The Future of Cryptocurrency: Are You Ready?

Introduction:

In the past decade, cryptocurrency has transformed from an obscure concept into a global financial revolution. With Bitcoin's rise in popularity, followed by the emergence of thousands of altcoins, the digital currency ecosystem has expanded rapidly. But what does the future hold for cryptocurrency? Will it replace traditional currencies, or will it remain a niche investment tool? Let’s explore the possibilities.

Types of Cryptocurrency:

Cryptocurrencies come in different forms, each serving a unique purpose. Here are some of the most prominent ones:

Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

Ethereum (ETH): More than just a currency, Ethereum enables smart contracts and decentralized applications (DApps).

Litecoin (LTC): A faster and lighter version of Bitcoin, designed for efficient transactions.

Ripple (XRP): Focused on revolutionizing cross-border payments with its high-speed transaction capability.

With thousands of cryptocurrencies available today, the diversity within the blockchain space is expanding rapidly.

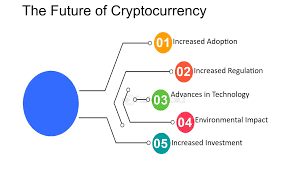

The Future of Cryptocurrency:

The future of cryptocurrency is a topic of endless debate. Some experts believe that digital currencies could replace traditional fiat currencies due to their decentralized nature and ability to reduce transaction costs. Central banks are even exploring Central Bank Digital Currencies (CBDCs) as an alternative.

However, mainstream adoption depends on factors such as government regulations, technological advancements, and market acceptance. If cryptocurrencies gain legal recognition worldwide, we could witness a future where digital assets become the primary medium of exchange.

Benefits of Cryptocurrency:

Cryptocurrency offers numerous benefits that make it an attractive option for businesses and individuals alike:

Security: Blockchain technology provides enhanced security, making it nearly impossible to manipulate transactions.

Transparency: Every transaction is recorded on a public ledger, ensuring complete transparency.

Speed & Low Costs: Unlike traditional banking, crypto transactions are faster and come with minimal fees.

Financial Inclusion: Cryptocurrencies allow unbanked individuals to access financial services.

Challenges of Cryptocurrency

Despite its advantages, cryptocurrency still faces several challenges:

Regulation: Governments worldwide have different stances on crypto, leading to uncertainty.

Volatility: Cryptocurrency prices are highly volatile, making them risky for everyday transactions.

Security Risks: While blockchain is secure, crypto exchanges and wallets remain vulnerable to hacking.

Overcoming these challenges will be crucial for widespread adoption.

Conclusion

Cryptocurrency has come a long way and continues to evolve at a rapid pace. While challenges remain, the benefits of digital currencies cannot be ignored. As blockchain technology improves and regulations become clearer, we could be heading towards a new era of digital finance.

What do you think? Will cryptocurrency replace traditional money, or will it remain a speculative asset? Share your thoughts in the comments!

.jfif)

.jfif)