The Complete Guide to Crypto Taxes

Taxing your cryptocurrency winnings might be a headache. Because of the volatility of coins, tokens, and NFTs, it’s easy to lose track of your real-world wealth gains. And, because crypto is such a novel manner of investing, many investors will try to stay under the radar of the authorities. But I’m here to tell you that this isn’t the best course of action. Failure to properly declare your crypto capital gains might result in substantial fines and cost you considerably more money than you gained in profit. — Do I have to file for bankruptcy? However, I’d want to make things easier for you. This is the greatest tutorial on the Internet for keeping track of your cryptocurrency. You may even be able to save money on your tax responsibilities if you do this properly.

The IRS appears to have procedures in place to acquire information from unnamed sources on who may have made money from digital currency investments. They wrote letters to 10,000 people in 2019 saying, “Hey buddy, you may have failed to pay your taxes on your cryptocurrency,” and they aren’t stopping there. It’s not going to get any easier now that the Infrastructure Investment and Jobs Act has institutionalized crypto taxes. The good news is that you only have to include your crypto activities in your tax report in a few scenarios, and I’ll go through as many as I can in this blog and provide you with a free guide. To keep things simple, there are just three major occurrences that should be considered taxable.

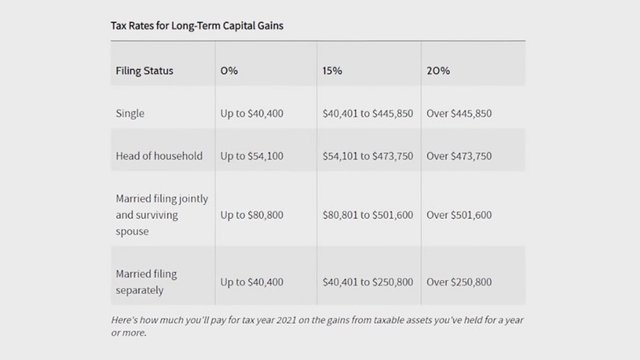

Selling your crypto assets are 1 year — Long term capital gains

Source: IRS

The first is to sell your crypto assets within a year after purchasing them. Because the government considers cryptocurrency to be property, this is the case. Any profit from the sale of coins or tokens is taxable income. A long-term capital gains tax applies if you keep the coin for more than a year before selling it. The amount you pay is determined by the tax bracket you are in. This figure from Investopedia effectively summarizes the situation. You’ll see that if you fall under the first pillar, you won’t have to pay any capital gains taxes at all. However, that is only true if you have been in your position for more than a year. If you’re single and file your taxes as an individual, you can earn up to $40,400 in capital gains without paying taxes on them. Also, if you’re the head of a household or file jointly with a spouse, the cap on tax-free gains increases. As a result, there may be certain tax benefits associated with marrying. You have no idea what a privilege it is.

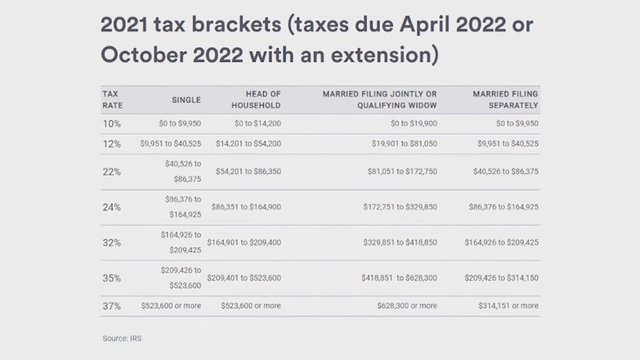

Selling your crypto assets within 1 year — Short term capital gains

Source: IRS

Now, using this IRS graph, let’s compare it to the short-term capital gains tax. Crypto trading revenue derived from the sale of less than one-year-old assets is taxed in the same way as regular income. So, based on this, federal tax rates in 2021 will begin at 10%, even if you make only $1 this year. Of course, this does not include tax credits. Also, keep in mind that the figures on this graph represent your entire revenue, not simply the profit you got from purchasing and selling cryptocurrency. If you made $50,000 this year with $10,000 in profits as a single filer, you’d pay 22 percent in short-term capital gains tax, compared to 15% in long-term capital gains tax. So, if at all possible, try to hang in there for the long haul.

Taxes on using crypto to pay for things

When you utilize your cryptocurrency to pay for products and services, you’ll run into another problem. This is due to the fact that spending an asset such as Ethereum or Bitcoin has the same tax implications as selling it. If you get paid in cryptocurrency as part of your wage or income, you’ll be taxed on it depending on the price of the cryptocurrency on the day you were paid. That is to say, if the value of your crypto increases by the time you sell or use it, you will be required to pay tax on the increase, at least until additional countries accept crypto as legal tender. If you were paid in cryptocurrency or bought anything with cryptocurrency, you should keep note of the date, quantity, and price of the cryptocurrency when you get it and spend it for accurate tax accounting. But don’t worry, I’ll have more information on that later in this blog. If you were paid in cryptocurrency or purchased anything with cryptocurrency, you should keep note of the date, quantity, and price of the cryptocurrency when you get it and spend it for accurate tax accounting. But don’t worry, I’ll explain how to keep track of everything later in this blog.

How to account for crypto transactions

The next step is to calculate the taxes you’ll owe each time you spend or sell something. The FIFO approach is commonly used for this (first in, first out). In other words, the first crypto you get is the first to be spent or sold. It is now feasible to save money on taxes by using LIFO (Last in, First Out), but you should be cautious and consult an accountant before doing so. returning to getting paid in cryptocurrency. If you’re converting your crypto to cash on the spot, such as when you are paid, it’s as simple as adding up the amount in US dollars and declaring it as regular income cash on your tax return. There is no such thing as a conversion. There will be no capital gains. However, if you keep your cryptocurrency for any length of time before selling or using it, you’ll need to declare the price difference as unintentional capital gains.

Tax on swapping your crypto for another crypto

The third option is to exchange your money for other cryptocurrencies. Many individuals wrongly believe that switching one cryptocurrency for another is a purchase and, hence, that this isn’t a taxable transaction, similar to buying Bitcoin with US dollars. But, regrettably, this isn’t the case. You’ll have to pay tax on your Bitcoin gains if you buy Doge with Bitcoin. It’s unfortunate, I know. Because crypto isn’t currently recognized as a currency by the US government or most countries, this isn’t considered a common purchase. This is viewed by them as a trade of one property for another.

How NFTs are taxed

The NFT is property in and of itself, but you don’t have to consider the appreciation as regular income if you don’t sell it within a year. Now there’s something more that’s taxed, but it’s free money: BlockFi. By merely registering an account with BlockFi, you may earn interest on your cryptos and receive up to $250 in free Bitcoin. But don’t forget to pay your taxes.

How to use capital loses to your advantage

What about the losses? If you go through with any of these steps and discover that you’ve lost money on your cryptocurrency as a result of a sell or exchange, you’ve suffered a capital loss. It’s also crucial to declare your losses since you may use them to reduce your taxable income. Here’s an illustration: You invested $500 in a stock, and it has since grown in value by $500. Congratulations. Let’s imagine it’s taxed at 10%, resulting in a total tax bill of $50 for the year. However, in the same year, you acquired and sold a crypto position that lost $50. By submitting the loss with your stock portfolio gains, you might be able to deduct the $50 tax. If you’re filing as an individual, you may deduct up to $3,000 in capital losses, according to IRS guidelines. This might be beneficial to you. It implies that your first $3,000 in YOLOs every year might be considered a tax write-off. “This is not financial advice.” So far, we’ve covered the fundamentals.

Crypto defi taxes

These three taxable events very much sum up how the IRS presently considers several frequent bitcoin transactions. However, the administration has yet to respond to these queries. In DeFi, for example, activities like staking and yield farming have different dynamics depending on which DApp you use. As a result, determining whether your profits should be taxed as regular income, capital gains, or non-taxable asset swaps is difficult. Let’s take a closer look at this. When you elect to utilize your tokens to get more tokens, your earnings in DeFi are considered regular income.

Taxes on staking crypto

Consider staking Cardano in order to earn extra ADA in return for verifying transactions. It operates similarly to our earlier example of receiving a paycheck in Bitcoin since you earn more ADA for doing so. Mining on a proof-of-work blockchain is the same. All of this is ordinary revenue. If you have Cardano, you should consider staking it in my stakepool (ticker symbol: MAX1) if you have it. Your ADA will earn you roughly 5% interest each year, with 5% of the proceeds going to the Autism Research Foundation. As a result, it’s a really amazing pool.

Taxes on lending your crypto

When you lend your crypto to a lending site like Aave or Compound, though, things get a bit more complicated. Liquidity pool tokens, or LPTs, offer another degree of complexity to these systems. You obtain a cETH in exchange for lending ETH to Compound to contribute to their liquidity pool, which acts as a form of receipt for the amount you deposited. The problem is that the IRS hasn’t decided whether or not it counts as an exchange, so we don’t know if it’s a taxable event. To break it down, your ETH token’s value may rise over time, and if and when you decide to withdraw your ETH share from the pool, this represents a capital gain. Because you are paid in ETH, you must account for both the price fluctuations in ETH and the rise in your ETH stockpile as a result of lending it out. Then you must specify whether your profit or loss is short-term or long-term in your file since this influences how your income is taxed. If you hold your ETH for more than a year, it may be eligible for the 0% capital gains tax bracket, as long as you don’t exceed the other income restrictions. Also, regular crypto lending, such as stablecoin lending, is treated as standard income on your taxes, making it a little easier to compute. That was only one example. Other DeFi platforms may operate using various mechanisms, token types, and rules. It’s vital to know when you may enter or depart a liquidity pool before you start yield farming or liquidity staking because it can affect your taxes.

Taxes on crypto bots

Some traders use bots to trade across many exchanges in a matter of days. Bots are typically employed for arbitrage possibilities or automated crypto trading. This is where there is some ambiguity. I have yet to come across anything specifically written regarding how this is taxed. However, given the trades occur on a daily basis, it’s safe to assume the worst and believe that these profits are short-term capital gains. So that would be the best option.

How to write off expenses as a professional crypto trader

If you’re a professional trader, stating company costs on your tax return may allow you to deduct part of your incurred taxes. You may claim electricity costs and almost any other acceptable business expense, subtract those costs from your total cryptocurrency revenue before taxes, and then just pay taxes on the profit left over. It’s a business, after all. So, if you spend a significant amount of time in regular trading activities, I would recommend registering as a business, but first consult with a tax professional, as this will only work for full-time employees who are willing to pay extra for accounting and ensure that everything is done correctly. If that’s an option for you, just make sure you do it right.

Other crypto tax tracking methods

If you’re worried about your crypto tax bill, I recommend either manually documenting everything or using an integrated accounting application like TokenTax or CoinTracker to keep your mind off it. The cost of these services varies based on how many transactions you do each year, but they usually cost less than $10 per month.

Thank you for your time and consideration and Max Maher, for his idea, and I hope that my blog will help you in the future.