Enthusiasm for ICOs remains on the market

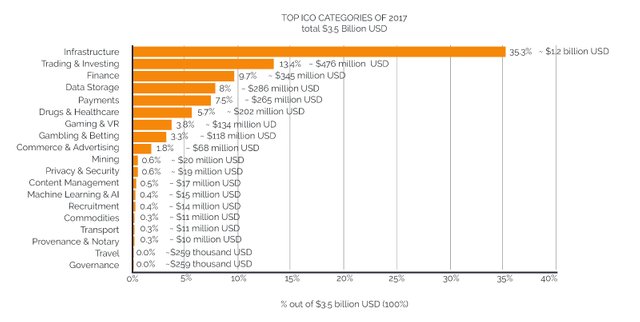

Since the launch of 2017, ICOs have seen a global warming. Amounts accumulated in 2018 show that the trend remains. Two such projects, EOS and Telegram, have accumulated together $ 5.7 billion in 2018. It should be taken into account that the total value of all 870 ICOs in 2017 was 6 billion.

In the first 5 months of 2018, ICOs have managed to raise funds worth over $ 9 billion, according to the CoinSchedule website.

Telegram, for example, has accumulated $ 1.7 billion in its pre-sale period. This amount comes only from accredited investors, and the results have led the company to drop out of the public ICO.

ICO with astronomical figures

Block.one, the company behind the EOS project, ended an ICO on 1 June, which lasted a year. EOS has managed to accumulate a record $ 4 billion. The EOS project is the main competitor for the Ethereum network. The technology is based on the same principles of facilitating the creation of token and dApps.

The new fund-raising model has also been ignored by regulators. Worldwide, governments have tried to find solutions to control the situation. It has been extremely difficult to create legislation that covers all the possibilities that the market generates.

In the US, for example, where securities and financial services legislation is well established, the SEC has managed to stop several projects - from the Tech Tech ICO, promoted by boxer Floyd Mayweather, to AriseBank , a start-up that managed to accumulate $ 600 million in just two months.

Enthusiasm for ICOs requires regulation

The SEC measures proved to be ineffective. Because the enthusiasm for investors' ICOs is still at high levels, regardless of the market price of cryptomonas.

Regulatory authorities around the world are confronted with the same problems as the crypto market. Unclear legislation on this type of project makes it very difficult to identify frauds and scams, as there are very few obligations for ICO initiators.

From the perspective of the authorities, it is difficult to identify illegal practices. Those who know how they operate have attorneys that offer ways to avoid laws because they are not adapted to the crypto market. The fact that digital transactions are encrypted facilitates money laundering. The fact that ICOs are running online makes it impossible to apply local law. The end result of the scams can be social instability and difficult economic problems.

These aspects do not even take into account the rivalry between the old financial models and the digital money market. Investment banks, funds and all the machines on which the underlying economy is based negatively feel the pressure that ICOs put on outdated models of financial markets. A large number of institutional investors are aware of the benefits the emerging market offers and are willing to get involved, but the strength of the system in general is expected and has not yet been felt.

Basically, the entire economic structure has to adapt to major changes of paradigms, and such a revolution in the way people see money is difficult for all the players involved.

.jpg)

Release the Kraken! You got a 5.13% upvote from @seakraken courtesy of @sergiudemerji!