As Pandemic Struck, Cryptocurrencies Failed A Key Test

Untethered from the machinations of modern-day monetary policymakers, cryptocurrencies have long been lauded for their "safe haven" properties.

The novel coronavirus pandemic presented a unique opportunity to finally test these assumptions.

The cryptocurrencies - namely Bitcoin and Ethereum - failed miserably.

Researchers from Dublin have found virtually any portfolio allocations of Bitcoin or Ethereum for any major market index portfolio only increased downside risk (VaR).

The decade-long bull run investors had enjoyed post-GFC was a fecund spawning ground for cryptocurrencies to thrive and grow. But, one major thesis of cryptocurrency enthusiasts was that, similar to gold, they could act as 'safe havens' - hedges against the movements of major market indices and macroeconomic conditions like inflation. The world flush with cash and inflation basically non-existent, the bear market conditions in which to test such assumptions were largely absent.

However, this year, the novel coronavirus pandemic presented an opportunity to finally test these assumptions.

Constraining ourselves to the two largest cryptocurrencies - Bitcoin (BTC-USD) and Ethereum (ETH-USD) - we can find not only did the cryptocurrencies fail to act as a 'safe haven' during this crisis, but as a whole - over the entire period since their inception.

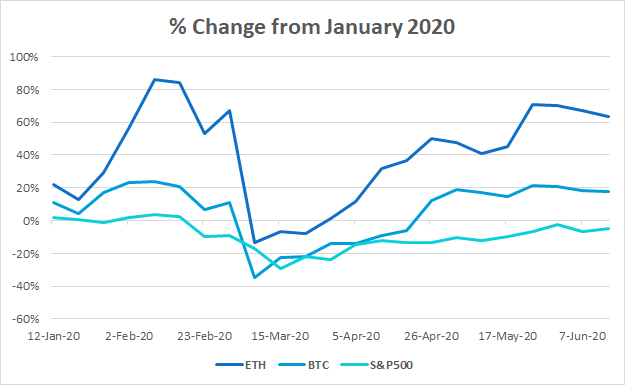

At the height of the pandemic panic, Bitcoin and Ethereum moved in lockstep with the S&P 500 - Ethereum losing over 53% of its value and Bitcoin losing over 47% of its value from the first week of February to the first week of March.

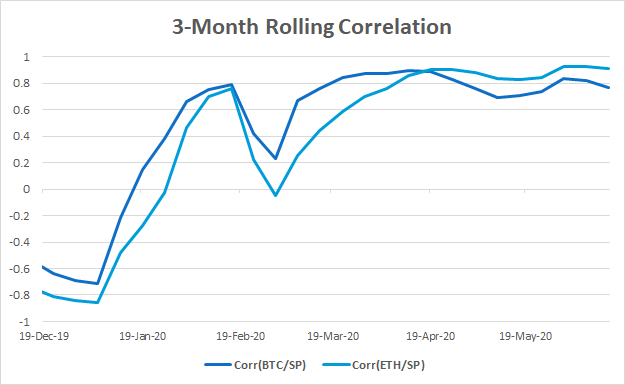

As markets reeled, Bitcoin and Ethereum reeled right along with them, reaching a near perfect positive correlation with the S&P 500 in March.

And even though the cryptocurrencies have come roaring back (as have markets generally) since March - Bitcoin and Ethereum have managed to eke out positive returns YTD, approx. 18% and 64%, respectively - it has not come without great cost.

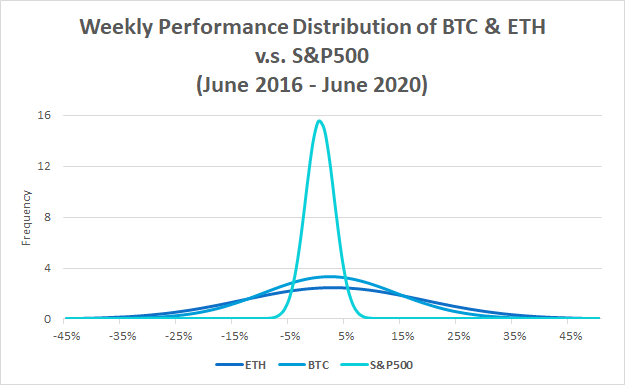

Both during the COVID-19 crisis and since data began being recorded on the value of these cryptocurrencies, Bitcoin and Ethereum have displayed massive volatility, not seen in any other asset class.

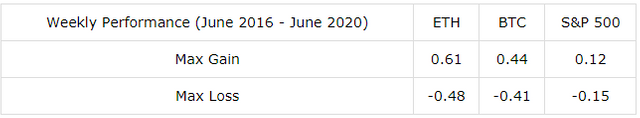

The average weekly gain/loss for the S&P 500 from June 2016 to June 2020 was about 1.48% or -1.75%; contrast that with Bitcoin which had an average weekly gain/loss of 43.82% or -41.49% or Ethereum which had an average weekly gain/loss of 60.56% or -48.14%.

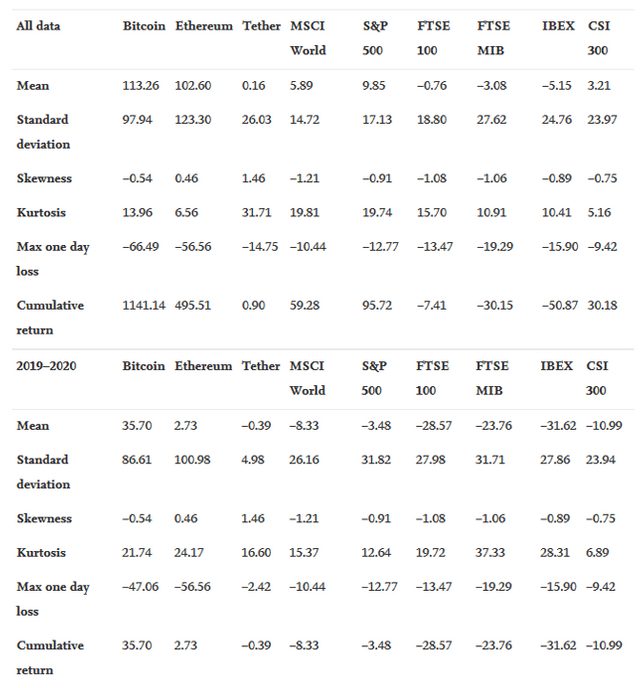

In their article, 'Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic,' published in Research in International Business and Finance, Thomas Conlon, Shaen Corbet, and Richard McGee examine the statistics and elucidate a number of key findings about Bitcoin and Ethereum's incredible volatility:

- While Bitcoin and Ethereum have been found to have significantly higher returns than those of major market indices, they exhibit far greater standard deviation. In the period from April 2010 to April 2020, Bitcoin has experienced an annualized standard deviation of 98%; for Ethereum, since August 2015, that's an even more volatile 123% a year.

- Unlike Bitcoin and the major market indices which display negative skewness, i.e. more extreme negative outliers, Ethereum exhibits positive skewness, a highly unusual property for any asset class.

- Similarly, over the long term, with the exception of the CSI 300, Ethereum exhibits lower kurtosis relative to the major market indices and Bitcoin, suggesting less extreme outliers.

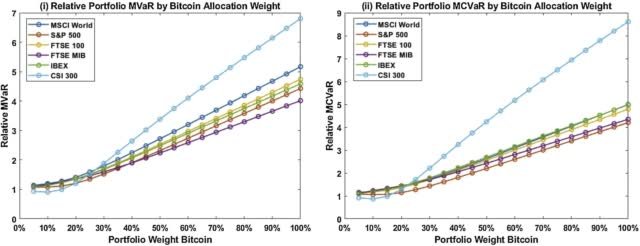

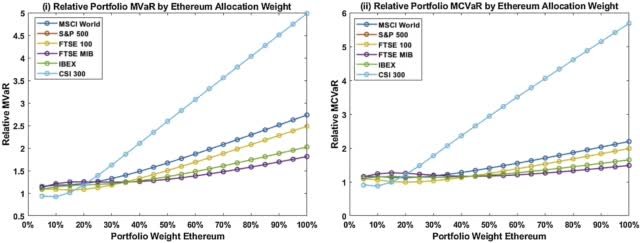

Their more significant finding, however, is that, using a modified value-at-risk equation* as the measure of downside risk, virtually no portfolio with allocations of Bitcoin or Ethereum reduced downside risk.

With the only exception being portfolios containing the CSI 300 index with allocations of up to 16% Bitcoin or up to 14% Ethereum, Bitcoin and Ethereum only served to increase downside risk of the portfolios.

These findings finally debunk the long-held notions about cryptocurrencies as 'safe haven' investments; the data gathered from the coronavirus pandemic has been the final nail in the coffin of that theory. On the contrary, they are extremely speculative, prone to massive deviations in value, and no risk-averse investor should be holding them. That being said, for investors with a high degree of risk tolerance, the outsized returns from cryptocurrencies and volatile markets may be an attractive feature.