My Crypto Investment Strategy explained

Investing in vagueness

What I try to do is value investing. It's the one strategy that works consistently in the stock market and I believe it works just as well in the crypto market. There are some differences in the approach though. The amount of information on any given crypto project is usually rather limited. Combine this with market manipulation by whales and you have the explanation as to why cryptocurrencies are so volatile.

The unavailability of reliable information necessary for making price estimates is a phenomenon that I like to call "clouds of vagueness". Whether you like this environment or not is entirely up to you, but one thing is certain; there is money to be made. Lot's of it.

To make the best out of the vagueness we need a set of criteria for coin selection.

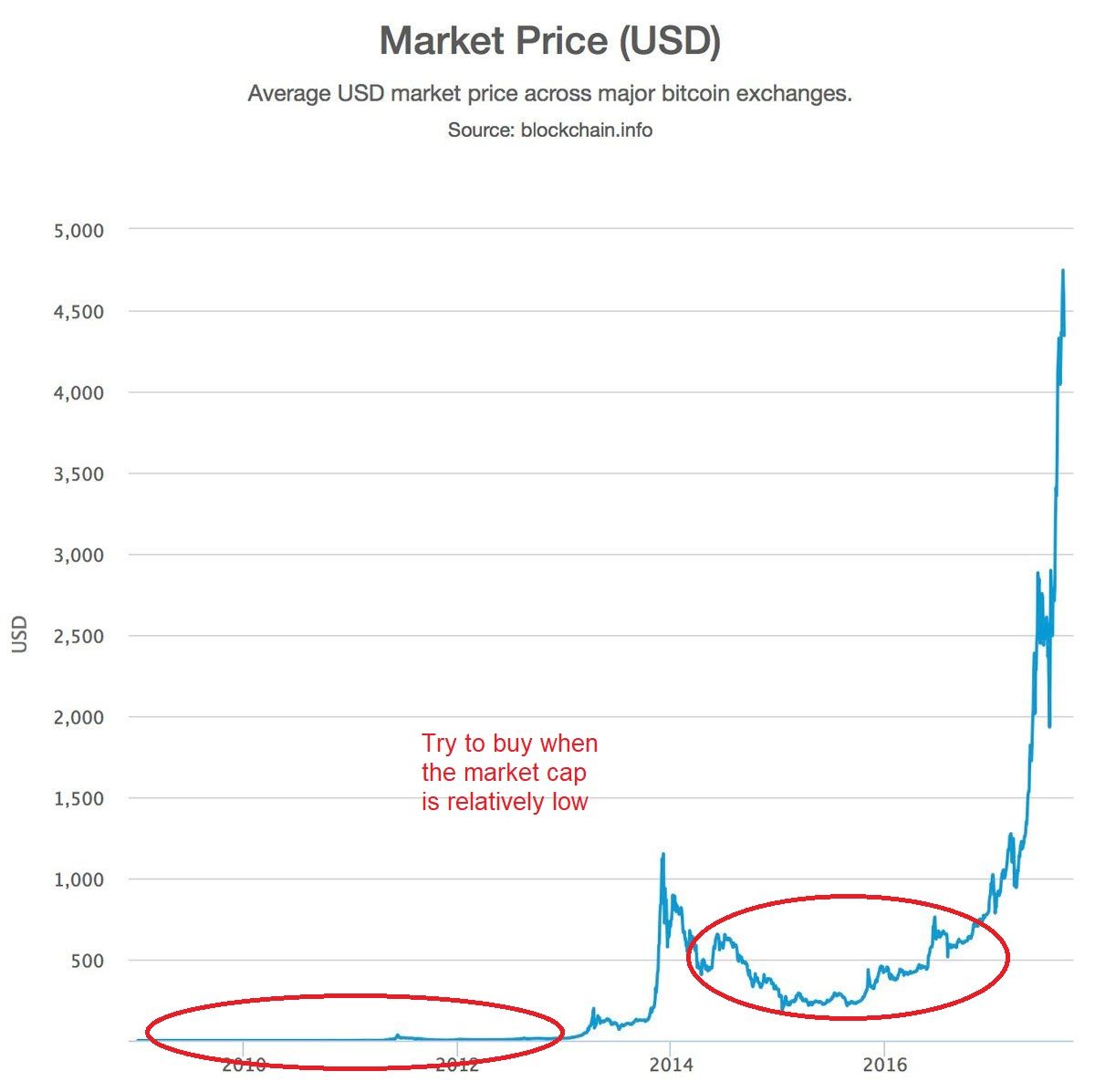

1) Market capitalization

First of all, I only invest in coins with a low market capitalization. I do this to limit the downside risk while leaving the upside potential open ended. Also there is less money needed for large price swings. Low market cap for me means around 5 to 20 million USD. This strategy can also be applied on coins where the market cap is higher, but the potential has to be greater as well, so it would have to be a large scale project if you want to see a lot of growth.

My rule used to be at least 20 million USD market cap but I broke this rule twice to invest in two projects that I believed in and they turned out to be my best performing coins. (In part because I bought them at a bargain price).

Simply put, we're buying coins that are located on page 2, 3 or 4 of coinmarketcap.com and that deserve a place on page 1 in the future. (Note: obviously, as the global cryptocurrency market cap rises, these page numbers will not apply anymore, so use your common sense!). I call them x10-coins or x100-coins. Like my friend always says: we're looking for Bitcoin 5 years ago.

2) Competitive advantage

Secondly, we want coins that offer something special. The coin has to either be the first of its kind or have a significant advantage over its competition. I say significant because a household name such as Bitcoin will not be knocked of its throne by a coin with slightly better technology.

When evaluating a project, do not doubt your own abilities. You don't have to be an expert on the subject in question. Use your common sense when judging if a project is realistic. That will take you a long way in this game. Common sense investing will beat emotional trading any day of the week. Remember: in the land of the blind, the one eyed man is king.

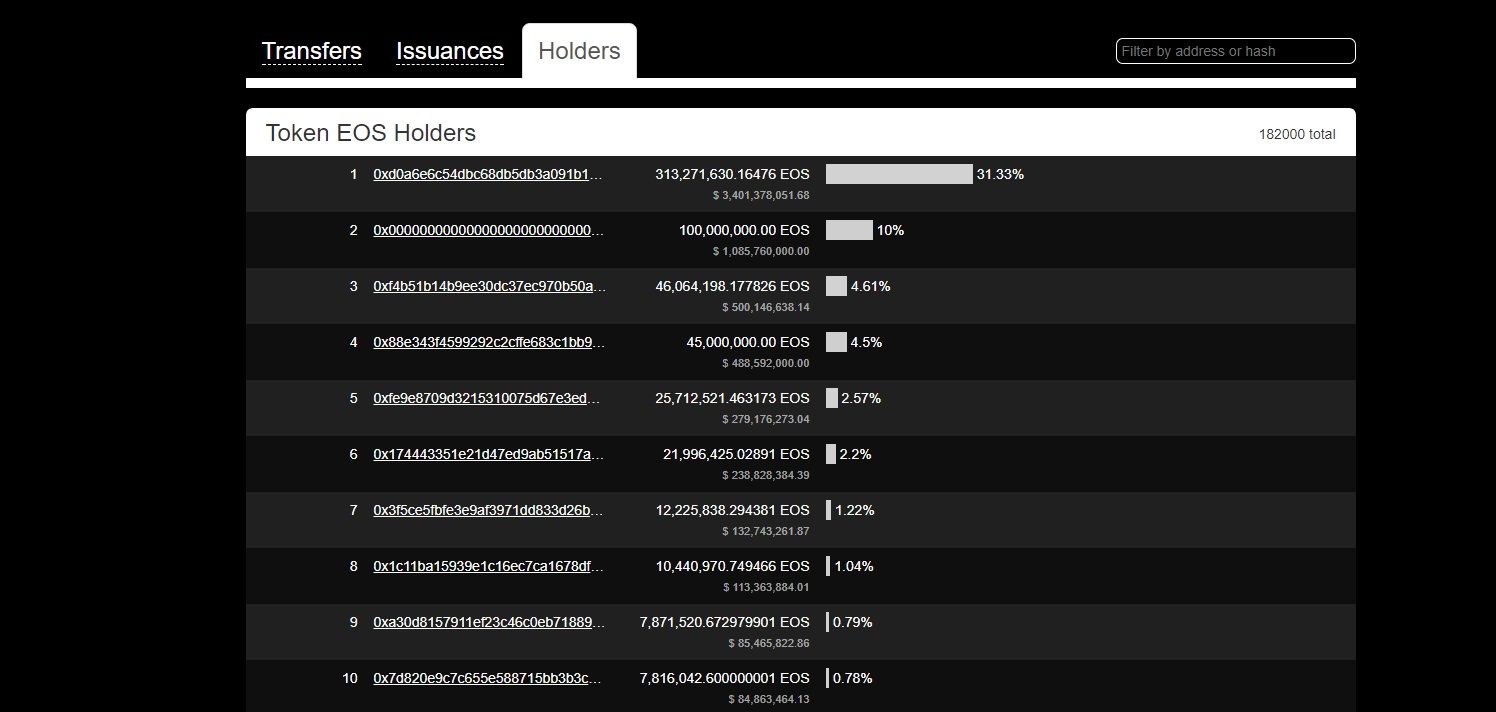

3) Coin supply and distribution

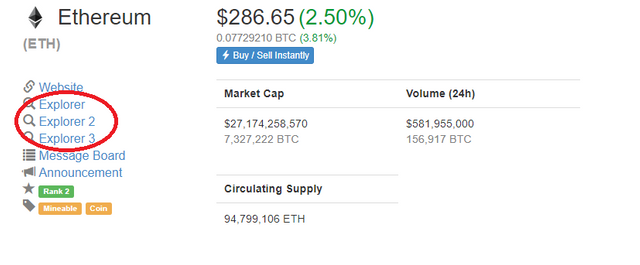

The transparancy of the blockchain offers us the chance to take a peek at who is holding which percentage of the coins. My rule of thumb is that the richest holder should not hold more than 60% of all coins. This is a lot, but if you choose a tighter criterion you're really limiting your potential investments. Even 60% might be tight in some cases. Also keep in mind that sometimes it's an exchange platform that is holding a lot of the coins. The key takeaway here is that if 1 guy is holding 90% of all coins, you should probably not invest. The token holders can be found on the "explorer" link on coinmarketcap.com.

The coin supply is also important. The circulating supply is used to calculate the market cap, or inversely, the coin price. The total supply is only relevant if there will be coins added later to the circulating supply. If this is the plan, it will usually be mentioned in the project's whitepaper. This way you can calculate the coin price with the assumption of further inflation. My rule of thumb when looking at the coin supply: if there is no maximum total supply, I do not invest. Inflation should be limited.

Market cap = circulating supply * price

Price = market cap / circulating supply

If you follow these rules when investing for the mid to long term, you will drastically improve your chances of winning. Don't overfocus on these metrics however, there are plenty of good coins that don't tick off all of the boxes. 2 out of 3 plus a good gut feeling based on common sense should be OK most of the time. The whole point of this strategy is to pick big winners that will more than compensate for losses on other coins, so don't be too rigid when investing.

This concludes the coin selection part of the strategy. Now onto something that is just as important.

Money management

This part is every bit as important as the first part because it might make the difference between "just doing some shit" and beating the market. This means achieving better returns than the top coins or a representative index such as the Blockchain Index (BLX). Remember, as soon as you are putting in more work than the regular buy and hold investor, you are not only investing your money, but also your precious time. Naturally you expect better returns because of that.

I don't know if my money management strategy beats the market or not. I haven't tried it out for a long enough time. It does have some good benefits which I will argue.

The 50/50-strategy

The idea is very simple; everytime you get a profit that gives you a euphoric reaction, you sell 50% of your holdings. This profit is then reinvested into a new coin or another coin that is currently dipping. Why such a simple rule? Because in times of heavy emotion, complex rules will be thrown out the window. This rule is one that's easy enough even in those moments. The great part is you can keep doing this until your stack of that coin runs out completely. Just don't do this twice a day. Or during a pump. There's a fat chance that your coin will keep rising after you sold and the price might even consolidate above your selling point. This happened to me and I wouldn't wish this upon any cryptohead. This event led me to making this rule in the first place. If I had sold only half, at least I would have still been in the coin.

By selling half, you are taking a sure profit while still keeping the potential gains open ended. In other words, instead of trying to be right all the time and ending up to be wrong more times than you'd like, you can be 50% right 100% of the time.

Conclusion

That is my current crypto investing strategy. I do not claim that this is the best strategy, or even that it will work for you. My goal was to create a strategy that is easy enough for a noob to follow, but leaves the potential for massive gains, without having to contemplate your next trade everytime.

I hope this will be helpful and profitable for at least some readers.

Thank you very much for reading.

BabylonSoldier

I too follow this strategy and I can confirm that it is one of the better ones to follow. To all the ones that want to get into crypto, I say: Be smart, educate yourself and don't just follow your emotions when dealing with large sums of money

be sure to leave a like if you enjoyed this post :)

babylonsoldier!! Thank you, your Post.

i'm glad i wrote it because everyone kept asking me how to invest :D

Congratulations @babylonsoldier! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!