Total crypto market cap shows strength even after the Merge and Federal Reserve rate hike

Large numbers of the main 80 cryptographic forms of money dropped by 15%+ in the previous week, however the Tie premium in Asia-based fates markets shows brokers resist the urge to panic.

Digital currencies have been in a bear pattern since mid-August after they neglected to break over the $1.2 trillion market capitalization obstruction. Indeed, even with the ongoing bear pattern and a fierce 25% remedy, it has not been sufficient to break the three-drawn out rising pattern.

The crypto markets' total capitalization declined 7.2% to $920 billion in the seven days prompting Sept. 21. Financial backers needed to leave nothing to chance in front of the Government Open Business sectors Panel meeting, which chose to build the loan fee by 0.75%.

By expanding the expense of getting cash, the money related power plans to check inflationary strain while expanding the weight on purchaser finance and corporate obligation. This makes sense of why financial backers created some distance from risk resources, including securities exchanges, unfamiliar monetary standards, items and digital currencies. For example, WTI oil costs surrendered 6.8% from Sept. 14, and the MSCI China securities exchange file dropped 5.1%.

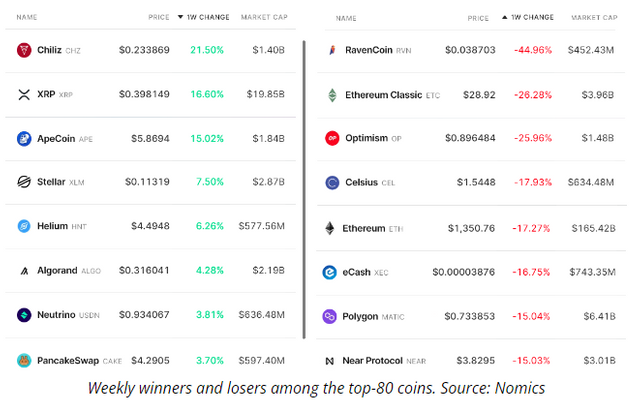

Ether (ETH) likewise saw a 17.3% remember during the seven-day time frame and numerous altcoins performed far more terrible. The Ethereum network Consolidation and its ensuing effect on other GPU-mineable coins caused a few slanted results among the most terrible week by week entertainers.

Chiliz (CHZ) revitalized 21.5% following two effective fan token send-offs from MIBR esports group and the VASCO soccer group from Brazil.

XRP acquired 16.6% after Wave Labs required a government judge to quickly lead whether the organization's XRP token deals disregarded U.S. protections regulations.

ApeCoin (Gorilla) acquired 15% as the local area expects the marking project to send off, which will be definite by Horizen Labs on Sept. 22.

RavenCoin (RVN) and Ethereum Exemplary (And so forth) remembered a large portion of their benefits from the earlier week as financial backers understood the hash rate gains from Ethereum diggers didn't be guaranteed to change over into higher reception.

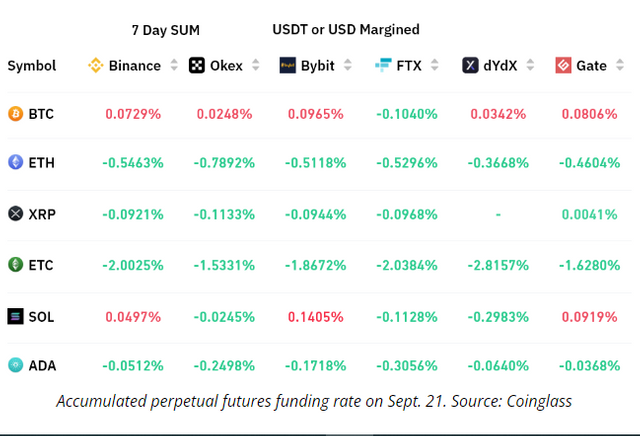

As depicted above, the accumulated seve-day funding rate was negative for every altcoin. This data indicates excess demand for shorts (sellers), although it could be dismissed in Ether’s case because investors aiming for the free fork coins during the Merge likely bought ETH and sold futures contracts to hedge the position.

More importantly, Bitcoin's funding rate held slightly positive during a week of price decline and potentially bearish news from the FED. Now that this critical decision has been made, investors tend to avoid placing new bets until some new data provides insights on how the economy adjusts.

Overall, the Tether premium and futures' funding rate show no signs of stress, which is positive considering how badly crypto markets have performed.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

News by: Coin Telegraph

Claim Your $500 Amazon Gift Card!

Claim now : https://bit.ly/3DM3IrM