Ethereum Loses 7% in Value After ETF Launch – What Happened?

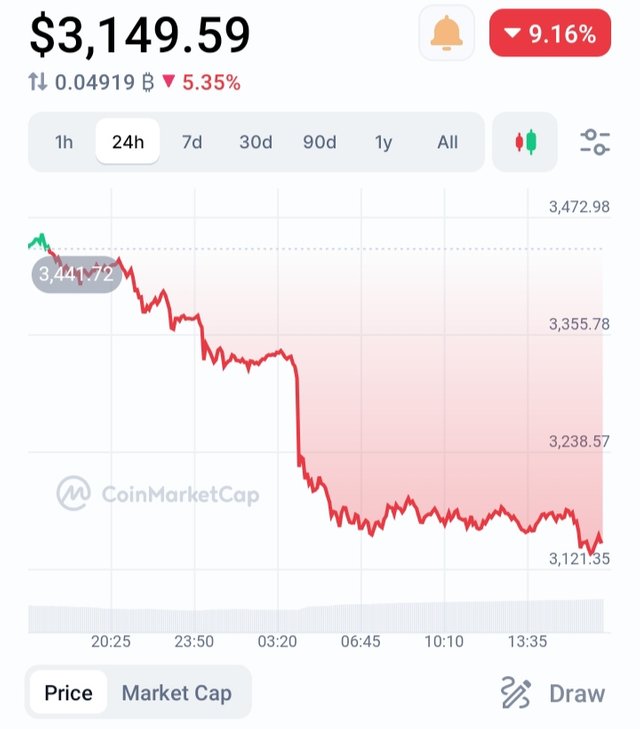

A day after the successful launch of the spot Ethereum ETF, Ethereum’s price experienced a significant drop, triggering substantial liquidations of long ETH positions within the last 24 hours.

According to data from Coinglass, Ethereum liquidations have surpassed those of Bitcoin, reaching $100.85 million compared to Bitcoin’s $83.35 million.

The approval of the spot Ethereum ETF seems to have become a “sell-the-news” event, similar to what occurred with Bitcoin earlier this year.

After Ethereum’s price climbed to $3,500 in July, investors appear to be cashing in on the ETF-related excitement.

Whale Activity and Market Impact

On-chain data indicates that a significant Ethereum whale has been offloading its holdings.

According to Spot on Chain, this whale made $173 million in profit by depositing 10,000 ETH, worth $34.2 million, on Kraken just before the price drop. This whale had previously withdrawn 96,639 ETH from Coinbase at $1,580 per ETH in September 2022. Since March, the whale has moved nearly 40,000 ETH to Kraken and still holds 56,639 ETH, valued at $188 million at the current price.

External Market Pressures

10xResearch has highlighted that current distributions from Mt. Gox are putting pressure on the broader cryptocurrency market. They noted that if this trend continues, the crypto market will need more support to rally, with Ethereum possibly being the most vulnerable due to stagnant or declining fundamentals like new users and revenue.

Analyst Predictions

Popular crypto analyst Michael van de Poppe suggests that Ethereum’s price might see a reversal amid significant outflows from the Grayscale Ethereum Trust. He predicts that Ethereum could experience a two-week downward trend before potentially rallying to new all-time highs.

According to his analysis, Ethereum might find support around $3,150 before resuming its upward trajectory.

At the time of writing, Ethereum is trading at $3,180 after a 7.4% decline in the past 24 hours, with a $20.95 billion trading volume. The market remains watchful of further developments and potential rebounds in Ethereum’s price.

Follow to get market updates