Bitcoin, Gold, Silver, Real Estate, Stocks are you protecting your wealth UK?

Real world UK wages when comparing them to 1971 have increased significantly. In 1971 an average annual salary would bring around £1079. Compare that to today and you would be earning £27,000. This equates to an increase a 2450% increase. At the time, this would have been unimaginable for the average person.

You would have expected wages to have risen with inflation at to ensure a similar standard of living today as those seen in the 1970’s. After doing some further analysis, we may not have as much purchasing as those who generated incomes in the 1970’s.

I want to share with you this information and hopefully you find it useful.

Real Estate

In 1971 the average house price was £5632 and today stands at around £217,500, a massive 3762% increase in price. As you can see from above. This has outstripped wages leaving affordability challenges for the average person.

Asset Type/ Value 1971/ Income to Price Ratio/ Today (2017) / Income to Price Ratio

Real Estate/ £5632 / 5.21 / £217,500 / 8.06

In simplistic terms, you would need to be earning £42,000, £15,000 greater than the average salary in 2017 to be able to afford the equivalent property in 1971. You could say that the standards of living have improved, but in short affordability hasn’t. For those that got on the gravy train and invested in the property market back in the 1970’s, they experienced large gains in net wealth as a result of the increases.

Today, is the UK housing market entering bubble territory or have we still got room to grow? For those on average salaries, obtaining an average house based on today’s prices looks increasingly out of reach.

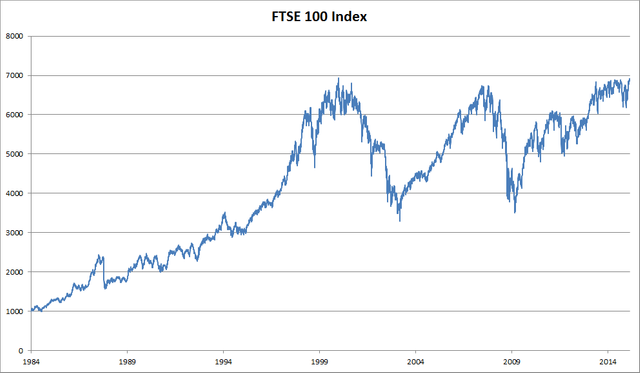

FTSE 100

Asset Type/ Points 1984 / Income to Points Ratio/ Today (2017) / Income to Points Ratio

Stocks / 1096 / 14.76 / 7427 / 3.64

n April 1984 the FTSE 100 Share Index was at 1096. Today it stands at a 7427 points, increasing over 6331 points over the last 30 years. This is a 577% increase over that time period. The average annual salary in 1984 was estimated at £16,175 whilst averagewages today are £27,000 hasn’t increased anywhere near the amount of the FTSE.

In 1984 an average salary could buy the FTSE 100 nearly 15 times over whilst today it remains at around 3.6. The FSTE has been hitting all-time highs and investing your currency in 1980’s would have led to significant gains. Investing today may be a different matter when looking at the historical context. The average person’s salary no longer has the same purchasing power as it did before, entering into today’s market.

Are stocks still a safe bet for the average investor? Affordability for the average investor could be a significant barrier to entry when considering the risk due to current economic uncertainty. What are your thoughts?

Gold

In 1971 President Nixon suspended the ability to freely convert between currency and gold, and ended the Gold Standard. Britain unpegged (floated) the pound and, in effect, the brakes were removed, and the freely-traded currency we see today was established. The price of gold back then was $35 per troy Ounce. Due to the strong pound we had an exchange rate at the time at around $2.44 per £. Due to the convertibility, you could get an Ounce of Gold for £14.6.

The annual income as described above was around £1096. If transferred for Gold, you could get around 75 Ounces. With the average wage standing today at £27,000 you would only be able to buy 27.5. This is 47.5 Ounces less over that time period. Again, the loss in purchasing power is frightening. A 63% reduction in purchasing power if you held the currency and not Gold.

Asset Type/ Price (1971) / Income to Ounce Ratio / Today (2017) / Income to Ounces Ratio

Gold / £14.6 / 75 / £980 / 27.5

Today it is currently priced at £13.22 £0.72 per troy Ounce. Out of all the assets I have assessed, Silver is the only asset where you can use today’s currency and get more for your currency than in the past. In summary, you can get 25% more Silver for your currency today, than you could nearly 50 years ago.

https://goldsilver.com/blog/when-do-we-get-the-silver-moonshot/

I have a lot of respect for Mike Maloney. He is an expert in precious metals and looking at this data I understand where he is coming from regarding Silver’s current valuation.

Asset Type/ Price (1971) / Income to Ounce Ratio / Today (2017) / Income to Ounces Ratio

Silver / £0.72 / 1522 / £13.15 / 2042

Bitcoin

Unfortunately for me, although I was aware of this technology way back in 2011, I failed to jump on that ship before it set sail. I just didn’t understand it and still need to learn more. Bitcoin was on par with the USD for its valuation. If you were holding British pounds you could have got them for around 50p which makes me cry at current prices. The average wage was around £24,000 back then which could have bought you 48,000 Bitcoins, ouch that hurts. In today’s money you would have £94million, let’s just digest this for a second, £94 million. What can you say? The rise in cryptocurrencies has been enormous. Well done for those early adopters for taking the risk and riding out the storm. Now the average salary can only buy 13 Bitcoins, wow. The only question now is can cryptocurrencies continue to rise? Are they in a bubble? Nobody really knows. For me this is the future, the technology has unlimited potential and with that backdrop, it will be hard to stop this journey now.

Summary

From my analysis it is clear. Those that have held their wealth in the British Currency have significantly missed out on many opportunities by not investing in assets. Even worse, their purchasing power would have significantly reduced as wages struggled to keep up with the increase in the prices of assets around them. Whether Stocks, Real Estate, Gold or Bitcoin, all have way exceeded the benefits of holding currency in a bank account. There looks to be massive opportunities in Silver as well as monitoring the development of cryptocurrencies. These areas need further investigation from my point of view.

There are a number of investments that look like they are headed for a bubble, but the measures I have used are not in any way scientific but do highlight some interesting themes

1) Currency devaluation (GBP): What does the future hold and how do we protect our wealth to avoid this?

2) Where do we best invest to ensure future purchasing power?

3) How do we exploit opportunities to protect our wealth and time?

4) What has stopped wages keeping up with asset prices?

5) What stops people from taking risks?

Hope you found this informative. Please do not take this as investment advice. Please upvote if you liked the content.

Great read! I just upvoted you. Please do the same and follow.

Glad you enjoyed it and thanks or reading.