What you should know about CryptoCurrency vs Fiat currency #1

At first sight Bitcoin and other CryptoCurrencies, also known as Altcoins seems to be no different than fiat currency, issued by central banks all over the world.

Cryptocurrencies are to most people a difficult to understand intangible kind of money.

The majority of the people who are familiar with and using Bitcoin and other Altcoins at the moment are between 24 and 39 years. So there is a huge part of the population that have not heard of or know what cryptocurrencies are.

Users of the virtual currencies would have no problem using an independent currency instead of the government controlled currency which is constantly being created out of thin air.

Few people know that Bitcoin is just a side product of a technological invention called the Blockchain created by Satoshi Nakamoto who is still an unknown person or group of people.

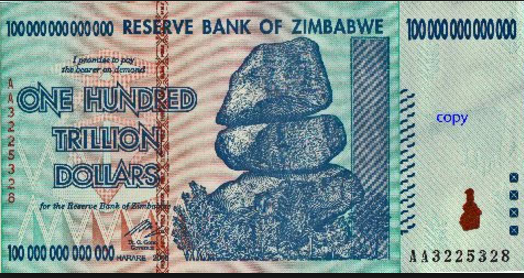

While the number of Bitcoin and the other altcoins is limited, there is no cap on printing fiat currency like the US dollar, the Yen or the Euro resulting in dilution and casing inflation and even hyperinflation.

In Zimbabwe they even had a note of one hundred trillion Zimbabwean dollar which wasn't enough for a bus ticket.

The number of Bitcoins ever to be mined is finite. It is set on 21 million coins and the last one will be mined in 2040. This number is fixed into the bitcoin blockchain and not be changed by anyone. At the moment about 16.603.500 coins are in circulation. The value of the Bitcoin has gone up since it was introduced in january 2009 and will continue to rise because of the influx of users which is growing every day. I think that the value which is at this moment $4250 will go up to $6000 at the end of 2017 and I see it reach $10.000 by the end of 2018.

Some people compare the value of Bitcoin and the other Altcoins to stocks and most investors in stocks cannot comprehend that the value can rise 400% or more in one year, because they are not used to these extraordinary profits.

Stocks as we know them are simply put ,a reflection of how a company is performing and therefore the increase or decrease in price is often limited to one or two digits in percentage on an annual base.

That is what we are used to see but with cryptocurrencies on the other hand everything is possible. I have seen coins triple or more within one day! Often these are ICO coins which are manipulated which is known as pump-and-dump, but the more established cryptocoins can also jump up and down in value in a short timeframe.

The so called established stock investors and bankers just cannot put cryptocurrencies in the same basket so they labels them as a Ponzi scheme, a Tulip mania like phenomenon and a fraud, but cryptos are none of these things nor is it a bubble soon to burst.

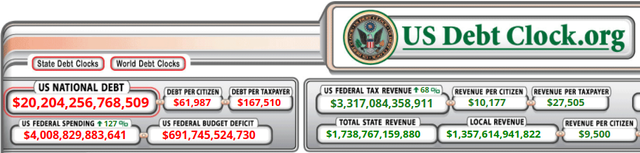

On the contrary : the fiat currency world where central banks are creating unlimited currency will come to an end within 2 years I predict. The US national debt has already exceeded 20 trillion dollars ( http://www.usdebtclock.org/ ) and debts of the european countries can be found here

https://www.debtclocks.eu/public-debt-and-budget-deficits-comparison-of-the-eu-member-states.html

Danny

Disclaimer: I am not a financial advisor nor is this financial advice . Please do your own research on the topics in this post

Nice post Danny

Thanks.....hope you snepped it :)

Congratulations @globalcash! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!