Crypto Trading Journal

Introduction

The purpose of this journal is to assist you to calculate your risk, track the progress of current open trades and help you identify what does/doesn't work for you. Most importantly, my aim is to reduce some of the pain in planning and executing trades, freeing your time to analyse charts. This journal is still a work in progress, this version supports Binance, BitMax*, Bittrex, Huobi, Kraken, Kucoin & Poloniex but I have only included BTC and ETH pairs in the journal tabs. I plan to add more exchanges and pairings in future versions.

*When using the Risk Calculator, select Other when using BitMax as CoinMarketCap has yet to add BitMax exchange details. All other functions should work ok.

Getting Started

I have tried to keep this tool as simple as possible, the tl;dr version is: make a copy of this sheet, install the CRYPTOFINANCE add-on and just enter data in the white cells. All coloured cells will be automatically calculated.

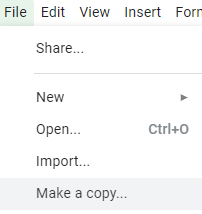

How to Copy a Google Sheet

Note: You will need to be logged into a Google account to continue.

- Make a copy of this sheet by going to File > Make a Copy...

- Name the file and click OK

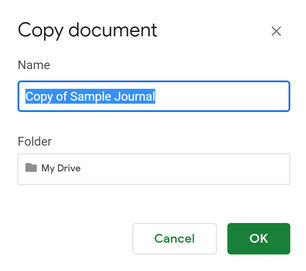

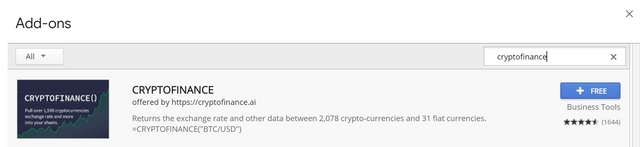

Installing the CRYPTOFINANCE Add-on

In order to get real-time crypto data, you will need to install the CRYPTOFINANCE Google Sheets add-on.

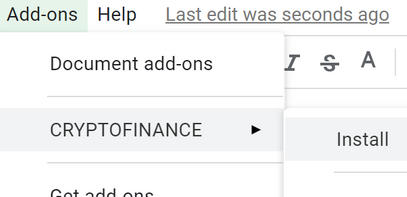

- Select Add-ons > Get add-ons...

- Search CRYPTOFINANCE and click Free

- Then go to Add-ons > CRYPTOFINANCE > Install

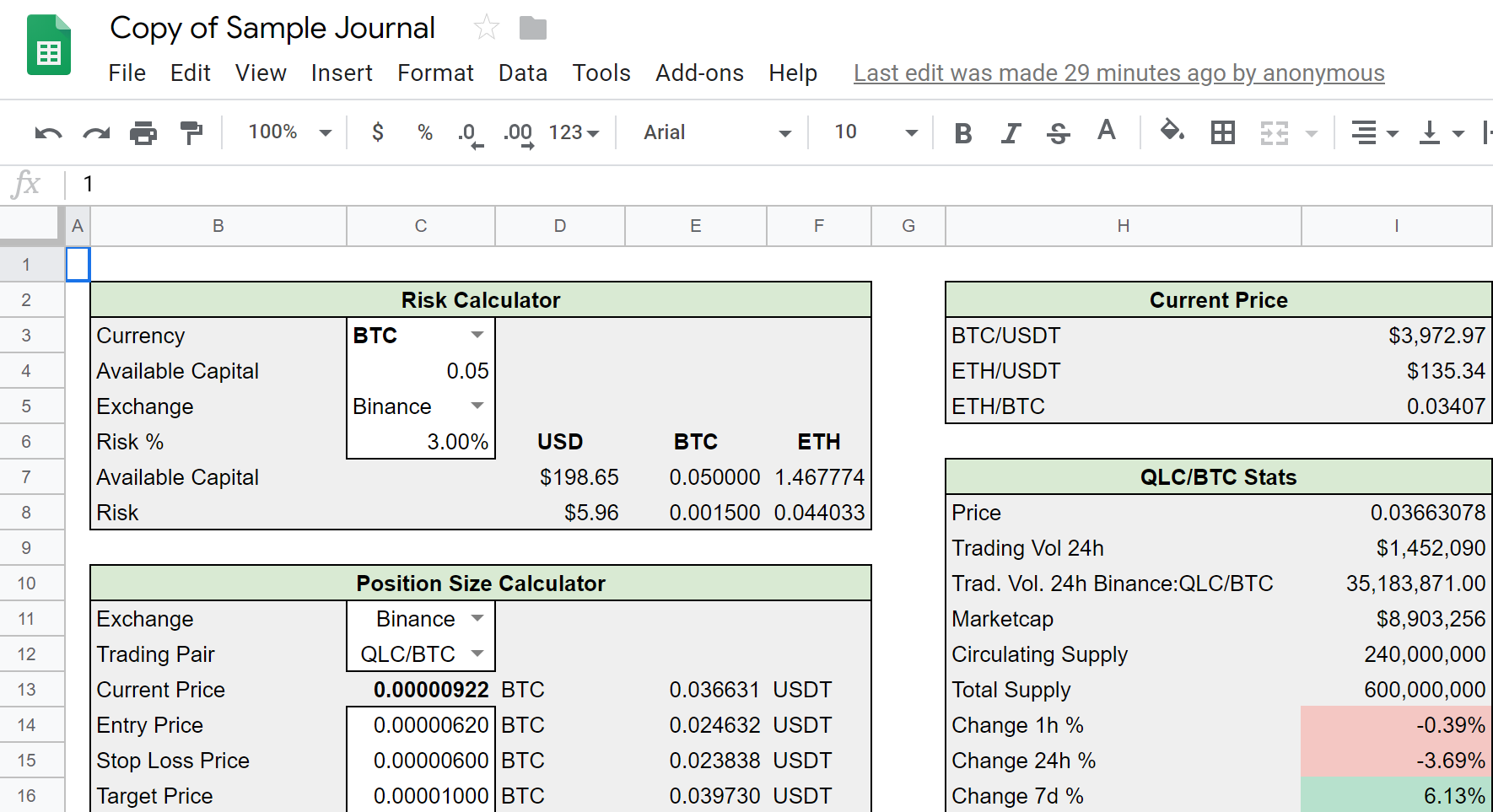

- Go to the Calc tab and wait for the values to load, you may need to refresh the page and be patient as it can take a minute to load. If it's working correctly, you should see something similar to the below screenshot.

Using the Trading Journal

Calc Tab

The Calc tab contains 3 calculators on the left, Risk Calculator, Position Size Calculator & the Average Entry / Exit Price Calculator. On the right, there are 2 stats boxes, Current Price & "XXX/YYY" Stats. For demonstration purposes, I have included a sample trade which I will run through and I'll explain each section as we go.

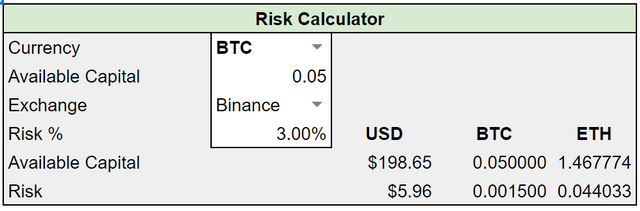

Risk Calculator

Start by selecting the currency you wish to trade with, you can choose between BTC, ETH & USD. For this example, we will go with BTC. The Available Capital will depend on your trading strategy, I wouldn't recommend putting your entire available balance in here as that's poor risk management. For this example, we are using a small percentage of our total available capital.

Select the Exchange you plan to trade on, the prices shown above will be calculated automatically accordingly for this exchange. This will also populate the Current Price section.

Finally, select the Risk %. For new traders, I wouldn't advise risking more than 1%.

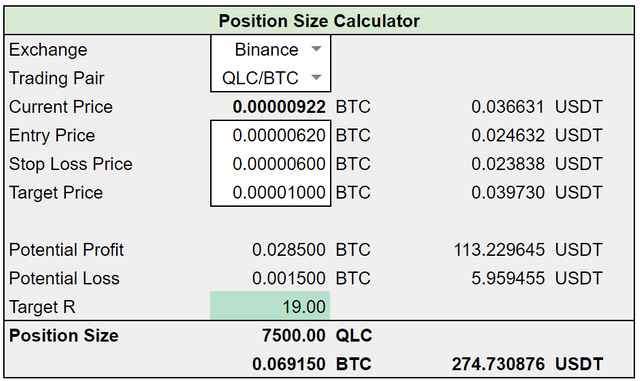

Position Size Calculator

The Position Size Calculator is a powerful tool, this will show you the potential profit or loss based on your entry, stop and target prices. The Potential Loss and Position Size will be determined by the Available Capital and Risk % set in the Risk Calculator.

In this example, I selected the QLC/BTC pair on Binance. Entry, Stop and Target as above.

Target R is the calculated risk to return ratio, I wont be getting into the maths behind this but I recommend reading more on Risk & Position sizing.

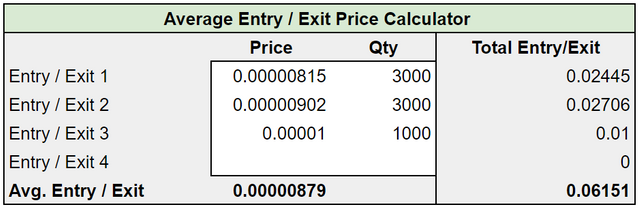

Average Entry / Exit Price Calculator

This calculator is optional, some traders like to scale in/out of trades (this means having multiple entry or exit prices). To keep the journal simple, I have used an Avg. Entry Price & Avg. Exit Price in the journal. As per above screenshot, you can see there are 3 exit prices but not all are equal amounts. This is a weighted average calculator, meaning its works out the average price based on the quantity.

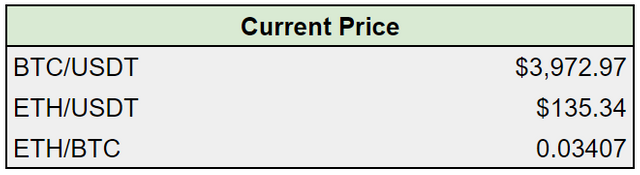

Current Price

This is the current pricing for each pair based on the Exchange selection in the Risk Calculator. If the exchange doesnt support the pair, or if it doesnt return a price, it will display "-" in the price section.

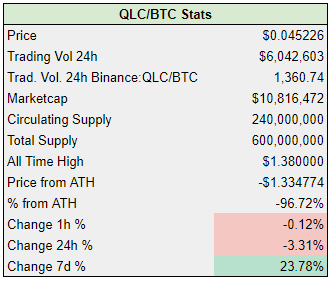

"XXX/YYY" Stats

Again, this section is self-explanatory, this is the current pricing for the Trading Pair selected in the Position Size Calculator. With the exception of Trad. Vol. Binance:XXX/YYY, this info is retrieved from CoinMarketCap which has a quota of 100 requests per day, exceeding the quota will result in an API error. You can pay to remove the quota but all other functions in this journal will continue to work as the rest of the data required obtained directly from the exchange.

BTC & ETH Journal Tabs

After calculating our risk on the Calc tab, we can now enter the data in the fields as I have above. All coloured fields will be automatically calculated, just add the date, select the exchange and pair from the drop-down menus. You can use the Status column to track and filter trades. As you can see above, I have entered the data (entry, stop and target) which we calculated in the Calc tab, the Profit / Distance from Entry will show your current profit on open trades or distance from Entry Price.

Total Position will show the base pair value of the entire position and there are also some check boxes on the right to remind you to set alerts for entry, stop, target, as well as orders for targets and stops.

The Trade Notes section can be used to record the thoughts/motivation behind your setup and further to the right there is a Post Analysis section where you can add notes after the trade is closed. If you execute a lot of trades, this is quite useful to reflect on to see what trading setups work for you and where you may need to improve.

Once you have entered your Avg. Exit Price the P/L on closed trades section at the bottom of the sheet will be populated, this will also be reflected on the P/L tab.

CryptoData Tab

This is where the magic happens, the Calc, BTC and ETH tabs all reference this tab to populate the drop-down boxes. I have added some notes on these pages if you wish to add\remove Exchanges and available pairs.

I hope you find this journal useful. If you have any comments, questions or requests, please post them below. All feedback is welcome, positive or negative, this helps me improve the journal moving forward.

Congratulations @sumusrname! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @sumusrname! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!