MimbleWimble GRIN Coin – Fundamental Analysis – Better than Bitcoin?

In this article, we take a deep dive into the fundamentals of Grin – an exciting cryptocurrency implementing the MimbleWimble blockchain.

On crypto twitter, you may have seen the cashtag $GRIN. Everyone was posting about $GRIN on social media, and the cryptocurrency pumped %50 from $10 to $15 in less than a day. Naturally, my curiosity led me to learn more about the cryptocurrency and from what I've uncovered, I'm intrigued.

What is Grin?

If you have been following Bitcoin for the last year or so, you are probably familiar with its two most prominent issues: Privacy and Scalability. To understand how Grin addresses these issues, you must first enter the Wizarding World of Harry Potter and Hogwarts. That's right...Harry Potter.

Grin is a fascinating project aimed towards solving the inefficiencies of Bitcoin with the implementation of a MimbleWimble blockchain. In Harry Potter, Mimblewimble is a curse useful in dueling that ties the target's tongue in a knot, silencing its victim. Relating to the real world, the MimbleWimble protocol essentially prevents blockchains from revealing personal information about the user.

So, how does MimbleWimble cast its spell?"I call my creation Mimblewimble because it is used to prevent the blockchain from talking about all user's information" - Tom Elvis Jedusor

How Does MimbleWimble Work?

To first understand how MimbleWimble works, we must comprehend information Bitcoin reveals. Bitcoin blabs three secrets about every transaction:1) Sender's address 2) Amount of coins sent 3) Receiver's address

Unlike Bitcoin, Mimblewimble has found a way to validate transactions while keeping the address and amount transacted information hidden. Grin has no amounts and no addresses at all. It hides where a newly created trade originates by relaying privately among peers before announcing to the public network. The concept implemented by MimbleWimble is similar to zero-knowledge proofs and RingCTs used by Zcash and Monero.Using a method called cut-through, MimbleWimble deletes old transactions on the blockchain, thus reducing its size drastically to address scalability issues.

Who is Involved with MimbleWimble and Grin?

On July 19th, 2016 a person operating under the pseudonym "Tom Elvis Jedusor" shared the whitepaper for MimbleWimble. If you are a Harry Potter fan living in France, then you would recognize Tom Elvis Jedusor is the equivalent of Voldemort's real name in French.

After Tom Jedusor proposed the blockchain protocol, excitement quickly grew among Bitcoin and privacy supporters. A few months later a new and improved version of the MimbleWimble whitepaper was released by a mathematician with Blockstream, Adam Poelstra (no Harry Potter reference?). Some have suggested the author of the original MimbleWimble Whitepaper is Greg Maxwell, a colleague of Poelstra at Blockstream and known Harry Potter fan.

Grin is the first implementation of the MimbleWimble blockchain and began coding in late 2016 with a volunteer-based development team.

Fundamental Analysis of Grin

In this section, I analyze the fundamentals of Grin to determine the strength of the project and attempt to provide a valuation. Although Grin has been live for less than a month, it is interesting to see how the project is performing. I like using Fundamental Analysis because it reveals if an investment is worthy of long-term capital allocation, as well as the intrinsic value drivers.

I examine the following:

1) White Paper 2) Decentralization Edge 3) Valuation 4) Community & Developers 5) Relation to Digital Siblings 6) Issuance Model 7) Operating Health of Network

Remember, it is always important to do your own research (DYOR) before investing in any cryptocurrency project.1) Whitepaper

Cryptocurrencies are supported by open-source code, with transparent and approachable communities, there is generally plenty of information readily available. Any cryptocurrency worth its mustard has a white paper outlining its proposal. The Grin website provides detailed information on what it is, how it works, how to get involved in the community, and so on. It also provides a link to the Grin white paper.2) Decentralization Edge

After reading the introduction and conclusion of the white paper, it is clear the problem Grin is trying to solve."Mimblewimble is a design for a cryptocurrency whose history can be compacted and quickly verified with trivial computing hardware even after many years of chain operation. As a secondary goal, it should support strong user privacy through confidential transactions and an obfuscated trans-action graph" - Mimblewimble WhitepaperGrin hopes to achieve dramatically better scaling and privacy properties than Bitcoin. The author states the problem he is trying to solve and offers a solution. It is clear there is a reason for Grin to exist in a decentralized manner.

3) Valuation

Becoming the go-to cryptocurrency for privacy-focused transactions is the best case scenario for Grin. Therefore, I will compare Grin to the most popular privacy-centric coins: Zcash and Monero.Today, the total Market Cap of Zcash is roughly $280 million, and the total Market Cap of Monero is $718 million. For the sake of argument, let's place the total market cap of all privacy coins at $1 billion.

If Grin's network value reaches $400 million market cap in one year, the price of one unit of Grin will be around $13.

In one year, if Grin were able to obtain a market cap of $1 billion, the price of one unit of Grin will be $31+. At a market cap of $2 billion, the cost of one unit of Grin is even higher at $63. Although, is a market cap as high as $2 billion realistic?

To put things in perspective let's take a look at the combined market cap of Zcash and Monero at their peak in 2017 (less than two years ago). The total market of Zcash was around $2 billion, and Monero was about $5.5 billion, combining for a total of $7.5 billion. It's not a far cry to imagine Grin obtain a massive market cap if the cryptocurrency market rises again.

I expect the total market cap of privacy-focused coins to continue to grow in the future. As more people become concerned about their financial privacy, they will turn to coins like Grin to mask their transactions.

4) Community and Developers

Grin has an engaged community as shown by the decent amount of activity on their forum. Additionally, the Grin Twitter Account has 12.6 thousand followers and 7,655 members on Discord. To put things in perspective, the Zcash Company has over 73 thousand followers on Twitter. Grin has a great deal of ground to make up in this capacity.

CryptoCompare has sought to amalgamate developer activity and metrics to make it easier to compare different cryptocurrencies with a Code Repository Points system to assess the strength of a cryptocurrencies development. CyrptoCompare doesn't have a score for Grin yet. Therefore, I will turn to Github to check the activity level.

According to Github, Grin has a total of 1,874 commits and 646 forks of their codebase. This number is far less than Zcash, which has over 12,000 commits and 1,400+ forks of their codebase.

I'm giving Grin the benefit of the doubt because they have been live for less than a month. It's obvious they have a passionate and growing community ecosystem. However, I would like to see more insight on development activity in the future.

5) Relation to Digital Siblings

The concept of validating transactions cloaked in privacy is similar to zero-knowledge proofs and RingCTs used in Zcash and Monero. Additionally, Grin addresses the issues of both privacy and scalability that face Bitcoin. It's safe to say Grin is a blend of Zcash, Monero, and Bitcoin, but operating on the MimbleWimble protocol. Perhaps there is potential Grin could work alongside bitcoin as a side-chain, but for now, this is not a possibility.

It's worth pointing out there is another coin built on top of MimbleWimble, called Beam.

6) Issuing Model

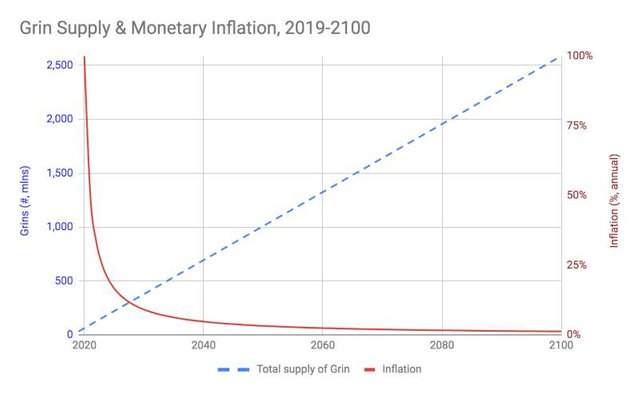

The issuance model of Grin has many similarities to Bitcoin because of the decreasing rate of inflation. Although, Grin has an indefinite supply.

The block reward is 60 Grin with a block target of one minute. Meaning one Grin is issued every second and 60 units of Grin every hour to the total supply. Grin is playing the long-term game when it comes to their supply schedule. Take a look at the below graph:

The total supply of Grin starts at 0. Initially, inflation is high, but as time passes the inflation rate decreases. A high rate of supply issuance in the early days can erode the asset's value if its utility isn't growing in line with expectations.

There was no ICO, no premine, and donations from the community entirely fund the development of Grin. Grin had a successful and honest release, giving the project credibility.

7) Operating Health of Grin Network

Security

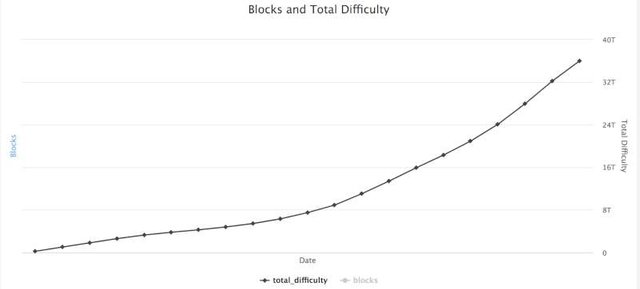

Because Grin uses the Proof of Work (PoW) algorithm, it is relatively easy to assess the security of the network by examining the hash rate. The Grin community is still developing the ecosystem and tools for evaluating the Grin network, so I will work with what I've got.

Hash Rate

One way to determine the security of a cryptocurrency is through its hash rate.

The above graph shows the total difficulty of mining a block trending in a positive direction. More miners are supporting the network, which signifies greater security.

Exchange Support for Grin

Exchange support plays an essential role by providing liquidity and supporting a healthy market. Also, speculation is fun. According to CoinMarketCap, there are a handful of exchanges that support Grin such as Bgogo, Hotbit, BitForex, Gate.io, and others.

Exchanges like GDAX, BitStamp, and Gemini offer an excellent benchmark for a cryptocurrencies validity. These exchanges are considered the cream of the crop because of their due diligence before adding cryptocurrencies. Unsurprisingly, neither of these exchanges list Grin. I didn't expect to see Grin listed on these exchanges, but its nice to some smaller exchanges offering support for the cryptocurrency.

User Adoption

One way to look at user adoption is to look at the number of wallet addresses created. However, at this time these statistics are unavailable. I'm excited to see some actual numbers in the future.

Transaction Chart

By using the transaction fee chart, we can assume that the total number of transactions are increasing and trending in the right direction.

Overall

Cryptocurrency is a very young and immature market.

Grin empowers anyone to transact or save modern money without the fear of external control or oppression. Grin is designed for the decades to come, not just tomorrow and wants to be usable by everyone, regardless of borders, culture, skills or access. I will always support a project with these goals in mind.

However, Grin is EXTREMELY experimental. It will be interesting to see the operating health of the network grows in a few months. Even though I am a huge Harry Potter fan, for now, I am standing on the sidelines and not investing. That could change soon if Grin continues to work its magic!

If you enjoyed reading this analysis, make sure to check out Why TRON Cryptocurrency Will Strike $1 - Fundamental Analysis.

What do you think of MimbleWimble or Grin? Do you think it has the potential to overtake power projects such as Monero or Zcash? Let me know!

Helpful Resources: