Is Bitcoin just driven by FOMO?

I recently read an article in The WealthAdvisor called, “Heed Warren Buffett Warning: bitcoin is pure FOMO.

My first initial thought was….

Another Acronym!!!! WTH? What is with all these fricken acronyms!!! Can’t anybody spell anymore? But I digress.

What is FOMO? Fear-Of-Missing-Out.

According to the article, what is driving the value of an essential value-free asset is FOMO. The article alluded to some interesting poignant questions. “Who buys a home expecting to double in value in a year (e.g. think 2007). Who buys an unproven web startup certain that it will disrupt an entire industry in short order (e.g. think dot.com bubble bust early 2000). Yet investors pounced on dot-coms and fixer-uppers (not the HGTV show, which my wife absolutely loves). They feared missing out on a chance to get rich quickly. This can happen to large company stocks of course. Nearly every asset class has it heady moments. Yet stocks bounce back, over and over, thanks to Buffet’s notion of intrinsic value.”

Question: What is intrinsic value? It’s a company that generates sales, and revenues. There are hard assets, debt, equipment, input costs. There is value in a company. Think Coca-Cola (which Buffett partial owns in his Berkshire Hathaway company ~ owns 9.4% of Coke ~ $16.7B). Intrinsic value is driven by the continuous waterfall of cash. Its not the stock price of Coke but the actual cashflow of business, after costs.

Which brings us to two questions:

- Is there intrinsic value in cryptocurrency? Does it generate cashflows like a large conglomerate?

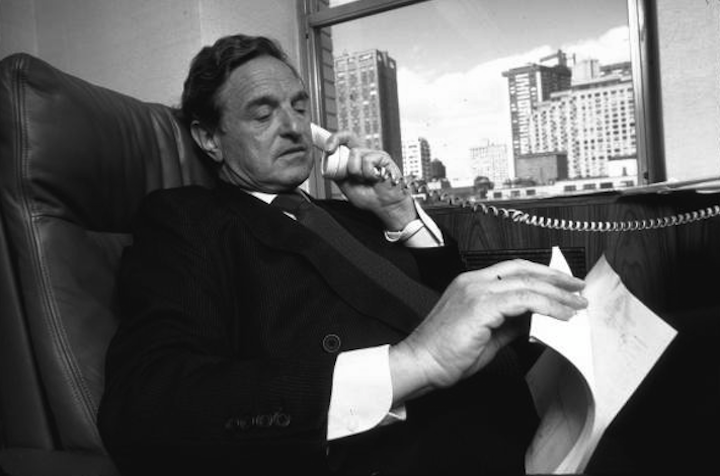

Answer: NO. That was easy. Of course not. Does the US Dollar have intrinsic value? No. Does any currency have intrinsic value? No. But does that mean we can’t speculate on the exchange rate between two currencies? Of course not. As a former senior currency trader for 2 very large mutual fund companies, where I traded billions of dollars on a daily basis, there is profits to be made in betting if a currencies value goes up or down relative to other currencies. Its as simple as that. “I think the dollar will appreciate against the EURO because of the EURO is about to embark on quantitative easing.” “UK is going to conduct BREXIT, I bet the British Pound will depreciate against the USD.” Large asset management firms do this daily. Not that big of a deal. And I would argue not really worthy of a debate either.

- Is FOMO true? Are we as Cryptocurrency investors driven by FOMO? Am I driven by FOMO? Are you?

Answer: Yes, and no. I would be lying if there wasn’t some truth to that point. I think there is something to be said about revolutionary technology. It just can’t be ignored. You wouldn’t ignore the internet when it was first created would you? Of course not. Somethings are just part of the future. To ignore it, would be to miss out. So yes, there is FOMO. More importantly, you need to participate, but only to the extent that you don’t get burned. You have to be willing to invest and run the risk.

Here is personal side story, an example. Back in 2008, after the financial crisis hit the markets. I decided to buy my current home. It was a great deal. -15% from asking price. I thought I was smart and timed it well. We practically bankrupted ourselves to pay the down payment and fix up the “Fixer Upper.” But we got our home (at a discount)! Anyways, in early 2010, my neighbor across the street told me that he bought some homes in Riverside county. For those who are familiar with Southern California, Riverside county experienced one of the worst parts of the financial crisis. Due to the big run up of NINJA Loans (I know, another acronym….No Income No Job No Assets loan). The homes in the county loss 75% of its peak value. Track homes by developers were desperate to unload their barely finished homes, that at the peak were going for $600K. I’m talking 3000 sqft homes (5 bedrooms, 4 baths etc, planned communities). My neighbor just bought outright 3 homes for $40K each. His mortgage on one property was like $200 per month. Later in 2010, he rented out the homes out for $1400/month each. In 2013 he bumped up the rent and rented them out for $2400/month each. Looking back, it was a once in a lifetime opportunity. And he had the cash to do it. But he didn’t get burned. He was smart and played the long game. He knew the intrinsic value of the asset.

But wait, didn’t I just say that Bitcoin doesn’t have intrinsic value? So what is my point?

A lack of obvious intrinsic value doesn’t mean that you can’t invest in Cyrpto/bitcoin. It just means that you are a speculator/trader. And that isn’t a bad thing. George Soros (a billionaire), made his 1st Billion dollar by shorting the British Pound in 1990. Stanley Druckenmiller (another billionaire) made millions on going long the German Deutsch Mark in the late 1980s. More importantly, we are not alone in this FOMO. There are tons of other players (hedge funds) that are playing in the same space as we are.

At the end of the day, if you're going to invest, Do it wisely and know that you could lose alot. But if you're like my neighbor, play it for the long game (several years).

As a personal motto: Go Big or Go Home!

Just sayin…..

Lastly: Finally got to see my oldest graduate from bunny slopes to greens and eventually to blue (all in 2 days!). Proud Daddy!

"I've learned many things from [George Soros], but perhaps the most significant is that it's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.” - Stanley Druckenmiller, 1994

Follow me: @epan35

A great article! I have a wuestion though - currently the dollar is i a freefall and I am wondering what is your opinion for thi situation.

Thanks. I think the US Dollar's fall is not anything to be alarmed about. Part of the decline could be attributable to the attractiveness of non-US equity markets, like Europe, Japan, China, Brazil, Russia, India, and others. The fact is that US equity markets has had such an amazing run up, that US equities are no longer as attractive as international markets. The current discount we're seeing between US and International markets are about 20%-50% (International markets are 20% cheaper than the US). For example, emerging markets equity mutual fund often will by the stocks in local currency. Which means that they are often selling USD and buying emerging market currencies. So the funds are unhedged.

Thank you for your answer. Very informative

Congratulations @epan35! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP