Digital Gold - The best stablecoin of our time.

Current situation. As noted earlier, the upward trend in gold has been broken. How can this situation be interpreted.

To begin with, you can simply note that the markets began to signal value and the share of players simply leaves the market. Consequently, the demand has decreased. But given the fact that the market practically did not react to the statement of the US Federal Reserve on easing monetary policy. It is a disturbing sign.

How can you consider it:

At first. To the view that the price of gold was artificially inflated, the market's response is a sign that the possible price has already been reached and it is not able to rise above it.

Secondly, large market participants have artificially inflated the price, now they are trying to artificially keep it in order to protect themselves from losses.

Third, the market is under such pressure from players that it is unable to respond to external changes.

All three assumptions are terrible, but, unfortunately, they have a right to exist.

Consider the situation globally. In the gold market now, players not only want to save their money, but also earn. And since this market is the most liquid of the raw materials, those who want to touch the gold source will not run out. The actual players who came to the gold market during the crisis have already lost some profits. Therefore, we would obviously like to make up for our losses. In crisis situations, the gold market has always been and is under slightly more pressure than others. In this case, it is not just about pressure, but about the actual creation of conditions in the market under which the price always rises.

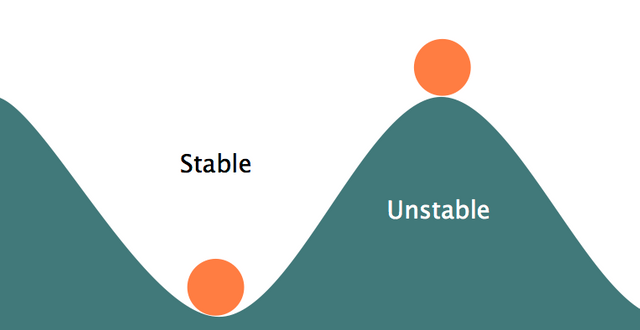

Of course, one can immediately note that the market itself is insured as gold is a real commodity, which has its own cost. But this is the main weakness. Gold is a commodity, its quantity is limited. Therefore, the distribution of goods between the players is not even. One player or even a group will always have a little more gold at this point. And since he or they purchased this product at a classic price, then they want to sell as much as not lower than the purchase price. But the system worked great with the wave-like appearance of new players looking to buy gold. At the moment when there were fewer such players, the system crashed. However, the price remained high. Consequently, fixed assets will hold it as slowly as possible as long as possible until conditions for resuming work appear again.

In fact, now new players entering the gold market do not feel pressure and try to value gold as realistically as possible. And they rely primarily on the cost of gold. Consequently, it is only now that gold is being valued relatively realistically again. At the same time, it is still difficult to judge the transparency of the market. The market cannot be relatively static, as it is now. Yes, the trend has changed, but the response to the trend trend trend is extremely unusual. Of course, this can be explained by a decrease in interest in investment, but why the reaction to changes is so weak. Why did the artificially created bubble burst so quietly? The gold market, as an indicator, is extremely important for the system as a whole. Therefore, this behavior cannot be called artificial.

Summing up, there are several main ideas.

First, for a certain period of time, the gold market began to acquire a speculative character.

The second, at the moment, the functioning remains not completely transparent.

Third, the current value of gold is clearly overestimated and there will be a downward correction of gold in the future.

And most importantly, in the current situation, gold can be used as an anti-crisis asset, but for a very short period. Since in the future it can lose some of its value. At the same time, as an indicator of the global financial system, the gold market cannot yet be indicative.

The real stable coin

This coin is stable as it is fully tied to gold. The GOLD token can replace all stablecoins, since its structure and system is much better than that of conventional stablecoins.

By storing USDT, your money will be burned by inflation, just like storing regular US dollars.

And by storing GOLD tokens, your money will not be burned up by inflation, since gold cannot be inflated, and therefore the GOLD token too.

GOLD is exactly what is needed to fix the value of cryptoassets. Your investment will not lose value because every GOLD token is backed by physical gold in a secure vault.

Digital Gold

Digital gold is an investment in gold that uses Ethereum-based blockchain technology that is backed by physical gold in such a way that an investor buys gold with a gold token. In other words, digital gold is like an indirect / direct investment that works the same as an ETF in which an investor invests in gold through a gold token provided by the digital gold project. But the main difference between ETF and Digital gold is that the latter is operated by a third party. Digital gold gives an investor direct access to buy gold with its tokenized gold and investors don't face the risk they face when considering other cryptocurrency investments.

Digital Gold token is based on the Ethereum network and is compatible with the most popular cryptocurrency wallets that support standard Ethereum ERC20 tokens.

The Digital Gold coin offers an even more comprehensive solution. The GOLD token will not only provide you with all the functions of a stablecoin, but it will also allow you to generate additional profit as it is constantly increasing in value compared to all stablecoins pegged to fiat currency. This is due to the fact that the GOLD token is tied to the value of physical gold, and the price of gold, unlike fiat currencies, is constantly growing.

Bullion Star

Bullion Star is an organization that trades and stores precious metals. It is based in Singapore and was founded in 2012. In this short period of time, he managed to earn a good name and reputation as the best place to buy and store gold and other precious metals. Singapore is a great business environment.

Why Singapore is the best place to store old metals?

Singapore is the number one place for buying and storing gold bars. Singapore has recently become one of the safest places to buy and store gold thanks to its powerful asset protections. The fact that Singapore is located in Asia is directly related to the success of the Bullion Star; here gold is valued not only materially, but also culturally.

Conclusion

With Advanced Gold Tokens, you can invest in Gold Mines efficiently and profitably. Detailed instructions for buying GOLD? Buying gold couldn't be less complicated, a computerized gold mine is a fully functioning biological system with its own commercial center. GOLD tokens can be successfully exchanged for computerized monetary forms such as bitcoin and ether.

This market is equipped with key tools to aid in the validation and evaluation of exhibits. The buy and sell structure is determined by clear agreements with predictable exchanges. The customer service is also open to help people with questions and other important information about going to market and various scene specifics.

Links:

Website : https://gold.storage/

Marketplace: . https://gold.storage/market

Whitepaper: https://gold.storage/wp.pdf

Follow us on social media:

Twitter: https://twitter.com/gold_erc20

Facebook: https://www.facebook.com/golderc20

Telegram: https://t.me/digitalgoldcoin

Author:

my username: mannybitcoins

a link to btt: https://bitcointalk.org/index.php?action=profile;u=140885

MEW: 0xd6Be01D3d1a2bfEaaBa315DAcd7B84039Fd607B8