Advantages and Disadvantages of digital money.

The advantages and disadvantages of digital money such as Bitcoin, Peercoin, Lightcoin and many others are relative to the existence, in relation to "regular" currencies such as dollars, shekels, euros, etc. Digital money is a significant technological innovation and has tremendous potential for real change in existing systems Only economic. The Bitcoin coin system is written in a functional and concise manner, the code is open and accessible to all, and since its publication, it has passed and undergoes countless tests as part of its ongoing use,

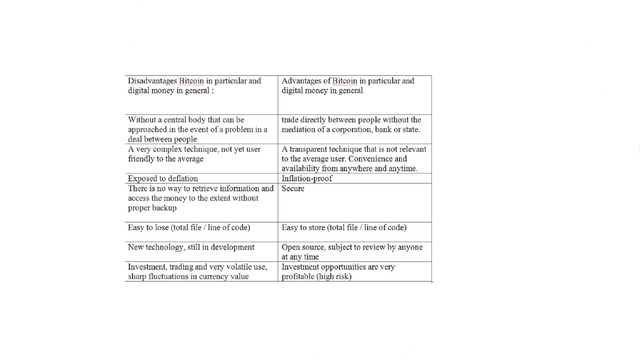

Initiated by the developers, researchers, curious and anyone who wants to, so far has been a complete success and the system has proven itself. At the same time, it is important to note that all of the new generation digital coins, led by Bitcoin, of course, are not "finished products" at the time of writing, and apparently in the foreseeable future. As noted above, the Bitcoin system (the basis for all other currencies) has proven itself but will always remain a "component" whose behavior can not be expected to be curtailed into user lines, so it takes time to characterize and make adjustments. For a new product. Below are the advantages and disadvantages of Bitcoin (this table will be updated from time to time according to changes and developments):

The above is a simple and convenient summary of the advantages and disadvantages of Bitcoin in particular and digital currencies in general, however it is worth knowing briefly what each clause means:

Direct trading: the ability to do business without the coercion of a broker (Isracard, Visa, banks, etc.).

Convenience and availability: Digital currency is not dependent on political boundaries, time-dependent and always available (as long as there is electricity in the world), geographic and / or political boundaries are irrelevant.

In order to understand the significance of this advantage, one should look at the most popular currency in the world today, and of course the dollar, the US Treasury will print. Dollars without being anchored in gold as it was at least until World War II, which would inevitably damage its value (inflation).

Easy to store: A line of code that can be stored anywhere you choose includes your own memory.

Open source: security, there is nothing hidden in the entire system and it is open and invites inspection and criticism by anyone who wants to.

A profitable investment: This section is both a disadvantage and an advantage, because because the area is new, the value of the currencies, led by Bitcoin, is moving down and up sharply.

With advantages, of course, the disadvantages are the same as anything in life ... Digital money is a new technology. This is the first time in history that such an initiative has developed to a significant size. Digital coins are a fact, they are here to stay. Each item in the list (advantage or disadvantage) incorporates a whole field of technology and economics which we will expand here on the site.

Remarks

(For example, no more than 21 million coins will be printed), and you can not print any more. In addition, users will lose coins (unsatisfactory backup, password loss, etc.) Therefore, as long as the currency is used, it is inflation-free (but it can certainly be reversed, Bitcoin, for example, is exposed to deflation).