Government, Regulations, and the Cryptocurrency Space

ABSTRACT: This article attempts to deconstruct - in an approachable manner - what is happening in the crypto space in regards to potential government regulation. Underpinning theses drawn from examples will be laid out, which will lead to potential outcomes.

As I've continued on this journey through crypto-land I've found myself confronted with ardent libertarians, rascals, criminals, well-meaning groups, nerdy developers, cool developers, charlatans, kids who have too much time and money, business suits, novice financial consultants, and others just trying to make a buck. I've talked to people who think that bitcoin will bring down governments and that freedom only exists through the blockchain. That is ironic on a philosophical level, if you will indulge me, because freedom comes from being able to change oneself at any moment and the blockchain can encode one's activities into perpetuity for all to see, or at least conjecture on depending on the system.

It's a fascinating, dynamic space that is only in its earliest stages of evolution. I've read several articles here on Steemit detailing that bitcoin can and will, in fact, take over fiat currencies; that crypto is the future and we're just now discovering it. I'm sure the discoverers of fire did not feel the same way - comparing the two in terms of evolutionary/anthropological development. They were probably just happy to have a useful, new tool and to keep warm at night.

There are several pressing concerns that come up with all these voices coming together and creating the cacophony that is the vision of the future for crypto. The following sections will speak to several dynamics that probably are taking part in the formation and development of crypto as a modern, regulated marketplace.

Regulatory lag time

One of the reasons we have not witnessed any real government intervention to this point is that crypto is too cutting edge. For the most part, the history of government regulations and drugs is that the government is usually a step behind whatever new popular drug is out there. Eventually they get caught up on whatever the mood altering substance is, classify the substance, and criminalize it. The key thing here is that they do eventually get caught up. Crypto is not a drug by any means nor is it innately bad or criminal, but it takes time for outsiders to the space (normies) to understand something, explain it in a way to codify it legally, and then apply those new definitions to a concept that will spend the next several years being sussed out in the courts through common law.

An interesting outcome of regulatory lag time is current crypto tax treatment. Now any crypto is treated as a capital asset. So, if one were to hold onto a coin for over a year, one would receive more favorable tax treatment at the long-term capital gains rate. Selling the coin before a year elapses would make the gain or loss beholding to short-term capital gains. In the stock market, securities are bought and sold with dollars, so the accounting for tax time is easier. On the other hand, crypto is often traded one for another and a dollar never enters into the equation directly. As a result, calculating capital gains is very difficult.

Population/volume impact

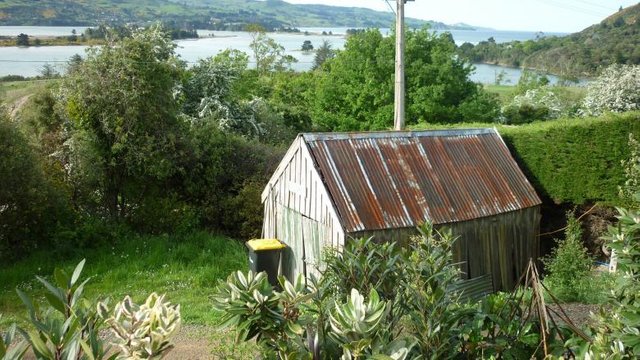

Have you ever noticed that more densely populated states have more laws? The simplest anecdotal example is trying to build a shed. If you live in the county, out in the country and you want to build a shed on your farm, more than likely you can build your shed without asking anyone if you can. On the other hand, if you live in Los Angeles and want to build a shed in back of your building it would require a number of permits won from attending and convincing a board that the shed was in the best interests of the neighborhood. The differences in processes is stark.

The crypto market, in general, is relatively small compared to other markets in the world. On the other hand, it is growing rapidly. As of August 2017 the average daily volume was 525 million to that point for 2017. In August particularly, the average daily volume was 1.04 billion for bitcoin. For comparison's sake, during the same period the slowest day of August for notional value (dollar amount) of traded S&P Mini Futures (/ES) was 72.46 billion. Only two months ago, bitcoin's daily volume represented a fraction of a fraction of one of the slowest days of only one futures product in the stock market (Tastytrade, 2017).

The most relevant point here is that bitcoin's volume is growing. A few years even months ago, it was small and not worth investing the time and effort to codify it legally and apply those laws. However, that is changing. As bitcoin grows it will garner more attention and go from being "out in the county" to being "downtown Los Angeles" if it continues on its current growth trajectory. It is likely too that as more people become involved in the space that there will be more interactions among market participants and as the number of interactions grow so too do the number of conflicts. In the end, action will be demanded to sort those conflicts out. After all, a shed out on the farm does not bother anyone, but a shed blocking a window of the abutting apartment building has an effect on the person living there. It will be seen that some mechanism will have to be put in place to arbitrate the situation, and for the most part people look to their governments. Still, smart contracts may prove, in the long run, to prove more efficient, although in practice this remains to be compared directly through actual use cases.

Identity, illegal activity, and getting away with it

One of the biggest fears of most outsiders to the crypto space is that the currencies are used to conceal and move money without having the government get in the middle of it. For the most part, it would seem as digital currencies are thrust more and more into the mainstream there would be less of this type of activity going on percentage-wise. More usage, thus smaller percentage of illegal or illegal-related activities would be the thinking because the average person does indeed try to pay their taxes. Plus, the negative stereotypes would die off. Yet because of the bad rap digital currencies have gotten it would behoove the government to do something about it in order to ensure that no one was escaping paying their due. And, of course, there are rampant stories of hacks stealing millions from unwitting cryptocurrency holders.

However, that is only one part of it. One of the bigger issues is consumer protection, which would include protections and safeguards from hacking and remuneration if something happens. For instance, recently there has been a clamoring for better oversight and procedures for ICOs (RPX Red Pulse Token ICO Review). This can be construed as odd because on one hand crypto is meant to be a libertarian's paradise, but when something goes wrong people want the guilty parties to be held responsible and look to some entity to give them that justice. This precise dichotomy is going to be one of crypto's most interesting challenges yet.

What to do about the marketplaces?

Because of the relative size, demographics, and characteristics of the crypto market there are several market manipulations that are possible. For instance, many in the crypto space are unaware that pump and dump schemes are illegal in the stock market ("Pump and Dump," Wiki). The common parlance used among crypto traders of "pump and dump" is actually a direct affront to efficient market theory. Ironically, it is paradoxical that libertarian ideology and the underpinning ethos of regulation in the traditional stock market go hand in hand trying to overcome these schemes. Espousing a "pump and dump" is also outright begging for government intervention.

At the moment, the crypto exchanges are not regulated. "Sell walls" and, less regularly, "buy walls" can also be construed as methods to manipulate the price of an underlying coin or token at times. What makes these schemes possible is the outsized percentage distribution of coins among a few holders and the rest of the marketplace. Unironically, larger holders are even welcomed and sometimes elevated in the planning architecture of a project, e.g. Steemit.

That these practices are found in the marketplaces undermines the ability of investors to contribute and exchange coins and tokens, viz a viz, through "efficient" prices. The author is by no means advocating an opinion on the current structure of the market place nor the impact on current and potential investors; however, it stands to reason that something deemed as illegal in the traditional stock market that is happening in a place that wants to be elevated to and treated as a currency means that with great titles come great responsibility. If, for no other reason, everyone can see the orders and depth charts clearly and there are some strange patterns. What could be found after a market forensics investigation is another matter.

Going Forward, What Might Be? (Potential Outcomes)

The back and forth between the libertarian ideology and consumer protections is the real battle ground for what cryptocurrencies will look like in the future. After all, no one wants Grandma's life savings to evaporate in a "sure" investment that turned out to be run by thieves. But there will always be the group that says that Grandma should have done her homework better (A Metaphor for Crypto Markets and How To Explain to the Uninitated).

In reality, the crypto universe is not all that unlike the regular stock market's securities and futures. What we could possibly see moving forward is more regulation constructed using similar laws and regulations analogous to the traditional stock market. As the space grows it will garner more attention and with that the closer eye of regulatory bodies. At the minimum, this logical linkage leading to some regulatory outcomes could change the very way many of the larger investors are forced to behave. For instance, larger holders of securities in the stock market are allowed to buy or sell large orders of course, but those orders have to be placed in an orderly manner throughout the trading day so as not to disrupt the price of an underlying security too much. We are seeing the complete opposite in many coin markets that are too small to protect themselves from the vagaries - whether intentional or not - of larger buyers or sellers. Plus, the onboarding mechanism of ICOs seems to be already squarely in the targets of regulators worldwide. One could say that canning ICOs in a country is to inhibit growth in the space, but truthfully it is probably motivated to protect consumers from themselves. Another sticking point that must be sorted out is tax treatment and better guidelines laid out that make it easier for crypto transactions to work out.

Moving forward, sadly, the wild west days of the crypto market could be coming to a close over the next few months to years, but with that comes a larger influx of liquidity (more money) as more people see it as a legitimate investment vehicle. After all, there is give and take in everything.

We're all gonna make it!

Minderbinder

External Sources:

Tastytrade, 2017. "How Relevant is the Bitcoin Market." https://www.tastytrade.com/tt/daily_recaps/2017-08-28/episodes/how-relevant-is-the-bitcoin-market-08-28-2017.

Wikipedia. "Pump and Dump." https://en.wikipedia.org/wiki/Pump_and_dump.

[Disclaimer: All the opinions expressed in this article are my own and are in no way meant to be construed as investment advice. All images come from either personal files or websites that allow free images and each has an inline citation for reference. Tastytrade is a fantastic resource for getting ideas about investing and trading options; however, the author and this article are in no way connected to the organization nor receiving compensation from the company.]

@originalworks

The @OriginalWorks bot has determined this post by @minderbinder to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here! || Click here to participate in the @OriginalWorks sponsored writing contest(125 SBD in prizes)!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Some of the anti-government movements are pretty big. Not that my dad's generation didn't have them in the sixties, but I'd really love to Liberland take off! Even the Libertarians have a bigger movement than 1980's punks and 1960's combined. I hope the government doesn't get involved for decades, but your're right, they will step in to rob whomever they can. They have the guns and the cages, so unless you want to get shot or go in a cage you will comply.

I didn't mean to sound so fatalistic, but blockchain tech really did spark and ignite some really interesting mindsets (I guess you can say). Frankly I don't know which is better, a Hobbesian free for all or the prison state. At the same time, it'll probably be something more to the middle of the road. Thanks for replying. Following you now too.

I expect people to use new technology, just not to do better things....

Time will only tell. :)

Regulator business make a best

It helps to level the playing field, but there's something to be said about the classic neo liberalism approach to markets. I'm just curious to see what'll happen next. Thanks for replying!

Excellent post, very well articulated. thank you so much.

Love the handle. Awesome. Thanks for the reply. Following you now too. And thanks for reading!

This is very informative. It is good news for us that cryptocurrency is rising in 2017.

I think we'll continue to see growth in the crypto space for the foreseeable future. I do have my misgivings about an overall market correction, but I'll get into that in another post. Thanks so much for reading! Following you now too.

Excellent @minderbinder

I guess cheetah didn't like your post, but I love Wayne's World. Party on! And thanks for reading! Following you now too.