Malaysia's Crypto Regulation Part 2: Requirements of Reporting Institutions

Further Clarification on Para 4.1

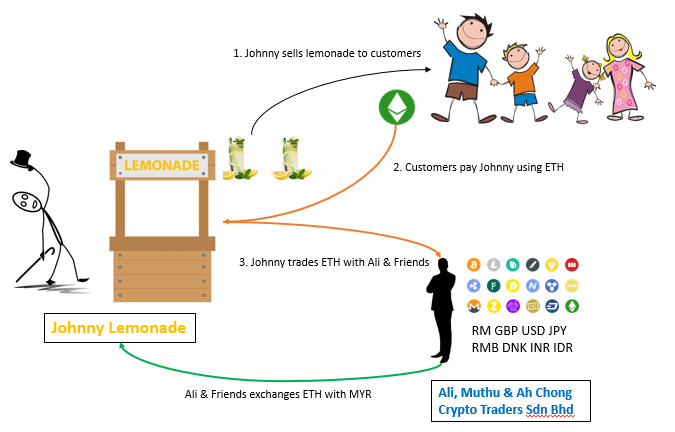

Before I proceed further, I would like to clarify further on Para 4.1. Earlier in my post, I gave an opinion about Johnny accepting digital currency in exchange of his product, the lemonade when I wanted to explain that Sector 6 is bound to reporting institutions which are conducting the activities listed in Para 4.1.

(i) exchanging digital currency for money;

(ii) exchanging money for digital currency; or

(iii) exchanging one digital currency for another digital currency

whether in the course of carrying on a digital currency exchange business or otherwise. - 4.1

Allow me to rephrase and add more clarity to this paragraph.

Let's have Johnny again as an example. He sells a cup of lemonade at the price of ETH0.05. He further exchanges his earnings denoted in ETH to his fiat currency (assuming in Malaysia, hence MYR) because he wants to use that money as working capital or business investment (to buy more lemons, more cups, more juicers etc); or even for his personal use. Ultimately, his business is bound by Sector 6 although his nature of business is not EXCHANGING or TRADING digital currencies.

Ok, let me draw this horrible picture for everyone...

Image Sources: Pixabay, Vecteezy

In an ultimately rare incident where he's only keeping the ETH in his e-wallet forever (or always exchanging his ETH with other goods and services) without having the intention to cash them out, I suppose it is safe to assume he does not need to report under Sector 6. Again, this is solely my opinion. I would still clarify with BNM if I am setting up a business which is accepting cryptocurrencies in exchange of goods or services.

Now that we got this set, let's answer some questions thrown to me earlier.

Questions & (Proposed) Answers

I'm no expert, and I am only interpreting this policy paper with through the lens of an accountant with the training of interpreting laws and regulations to consult businesses. Most of these answers (and the entire script) are solely based on my opinions. You may bring up some clauses here and we shall interpret it together should I fail to interpret it correctly. Do take my answers with a gunny of salt.

1. Question by @steemitguide: Would a peer-to-peer (p2p) exchanges be subjected under Sector 6?

The bank regulation covers the reporting duties of REPORTING INSTITUTIONS.

“reporting institution” means any person, including branches and subsidiaries outside Malaysia of that person, who carries on any activity listed in the First Schedule; - Section 3, Anti-Money Laundering, Anti-Terrorism Financing and proceeds of Unlawful Activities Act 2001 aka AMLA.

Until and unless you as an individual decide to carry on activities listed in First Schedule (predominantly banking and financing), you would less likely be subjected to Sector 6 regulations.

2. Question by @littlenewthings: What is your opinion of lifestyle that uses cryptocurrency as an alternative source of income? However, the major transactions of the person is dependent on fiat currencies. Would this person be taxable?

NOTE: Sector 6 (guideline for reporting institutions) is under the jurisdiction of Bank Negara Malaysia (BNM). Income taxability issues are under the jurisdiction of Lembaga Hasil Dalam Negara (LHDN). They are two separate regulatory bodies in Malaysia.

Now, let us divert our focus to Income Tax Act 1967 for this purpose.

Classes of taxable income

Subject to this [Income Tax] Act, the income upon which tax is chargeable under this Act is income in respect of—

(a) gains or profits from a business, for whatever period of time carried on;

(b) gains or profits from an employment;

(c) dividends, interest or discounts;

(d) rents, royalties or premiums;

(e) pensions, annuities or other periodical payments not falling under any of the foregoing paragraphs;

(f) gains or profits not falling under any of the foregoing paragraphs. -Section 4 of Income Tax Act 1967 (ITA)

So, in other words, this person who earns his pocket money (however small or big) is deemed taxable. However, since BNM does not recognize crypto-currency as a legal tender, it is debatable as to how should we declare this source of income. I was not able to find any related Public Rulings issued by LHDN. My closest assumption is on the "market value" test at the end of the year of assessment of the individual. Let us see if they agree with this computation of total income for the year.

Definitions again

“market value”, in relation to any thing, means the price which that thing would fetch if sold in a transaction between independent persons dealing at arm’s length. - Section 2 of ITA

"year of assessment," if you don't understand this, it could only mean you have never filed tax return. Therefore, there is nothing for you to worry about at all. - Yours truly

Back to Square 1: Summary of Part 1

To some of my peers, like @calebleejl and @orangila who think the previous post is too heavy, here's a boiled-down summary for you. I hope this clarifies.

- Malaysia doesn't wanna miss the fun in addressing risks associated around digital currencies

- BNM's regulation on cryptocurrencies are issued and effective from 27 February 2018

- The regulation is known as Sector 6

- Purpose of Sector 6 is to enhance business accountability and transparency

- Sector 6 is not standalone, but to be read alongside AMLA and other acts

- Reporting institutions covered under the first schedule of AMLA and Para 4 of Sector 6 are subject to compliance

- Cryptocurrency is not a legal tender

Let's proceed to Sector 6 already!

I wished to write on Applicability and Definitions. But I suppose, everyone has had enough of definitions with no implications. I shall attempt to write Part B of Sector 6, and where needs arise, I will define those terms.

Para 7: What do I need to do as a reporting institution?

- If you have not registered your company under SSM, please do so

- Fill up the Declaration Form for Digital Currency Exchangers (Annex 1)

- If there are any huge changes after you submitted Annex 1 to BNM, please inform BNM within 5 working days

- Don't create legitimate expectations that your activities are regulated by BNM

In other words, it's like you should not tell the public you're serving kosher food if you're not certified to do so. - Inform BNM when you stopped your operation of exchanging cryptocurrencies

Para 8: This seems to expose my company to a lot of risks, especially fluctuations. Do I need to inform BNM also?

(Documentations) Risk assessment application

Yes, you would need to do a risk assessment through a structured flow and keep the documents in a dark, dry and cool place. The documentations would include, but not limited to the following:

- Risk assessments and findings

- Relevant risk factors, level of the overall risk and appropriate risk mitigation strategies

- Periodic reviews and updates of the risks

- Clearly defined mechanisms (aka process flowchart or job description of the officer in charge of this chunk of portfolio)

(Actions) Risk control & mitigation

- You must have your policies, controls and procedures to manage the risks identified above

- You must monitor the implementation of all you say, and enhance them if needed

- When the going gets tough, take enhanced measures to manage your business

(Actions) Risk profiling

- You must conduct risk profiling on your customers (known as Know Your Customers, or KYC)

- Your KYC process must consider the following factors:

[ ] Customer risk

[ ] Geographical location

[ ] Products/services/delivery channels

[ ] Etc if you feel the customer is of higher risk - Your risk mitigation approaches must be able to treat the different levels of risks identified. Aka, use your business sense to treat different severity of problems you're exposing yourself with.

As we go deeper, you can tell that it is getting more technical. If you're only a p2p trader, I can safely assume the following posts would not be suitable for you. However, if you are a business entity thinking of venturing into the trading of cryptocurrencies, do leave your comments below and let me see if I am able to meet you up for pro bono consultation.

With that, I will only continue writing Part 3 to clarify further general public doubts, rather than expounding deeper and losing tract of all of you. I appreciate your upvotes in my previous post. If there are other business concerns you wish me to share my opinions further, do comment below also.

Cheers,

Alex.

Wow.. will have a good read when I am free.. thanks