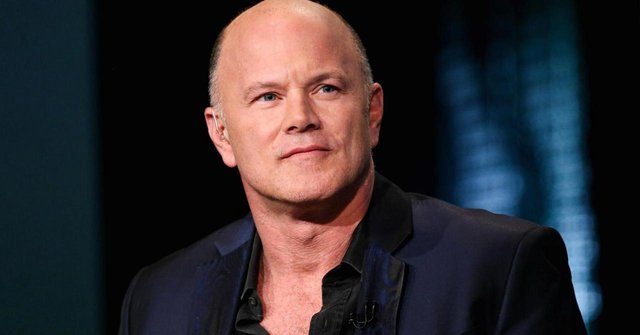

Mike Novogratz - "This will feel like a bubble when we are $20 Trillion"

Mike Novogratz recently sat down with Bloomberg to discuss his views on the crypto markets.

Some of his thoughts were pretty exciting to say the least.

If you are not familiar, Mike Novogratz is a billionaire who previously worked at Goldman Sachs and was a hedge fund manager with Fortress Investment Group prior to getting involved with cryptocurrencies.

In 2017 he planned to launch Galaxy Investment Partners, which was set to become the largest cryptocurrency investment fund in the world. However he shelved those plans due to market conditions.

More recently he has been building a crypto merchant bank which he said he hopes to turn into "The Goldman Sachs of Crypto."

Interview with Bloomberg:

Mike sat down with Bloomberg yesterday to give a candid and indepth interview and talk about all things crypto.

The interview was just under 40 minutes in length and can be seen here:

There were a couple things that really stood out to me, from a decentralized Uber to price predictions on the entire asset class.

Price predictions:

This is where things get really exciting.

Mike says that yes we were in a FOMO (fear of missing out) bubble in late 2017, and it was lead by mostly retail.

However, this next surge in crypto prices will make the prior one look like child's play and it will be lead by mostly institutions according to Mike.

Specifically, he says this next surge is going to feel like a bubble only when he get up near $20 trillion in total market cap. The previous one peaked just over $1 trillion.

That would indicate 20X from where the prior surge peaked.

He also said that he anticipates those institutions will start coming into the market in late 2018, which means we could be roughly 6 months away from another massive surge in prices.

How Duber (Decentralized Uber) might work:

One of the most fascinating aspects of his interview was at the very end where he talked about how a decentralized Uber might work.

He says that basically the company would raise funding via an ICO, issue tokens, and then operate very similar to how Uber does right now.

Though, instead of Uber having 30% margins, Duber would undercut them because it could operate with less margin and use tokens as payment.

People would pay for the ride in tokens that are immediately convertible to cash.

The person could either hold on to those tokens in order to speculate on price increases or convert them immediately.

The beautiful thing is that as the system grows it makes everyone a stakeholder in the company by giving them tokens.

All of the sudden these people will now go out and tell their friends to use dubers (instead of ubers) because it will help their holdings. Everyone that uses the service also becomes a stakeholder in the network which gives them incentive to push the service.

(Source: https://safenetforum.org/t/duber-decentralise-self-driving/13959)

The perfect business model.

This literally is the perfect business model.

Millions of people all touting the service because as it grows they benefit.

Over time those coins become more valuable as the entire pie grows.

I couldn't help but think of all kinds of businesses that might be impacted by this kind of business model. Making everyone who uses your service a stakeholder is pure genius.

Watch the video and stay informed my friends.

Image Source:

https://news.zedid.com/business/finance/another-goldman-exec-dumps-wall-street-for-crypto-world/

Follow me: @jrcornel

A big warning sign.

BTC and a few others should be expected to break their all time highs, and this will already be more than a doubling from where they are now, but a 20 times rise from where they are now?

For this they would require a large scale adoption by the public, or more than 4 years, or both.

20 times means an average rise of over 100% per year each year for 4 straight years.

Blankfein is much more digital currency friendlier than Dimon.

Honestly I don't think it is a warning more than it is a validation of the asset class in that traditional finance is getting involved.

Partially true too.

Consider that "traditional finance" is not a monolithic entity and that Jamie Dimon and Warren Buffett (whom is usually decades backwards and made his fortune through persistence, connections and size) do not share the same narrative with Lloyd Blankfein and the Goldman Sachs gang, from which this Mike Novogratz came.

You got a 32.22% upvote from @sleeplesswhale courtesy of @stimialiti!

@youtake pulls you up ! This vote was sent to you by @stimialiti!

You got a 57.14% upvote from @luckyvotes courtesy of @stimialiti!

You got a 66.67% upvote from @voteme courtesy of @stimialiti! For next round, send minimum 0.01 SBD to bid for upvote.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to voteme by clicking following links: 10SP, 25SP, 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

You got a 30.15% upvote from @proffit courtesy of @stimialiti!

2-25% Return on investment. Check steembottracker.com for current status

Minimum 0.01 SBD/STEEM to get upvote , Minimum 1 SBD/STEEM to get upvote + resteem

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

This comment has received a 5.88 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.1 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

Hey @stimialiti, Congratulations! Bodzila just upvoted your post with 20.00% power. Keep up the good work!

Delegate your Steem Power to @Bodzila & Earn 80% Weekly returns based on your share. You can cancel delegation of your SP at anytime as the money & power remain in your hands only.

Any queries or required support can be discussed in person. Join our discord channel https://discord.me/SteemBulls

You got a 21.98% upvote from @sleeplesswhale courtesy of @stimialiti!

@youtake pulls you up ! This vote was sent to you by @stimialiti!

This comment has received a 90.91 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.1 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

Good article; hope he is right. Just a little hesitant due to his Goldman pedigree 🧐😵🧐

Hopefully he brings is old buddies along with him ;)

this guy knows what he is talking about

I watched the interview too! He was really promoting EOS at the beginning. I didn't know he has been in Crypto since 2012. I liked how he said the crypto markets are a lot like macro trading because of "momentum".

That's crazy that the potential market for crypto is $20 trillion :O. I'm expecting conservatively somewhere in the $3-5 trillion land in 2019/2020. Based on the NASDAQ hitting $3 trillion in 2000, and with today's inflation that could be $9-10 trillion if we are comparing apples to apples.

I've never heard of the Uber concept. It'd be great to have a liquid marketplace available to the public. It's just a theory for now!

Novogratz said the Nasdaq hit $6 trillion in 2000, though I haven't verified that number.

I watched that video yesterday. Very interesting stuff. Mike is always very intelligible and breaks down the complex concepts in simple ways.

Hopefully more retail and institutional investors listen to Mike, get excited again and invest to the moon.

Duber all the way!

I like that as well. He is a smart guy but explains things in a way that everyone can explain.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Great find! EOS on Bloomberg already.

Y vendrán los remplazos de las redes sociales tradicionales (facebook, twiiter), si estas no de acoplan a la Crypto-era; Y steemit será la base de donde partan todas estas ciber industrias crypto capitalistas. Hasta Amazon y Alibaba van a tambalearse... Como dicen en mi tierra: o corren o se encaraman

Great minds @jrcornel, I wrote about this too.

I basic economy, how could be a bubble when it just started

In 40 years time will definitely be a bubble or maybe the second bubble of cryptos....we haven't reached even 1 trillion yet.