HOW TO (AND HOW NOT TO) INVEST IN CRYPTO AND BLOCKCHAIN

With all this hype around blockchain, Bitcoin, and cryptocurrencies there are a lot of people specutively pushing an ICO, specific coin, exchange, business idea, or blockchain stock that is taking advantage of this new trend! Like anything else with a huge number of proponents, there is an equal number of people who are warning people to STAY AWAY from everything crypto/blockchain.

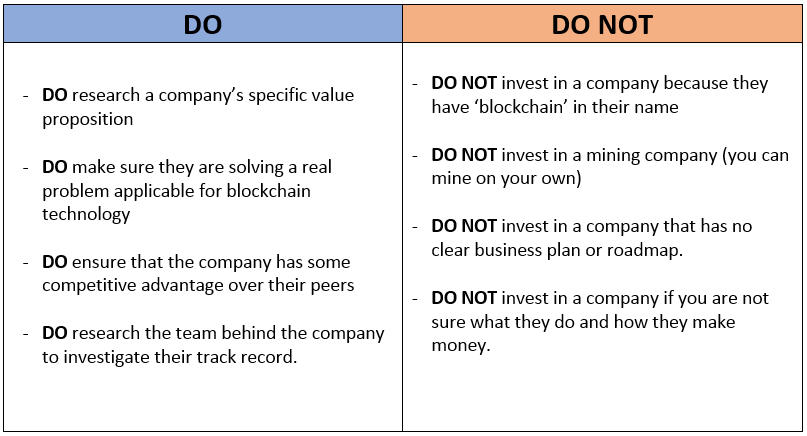

There seems to be a never-ending supply of cryptocurrency success stories followed with an equally large supply of cryptocurrency nightmares! After spending a bit of time learning about this space, I want to help you avoid the common pitfalls and mistakes by sharing my DO’s and DO NOT’s when it comes to investing in cryptocurrencies and blockchain technology!

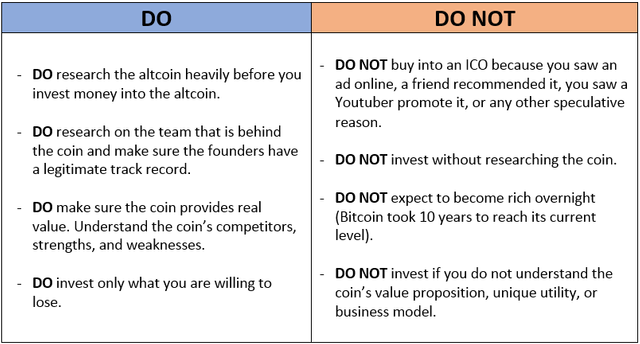

ICO’s, Tokens, & Altcoins

Summary: In my last article, I mentioned a few well-known alt-coins like Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Monero (XMR), and Bitcoin Cash (BCH) – just to name a few. An alt-coin, or ‘alternative coin’, is defined as any coin that is not Bitcoin. There are thousands of alt-coins on the market today and there does not seem to be a slowing down of ICO’s anytime soon.

ICO’s are ‘Initial Coin Offerings’, similar to an IPO, where public investors are allowed to buy the specific alt-coin or ‘tokens’ with fiat (paper) money. If you have read my article ‘The Snapchat Story: More Common Than You Think’, you will know my feelings about IPO’s. ICO’s are no different than IPO’s in terms of speculation, insider incentives to get rich quick, and lack of transparency.

There are a lot of potential gains to be obtained from speculating in buying tokens in ICO’s for coins that provide real value, and many people have become rich by investing in ICO’s early on. Take Ripple (XRP) for example, which started its ICO for $0.005 (half a penny) per Ripple, and is currently priced at $1.13 which would be a 20x+ gain if you bought at the ICO and held it until now.

However, the other side of the argument reveals a real chance to lose your entire investment if the coin you invest in disappears. Coins like Bitconnect are a perfect example of the dark sides of humanity at work, where the company scammed all of their investors. Bitconnect did not provide any real value, instead it was a sort of ‘ponzi-scheme’ that tricked investors to buy into its crypto lending business model.

***************BUYING COINS THROUGH AN EXCHANGE*************

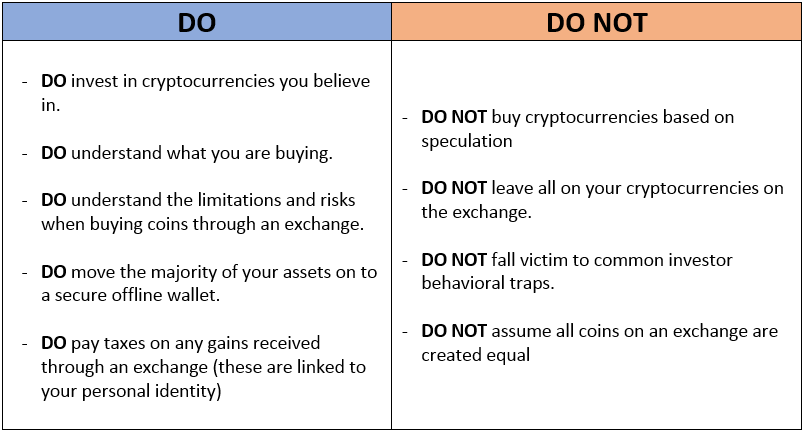

Summary: The most common way for people to invest in cryptocurrencies and blockchain technology is to buy cryptocurrency through an exchange. Exchanges like Coinbase allow you to trade your USD into the cryptocurrency of your choice. Exchanges do not allow users to buy every alt-coin on the market, instead, users are restricted to the specific list of coins available in a specific exchange. For example, if you wanted to buy Ripple (XRP) today, then you would not be able to use Coinbase since they do not support XRP transactions today.

This limited list of cryptocurrencies is one weakness of buying through an exchange today. Another concern is that exchanges do not really ‘decentralize’ anything and defeats the original purpose of the blockchain being a democratized ledger. Exchanges act as an intermediary between the blockchain and an individual person. Major exchanges like Mt. Gox, Coinbase, and Coincheck are a few notable exchanges that have had issues recently. There have even been issues related to an exchange stopping trades during times of high volatility (which is normal in the crypto landscape). This is frightening as the last time Coinbase stopped processing transactions was when Bitcoin was crashing from ~$19,000 to ~$6,100.

When purchasing cryptocurrencies through an exchange, the best way to remain secure is to use offline wallets like ‘Ledger Nano S’ or ‘Trezor’ to store your wallet private keys.

***************MINING - BECOMING PART OF THE BLOCKCHAIN*****************

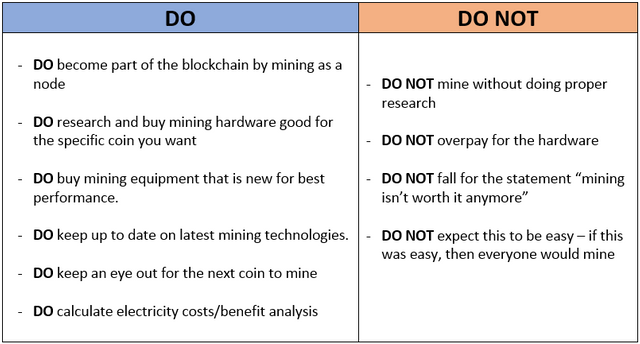

Mining is a core component of any blockchain. Miners (or nodes) are essential in blockchain technology as the blockchain relies on these miners to confirm encrypted blocks (blocks are a group of transactions) are valid and not fraudulent. Miners set up hardware components (typically a PC with too many GPUs) to be a part of a blockchain and confirm transactions on the blockchain. The incentive on the miners’ part is that they get paid a small percentage of every block they help decrypt and add to the blockchain.

Currently, mining has a high barrier to entry in terms of the actual dollars needed to set up the hardware. Many companies are pivoting to include mining as a part of their business model and some even offer a service to rent out mining power to any interested customers. I would stay away from investing in these types of companies as individuals would be better off building/buying their own mining rig as that is how blockchain technology was initially designed.

The purpose of a blockchain is to be a distributed ledger across many independent miners. Investing in a mining company to mine on your behalf seems to defeat the initial design of the blockchain. Instead, become a part of the blockchain by becoming a miner.

***************INVESTING IN "BLOCKCHAIN" COMPANIES*******************

There is an insane number of private and public companies that have all claimed to be pivoting to blockchain technology. Whether it is the “Long Island Ice Tea Corporation” pivoting to become a mining company and re-branding their name to become “Long Blockchain” or Kodak announcing their new Kodak Coin – there seems to be an endless list of companies that are desperately trying to hang onto the coattail of the crypto craze.

Unless a company is really using blockchain technology to solve a real problem in the world, many of these companies will disappear as quickly as they appeared. There are real-world use cases where blockchain can fix a problem that current technology just cannot handle. For instance, there is a real concern in the U.S. around voter fraud, duplicate voting, and manipulation of votes in general – this is a perfect use case for blockchain technology. Instead of trusting individual districts to tally up votes, the entire voting system would be on a publicly distributed blockchain that was far more secure than the traditional system in place today.

Voting is just one example that can be fixed or enhanced by the blockchain. If the healthcare industry used blockchain technology to store and transfer information, then patient information across hospitals would be up to date, latest breakthroughs in research would be distributed much faster, or organ donations would become much more efficient. The list of possibilities is endless.

I have been keeping my eye on the cryptocurrency space for a while now and have seen many horror stories when it comes to investing in cryptocurrencies. However, I have also seen many success stories of people making a fantastic living by betting on the future of the crypto space.

Blockchain technology is as real as the sun rising everyday. Cryptocurrencies on the other hand are more speculative when it comes to trying to quantify a coin’s real value since much of the value is directly correlated with the number of people who believe in the coin. To me, Bitcoin is a proof of concept and the real question we all should be asking ourselves is: “Which other alt-coins can provide real value in the future? Or which can fix an existing problem today?”

Stay tuned for my next article where I will review the top 10 alt-coins for the foreseeable future.

Thanks for reading!

-Jack

P.S. The above article is not meant to be investing advice for anyone as I am not aware of your particular financial situation or risk tolerance. The above is meant to be supplementary to your own research. Do not invest solely based on the information above. The world of cryptocurrency is like the ‘wild west’ – invest only what you are willing to lose.