Garbage Crypto Product Dies Immediately After Launch

Garbage Crypto Product Dies Immediately After Launch

What happens when you mix esoteric financial instruments with poor coding practices? You get decentralized finance (DeFi), a new buzzword popular with crypto fans who see it as a way to invest in new startups or put money to work by lending out dormant crypto to eager customers.

The latest in DeFi hilarity comes to us in the form of the YAM token, a cryptocurrency that was originally designed to do nothing and be completely valueless.

What that means in practice is pretty funny. The YAM, announced in a Medium post by founder Brock Elmore, was supposed to be a “minimally viable monetary experiment,” parroting the concept of the minimal viable product in the startup world. The MVP is a product that works—but barely—and is used to test product-market fit. In this case, however, there was no product-market fit.

“After deployment, it is entirely dependent upon YAM holders to determine its value and future development,” he said. This means Elmore expected the YAM owners—or investors—to come up with projects to fund using the platform.

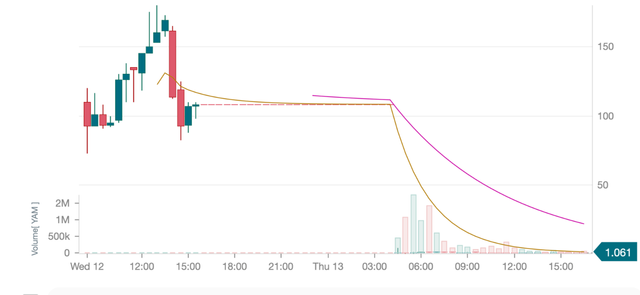

Elmore posted the first mention of YAM on Medium on August 11. The token went on sale, and savvy crypto investors drove up the price to almost $180 on August 12, giving the project an instant $460 million market cap.

A few hours after its all-time high, the project heads posted a dire warning: “SAVE YAM! 🍠” They said that the developers accidentally injected a bug into the system that “minted” too many starchy cryptocoins, resulting in a glut that would not allow anyone—not the creators and not the YAM “investors”—to control the platform. They wrote:

If governance is unable to submit a bug-fix proposal prior to the second rebase, no further governance actions will be possible as so many YAM will be held in the reserve that it will be impossible for any proposals to reach quorum. If this happens, the YAM treasury will become ungovernable and these funds will be lost.

By August 13 the entire market cap fell to near zero as the single exchange that supported these YAMs stopped selling them. The exchange, Gate.io, has since reinstated the YAM but it’s not looking good for YAMsters.

The YAM is currently trading at around $1 with many users trying to drop their bags of YAMs on the open market. For his part, Elmore followed the advice of Kenny Rogers and decided to fold.

The cryptocurrency world reacted with amusement.

“What a truly wild ride. From absolute glory and everyone getting rich to train wreck all in less than 48 hours. It was a crazy experiment, and demonstrates the importance of competent coders,” wrote one Reddit user. Others saw the hand of greed in the YAM’s downfall.

“It got huge fast off of Defi nerd FOMO and then died when they found a bug in the unaudited, complex smart contract which couldn’t be fixed,” said Adam Levine, host of LetsTalkBitcoin. He likens the excitement to 2017 when crypto projects were launching (and failing) almost as fast as this noble tuber did.