Created a Crypto Index Fund - Case Study Part 2

You might remember back in late November, I started a project that created a Crypto Index Fund of 35 cryptos. Here's the link: https://www.reddit.com/r/CryptoMarkets/comments/7f8em8/so_i_created_a_crypto_index_fund_of_35_cryptos/

After a fair amount of feedback from the community and some criticism of whether it was a “true” index fund, I tweaked it a little and decided to limit the updates I did for this.

I've had a lot of PMs and feedback on this, and people wanting to know how it's going, so I felt compelled to update you all.

By tweaked, I mean I added a number of cryptos to the Index Fund. I now have 51 cryptos in the index fund.

Why?

Because I’m trying to create the best possible index fund portfolio and it gives me further diversification. There were also a few newcomer cryptos that I wanted to add (Dragonchain, ICON and Wabi among them). These cryptos hadn’t debuted back when I started the index.

Yeah, so I went a little crazy. It’s not the initial experiment that it was. It’s a little something more.

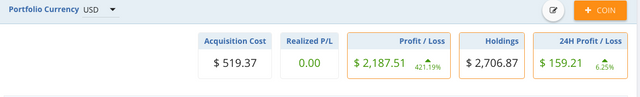

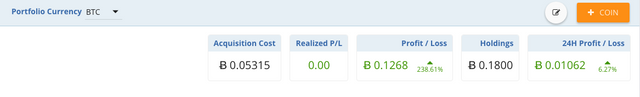

This portfolio is currently up 421.19% in dollar terms. It’s also interesting to note that it’s outperformed BTC to the tune of 238.61%

Important points:

The newly added cryptos still follow the $10 rule. That is, I purchase $10 of them and get as close to that figure as I can (naturally, BTC price has changed since November 21st).

It’s not a fair fight. I know that. But what else in life is fair? I use Crypto Compare to follow the portfolio and it gives me a leaderboard of which cryptos are performing best.

I know that adding new cryptos to the portfolio means that I void any real sense of “competition” between them. Still, this is (still) a longterm project/experiment afterall.

Over time, these details will iron themselves out and a true measurement will take shape.

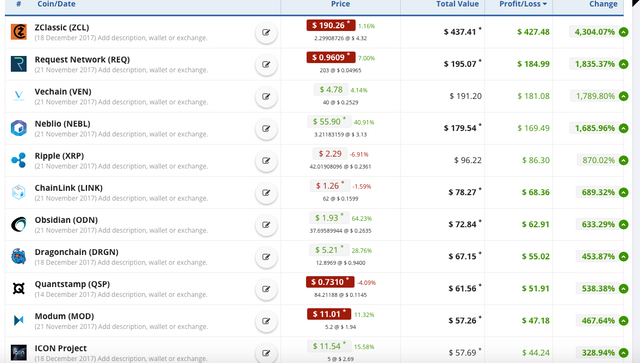

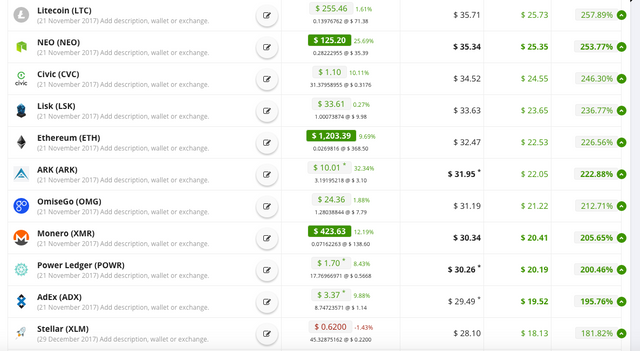

The Current Leaderboard

Speaking of the leaderboard, here’s what we currently have as a Top 10 (ranked by profit - 9th January 2018):

- ZClassic (ZCL) - 4,304.07% ($467 Profit)

- Request Network (REQ) - 1,835.37% ($184.99 Profit)

- Vechain (VEN) - 1,789.80% ($181.08 Profit)

- Neblio (NEBL) - 1,685.06% ($169.49 Profit)

- Ripple (XRP) - 870.02% ($86.30 Profit)

- Chainlink (LINK) - 689.32% ($68.36 Profit)

- Obsidian (ODN) - 633.29% ($62.91 Profit)

- Dragonchain (DRGN) - 453.87% ($55.02 Profit)

- Quantstamp (QSP) - 538.38% ($51.91 Profit)

- Modum (MOD) - 467.64% ($47.18 Profit)

Yes, three of the Top 10 places are currently held by cryptos that were added after the Initial 35. To say that ZClassic has been a revelation is an understatement of the largest proportions.

If you asked me a few weeks ago if I thought Modum (MOD) would have been in the Top 10, I would have laughed you out of the building. Still, MOD has seen great progress in recent weeks and is well deserving of a Top 10 spot.

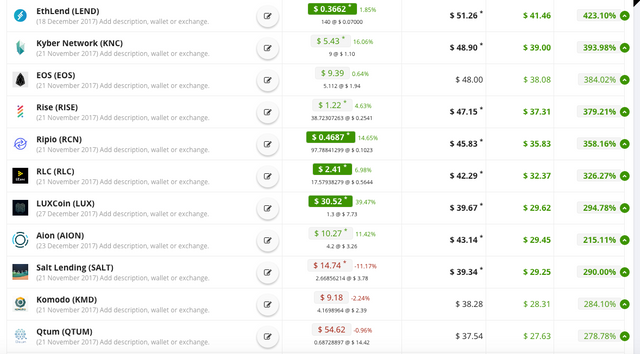

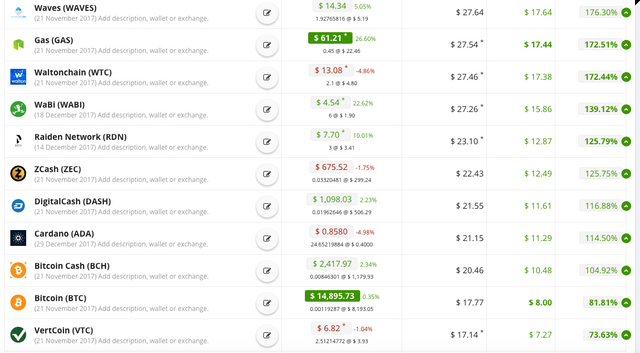

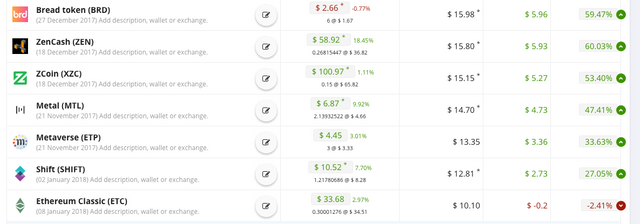

So what does the entire fund look like?

Until I find a better way that I like to present this data, we'll have to settle with screenshots of Crypto Compare:

So What Happened?

Interested in a bit of history of the experiment so far?

After choosing the Initial 35 on 21st November, I let the experiment run. In the first week or so, the early leaders were PowerLedger and then Obsidian. They both went on impressive runs around the start of the experiment.

From there, Request Network went on its crazy run and has led the portfolio virtually for the entire run (with the exception of a short time when Vechain took the leader’s reigns). And lead it did until ZClassic came along! More on ZCL in a bit.

If you remember, I got 203 REQ tokens for 4 cents at the start of the experiment. Timing is, of course, everything. It all came together for REQ to be in the right place at the right time in order to lead this experiment. Still, it’s a fine project and a worthy crypto in this index fund.

So I added ZClassic (ZCL) on 18th December. This represented what I came to call “Wave 2,” cryptos that I “Should have added initially” or newcomers that weren’t available when the experiment started.

Among “Wave 2” were:

- ZClassic (ZCL)

- Quantstamp (QSP)

- Raiden Network (RDN)

- Wabi (WABI)

- ICON Project (ICX)

- ZCoin (XZC)

- ZenCash (ZEN)

- Dragonchain (DRGN)

- EthLend (LEND)

With the exception of ZCL, ZCoin and ZEN, these additions are all relatively new cryptos that I predict will be market shapers in the crypto space for 2018 (and beyond). I needed to add them to the portfolio to help strengthen the older cryptos that have already been on large runs themselves.

ZClassic’s run has been tremendous and it’s now the first member of the 4,000% Club in this portfolio!

As well as the Top 10, other cryptos have gone on great, sustained runs and spent long periods in the Top 10.

- EOS

- Rise

- Litecoin

- Lisk

- Komodo

- Ethereum

Have all had brilliant runs since the experiment began and they’ll continue to grow and prosper into 2018 and as the experiment matures.

How is Bitcoin Itself Doing?

One of the big surprises has been Bitcoin and Bitcoin Cash’s performance relevant to the portfolio. Both currently sit near the bottom of the rankings by Profit, although that certainly won’t last forever.

It’s interesting to note, of course, that the portfolio overall does well in BTC terms (as opposed to $ terms) when Bitcoin isn’t running (or falling). If Bitcoin was near the top of the rankings, it’s doubtful that my portfolio overall would be doing as well as it currently is - at least in BTC terms.

Phase 3 - The Final Phase

After I added Wave 2, I found still more cryptos that I wanted to add.

These became Phase 3:

- Aion (AION)

- LUXCoin (LUX)

- Bread (BRD)

- Cardano (ADA)

- Stellar (XLM)

- Shift (SHIFT)

- Ethereum Classic (ETC)

- Stratis

- Tezos

Cardano, XLM, ETC and Stratis was noticeably absent from the Initial 35 in many people’s minds. They find a place here.

Aion, LUX, Bread and Shift are currently undervalued and lesser known picks that I believe will be a force to be reckoned with in 2018.

There's one more coin that I want to add to round out the Index Fund. Unfortunately, it's not available right now. Wanchain will be the final member of the fund, once it's released.

With these additions, the Index Fund portfolio is now incredibly strong. It boasts a range of cryptos established and young guns, in a vast range of industries and offerings. Although these are all $10 amounts, the strength, scope and diversification of this portfolio means it can do some serious damage moving forward!

I’ll be posting further updates here. Also, feel free to follow me here for more regular updates: https://twitter.com/cryptoindexfund

Enjoy the vote and reward! Mutual Upvote you :) Follow and Upvote you.

Welcome ! Thank you .

Thanks!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.reddit.com/r/CryptoMarkets/comments/7p8y9z/i_created_a_crypto_index_fund_case_study_part_2/

Thanks!

Congratulations @cryptohunter188! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!