer, which contains Book storage, world status cache, functional smart contract engine and virtual machine, Account, Consensus algorithm. Interactive layer contains the open APL and cross-chain adaptation.

In conclusion the Distributed Credit Chain Distribution plan is based on the cyber sheng foundation plans to issue a total of 10,000,000,000 of the encrypted digital currency DCC. In privates’ rounds, famous qualified investors in the field of credit and banking will be invited for the investment, with the fundraising percentage no more than 18% and the investment amount of a single investor no less than 100 ETH. At this stage, DCCs will be looked with 25% of the total to be unlocked before the opening of exchange and another 25% to be unlocked every two months, with full amount to be unlocked in 6 months.

In ICO rounds 200,000,000 DCC will be issued to Non-Chinese and American investors. All these will be directly circulated. DCC token will be exchanged by ETH. The Contributions in the token sale will be held by the Distributor or its affiliate after the token sale and Contributors will have no economic or legal right over or beneficial interest in these contributions or the assets of that entity after the token sale. The sale would be ran and operated wholly independently of the foundation, the Distributor and the sale of DCC.

Important Informations:

Website: https://dcc.finance/

WhitePaper: https://dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/DccOfficial

Facebook:https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

Medium:https://medium.com/@dcc.finance2018

Twitter: https://twitter.com/DccOfficial2018/

Author: https://bitcointalk.org/index.php?action=profile;u=2170055