Microfinance: Challenges and Possible Solutions

What is Microfinance?

In many developing countries, it is very tough to find good paying jobs or to start your own business. Micro finance is a way of supporting individuals who are unemployed or from low-income groups. Micro finance institutes such as SKS Microfinance and Spandana Spoorthy Finance are providing individuals a small amount of money to support their families. This financial support includes anything from compensating their children's education to building toilets at home or mainly to start some small “Micro-ventures” that range from $100-$1000. Majority of these institutions offer credit to beneficiaries without any collateral and previous credit history.

Major challenges of current System:

- Budgets are very Limited:

It is not possible to Banks and MFI to lend for all the Ideas of people. To help maximum people Microfinance Institutes are partnering with Crowdfunding websites like Rangde.org and Milaap.org. Any MFI or NGO can register with these sites and raise funds. In this case the individual need to bear extra costs such as taxes and payment charges of websites. - Transaction Cost: As the credit given to people are very small and they are going through banks, the cost incurred as transaction fees are more when we see as a whole. Either MFI or banks need to bear the extra cost, if not the individual will end up paying for it.

- High rates of Interest: As loans are given to individuals without any collateral, the interest rates charged by majority of the MFI are relatively high than any traditional banks. Even if we use any crowdfunding websites the cost of payment gateways are coming in to picture as the borrowers need to bear the cost.

- Credit Risk from defaulters: There are some cases that the credit given to individuals may not be recovered as there will be unforeseen circumstances. If MFI is funding to farmer or small micro-venture, there are problems like drought and death of lenders.

Top Microfinance Institutes in India:

- Ujjivan Small Finance Bank: Its head office is located in Bengaluru, India. It has presence across 24 states of India and going deeper into unserved population to enhance their financial ability.

- Bharat Financial Inclusion Limited: Previous known as SKS Microfinance, was founded in 1997 in Hyderabad, India. It has presence in 13 states of India.

- Asmitha Microfin Ltd: Which was founded in 2002 in Hyderabad, India. I has more than 375 branches across the country.

- Spandana Sphoorty Financial Ltd: It was established by Ms. G. Padmaja Reddy in 2003 in Hyderabad, India. They have presence in 12 states of India.

- Share Microfin Limited: It is also located in Hyderabad, India with presence in 19 states of India.

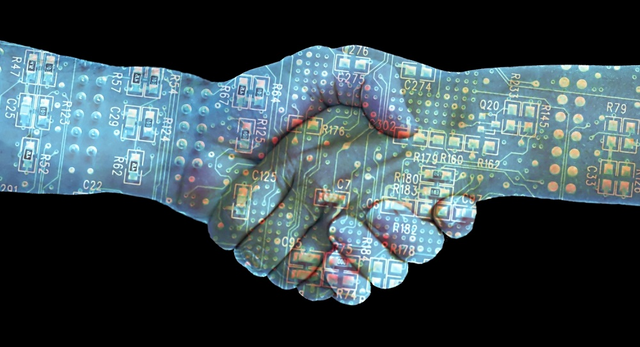

Blockchain based Microfinance as a solution:

If all the major companies are adopting blockchain based micro-finance, we can address the major challenges such as interest rates and transaction costs.

If we are running these applications on top of Steem blockchain, users can get loans without any interests and there is no fee for using network. We need to build a solution where individuals can withdraw their funds to fiat currency. MFI and field partners can handle this for borrowers. In this case the borrowers are creating content as they have variety of stories to tell.

Join Steemit India Chapter

Whatsapp Group

Telegram Group

Microfinance is not really helping the poor in the first place, rather they preying on them. Unless we have something like your idea is. Microfinance on top of the blockchain is far better I think.

great job

nice post

@dcrpto great job. I am from Nigeria and I know how difficult it is to get loan from bank aside from collateral, the interest rate is too much, if only developing county can key into blockchain technology fast this will solve our banking problem and we will develop fast

I am a Nigerian too, I worked in MaxiTrust Micro Finance Bank Port Harcourt as a Branch Accountant. I can honestly attest to the fact that we lend at a high interest rate , most times also the incidence of customers default is also alarmingly high to the extent that the Banks has to make adequate provisions for loan recovery expenses.

Bottom line , I think Block chain technology and Steem has a pivot role to play in the industry. I dont mind being a volunteer to this course of affirmative action to bring blockchain knowlegde to the ignorant Nigerian masses as it will go a long way towards increasing our income per capita and also creating a more rubust economy where transparency , prudence and effectiveness reigns.

Great

This could be an awesome solution for many trying to start or operate a small business.

Tell your story make your money Steemit!

You know what this could work! Awesome idea and great aritcle

Good idea, thanks for this

Seems very in tune with people centered development, a good way of cutting the state and the corporations out of the whole process.