The trend of DeFi and Farmland's cross-chain DeFi

Please briefly introduce what the Farmland agreement does?

Farmland is a cross-chain DeFi platform. Users can directly enter BTC and other assets into our contracts, and then they can mine, borrow and trade on Ethereum. The first phase of our product has been launched. It can be said that it is the best BTC cross-chain tool currently on the market to achieve decentralization. It is especially suitable for hoarding parties to enjoy the interest of BTC holdings.

Our mid-term goal is to provide more BTC cross-chain asset management tools so that everyone can enjoy a bull market with higher returns.

How do you view the current development trend of DeFi?

DeFi has changed from last year's concept to this year's actual landing. Through the exploration of several head projects this year, the DeFi project has formed a set of mature play methods. Liquid mining is almost the standard configuration of the project. The paradigm for subsequent DeFi projects has been initially established.

In addition, if you want to compete with CeFi, cross-chain is also the next area that DeFi needs to focus on. There is not only Ethereum in the blockchain world, but assets on different chains need to be interconnected. BTC is the most important part of it. There are more and more DeFi attempts around BTC, and the amount of BTC flowing into DeFi has surged since June this year, and there have been hundreds of thousands of them so far.

However, I believe that the vast majority of users have not operated cross-chain by themselves, and some friends have replaced BTC with the erc20 version of BTC in a centralized organization. This is because BTC cross-chain is currently inconvenient to operate, which is different from the familiar Ethereum wallet and Bitcoin wallet operation methods. This ease-of-use issue needs to be resolved to allow BTC's DeFi to move from experienced users to ordinary users. Therefore, cross-chain DeFi aggregation products that are easy to use and can be cut from mining are an obvious demand and trend.

We mentioned above that cross-chain DeFi aggregation products are a trend, but what are the main obstacles facing it in order to become popular?

I think there are two core points that need to be broken through. One is to be decentralized enough to ensure security, and the other is to be easy to use to lower the threshold.

Let's talk about the second question first. Take the user who has BTC to mine curve as an example. Users need to learn to use renVM to generate renBTC on Ethereum. This process requires at least 6 Bitcoin block waiting time, and then stake renBTC on Curve. This step requires tens to hundreds of dollars. Then the user needs to sell the CRV after a certain period of time. This process will cost a high fee. Therefore, without dozens of BTC, it may be difficult to return to the cost.

So the first question is that the current solutions on the market are not very good. Basically, BTC cross-chain providers use centralized solutions, which are actually not very secure.

What solutions does Farmland have in addressing these major obstacles? What is the current stage of the product?

Our products are planned in phases. In the first phase, decentralized cross-chain aggregation will be realized first. What do you mean specifically? That is to say, we have realized the user's low handling fee or even zero handling fee mining function, and the user's income is automatically credited to the account on a regular basis, and there is no need to spend more handling fees to actively operate. At the same time, users don’t need to cross-chain manually, just like using a wallet, just punch BTC into the address generated by our contract. They don’t need to know what cross-chain is, and it’s completely insensible. More importantly, the whole process is achieved through decentralization of contracts, and there is no problem of fund pools.

So our first issue has solved the problem of ease of use and partly solved the problem of decentralization.

A very important point in Farmland's cross-chain DeFi is decentralization and transparency. How is it done?

Farmland bridges other cross-chain systems on the market through contracts. Let’s take the bridged renVM as an example. When a user wants to participate in cross-chain mining, its assets actually enter the pool of ren through our contract and generate renBTC, and then our contract automatically realizes this part of renBTC to curve. Of mortgage mining. The whole process is the realization of the contract on the chain, which is publicly available for inspection. BTC does not stay with us, but directly leads to the revenue pool. So the whole process is decentralized and completely transparent, safe and reliable.

The cost problem in DeFi has always been a big problem that plagues users, which also hinders its development to the mainstream population. How did Farmland solve this problem?

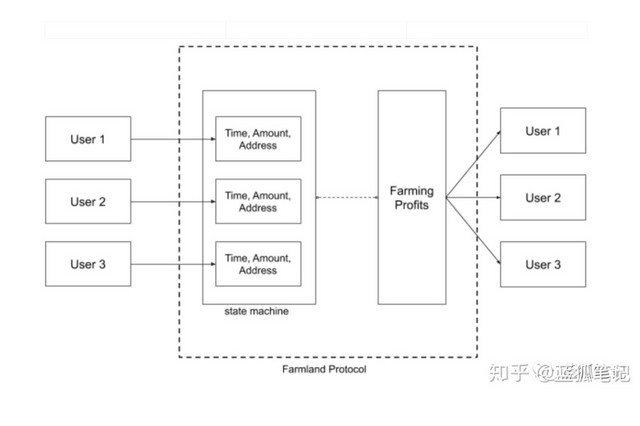

Farmland Protocol uses smart contracts to realize the automatic aggregation of mining funds, mining and automatic income distribution. The process is completely through the chain, and the flow of funds and income distribution are open and transparent.

The specific implementation method of this function is as follows:

Open aggregation

Read and record the address, time and amount of funds sent

When certain conditions are reached, this part of the funds will be promoted to the mining pool as a whole

After a certain period of time, the income will be automatically withdrawn

Put the proceeds into the revenue pool

Send revenue from the revenue pool to the user who sent the request to withdraw revenue

Through this kind of aggregation, we can reduce the handling fee of a single user to about one percent of the original. In this way, by deducting the back-end revenue, we will achieve zero handling fee for the entire process.

In terms of cross-chain DeFi mining, how does Farmland maintain its revenue competitiveness?

There are two aspects that we emphatically consider:

One is the diversity of chains. We will provide mining pools on different chains. In the future, we will add functions such as lending and trading to provide users with more sources of income for various assets.

The second is flexibility. Many aggregators adopt the form of machine gun pools. Users have only a few pools to choose from. In fact, this model is more centralized and dangerous. At the same time, they are afraid to try many high-risk and high-yield pools. By connecting the revenue pool directly, users can have more direct choices, so that they can pursue higher revenue when the risk is clear.

What is the main purpose of Farmland's token FAR? What value can it capture?

Farmland's token (FAR) mechanism mainly adopts the model of platform currency. Users get very good income through Farmland, but also get convenience, Farmland and users share the income results. Farmland will charge 5-20% of user profits to purchase FAR in the secondary market and destroy it.

At the same time, FAR also has the function of governance tokens. FAR holders can vote on issues such as the profit ratio and mining pool selection.

So the FAR model is like a combination of BNB+YFI.