Bitcoin - start of the bounce?

Hello Everyone!

Please welcome my analysis of the current BTCUSD trend. First I will take a look at the high level trend from the daily chart then go through a very recent example of a failed bounce attempt. Then I will analyze the current situation. The most interesting for me is what we can learn from the failure of the last bounce attempt and what to look out for based on that in this bounce.

Daily chart overview

First let's check what happened in the last few days with bitcoin from a technical perspective:

- On 6th of March the big original dump ended.

- On 20th of March the ultimate high of the bounce has formed. Of course this was a lower high compared to the original point, but this is not that important from our current perspective.

- On 26th of February the higher low formed (compared to the original dump and also to smaller "lows")

- On 6th of March a lower high has formed

--> Based on the above my expectation was to have an equilibrium pattern for a few days / weeks which would eventually tighten and break in a bull or bear direction. However this is not what happened: - On 8th of March the pattern broke and produced a lower low. Today is forming a bullish reversal candlestick however the day is not over and I would wait for a confirmation to be sure in this.

I am concentrating on technical analysis, however there are multiple fundamental theories in circulation why this has happened the two most notable in my opinion are the Mt GOX dump and the fears about EU regulation.

Hourly chart - the story of the failed bounce attempt

Yesterday afternoon (in EU time) an interesting bounce attempt took place which failed ultimately, however it can teach us valuable lessons for the future.

- The low of the bounce was formed at 9400, this was the ultimate level to watch for a bear break

- As you can see on the chart above there were lower highs and higher lows which is also an equilibrium pattern. The most interesting is the 10112 higher high / fake bull break. It is a matter of perspective, looking back it is simple to say it was only 15 dollars away from the earlier 10097 high, however at the moment of the high it could be understood as a bull break of resistance. Looking back it was simply a fake bull break and only 15 USD away from a double top.

What followed this was a list of red flags:

- double top (should not be confuses with a lower high which would have been normal)

- higher low patter breaking (first 9719 then 9489.4)

- low of the dump breaking (9400)

Current bounce

After the above, the pattern broke and the fall lead right where we currently are which looks very similar so I will watch out for the above list of red flags!

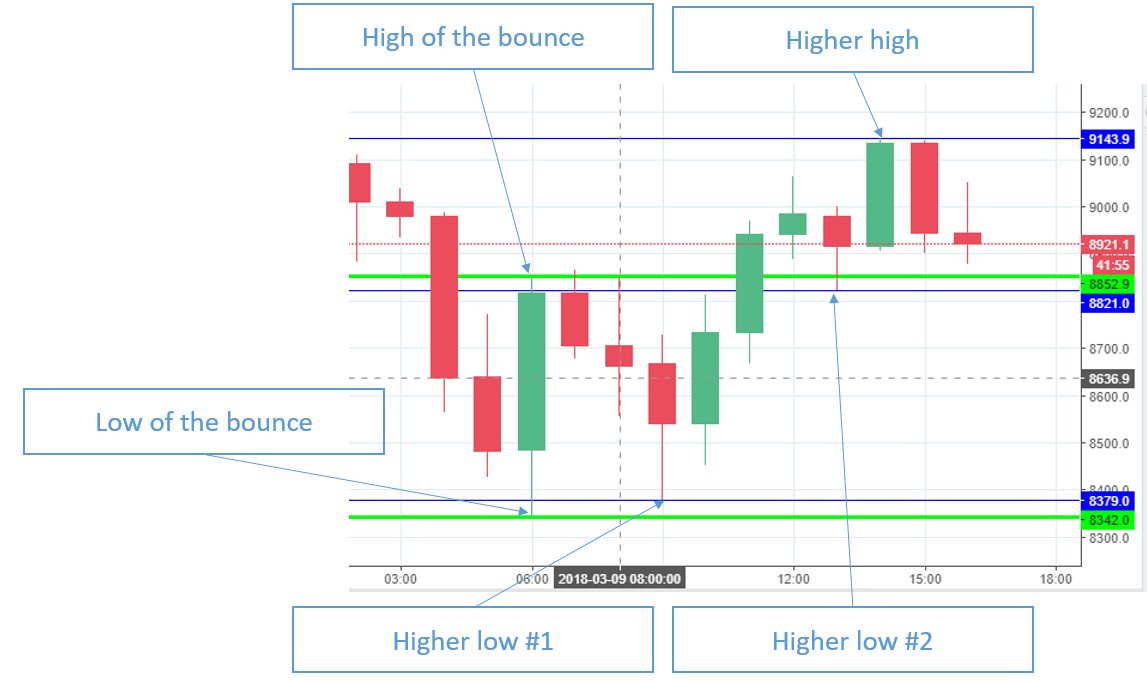

The start of the current bounce looks very similar as the low of the dump has formed and after the initial high a higher low was also created by the bulls. However what happened after is very-very different:

- the high of the bounce was broken bullish at 8852.9 which is a big bull flag!

- then a higher high and a higher low was formed which was even followed up with a higher high at 9143.9

In my opinion if the low currently forming is above 8821 (the current hourly support level) it is a big bull flag. On the other hand if it is a lower low (anything below 8821) that is a red flag. Not the end of the word so the bounce could still succeed but not a good sign.

So red flags to watch out for:

- 8821 support breaking

- 8379 breaking

- but ultimately the 8342 level breaking -> this would be the ultimate red flag

The most serious bull flag on the other hand would be a higher low (above 8821) and ultimately the break of the resistance on 9143.9 which would be a higher high.

Please be aware everything I shared above is just my opinion and is shared only for discussion not as financial advice

Thanks and have fun!