This weekend is a scorcher on the Blockchain!

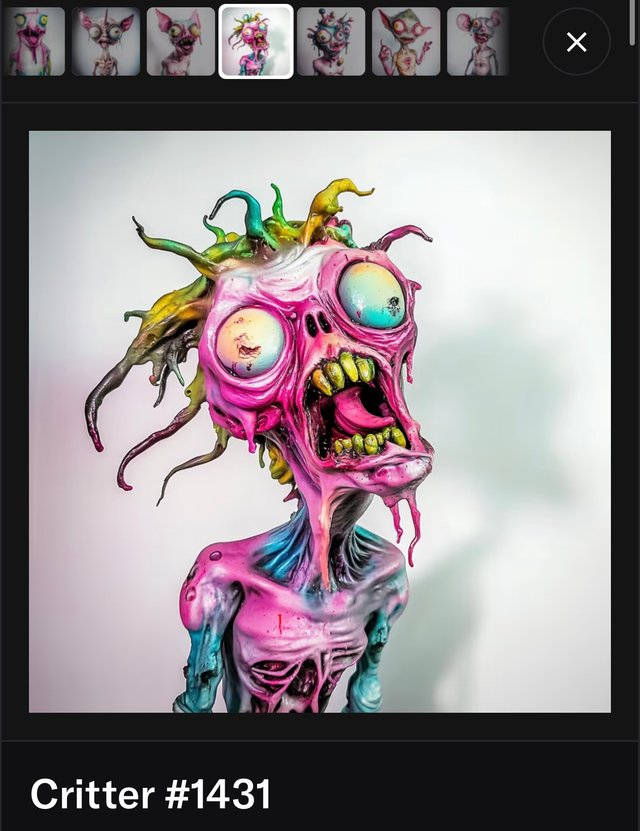

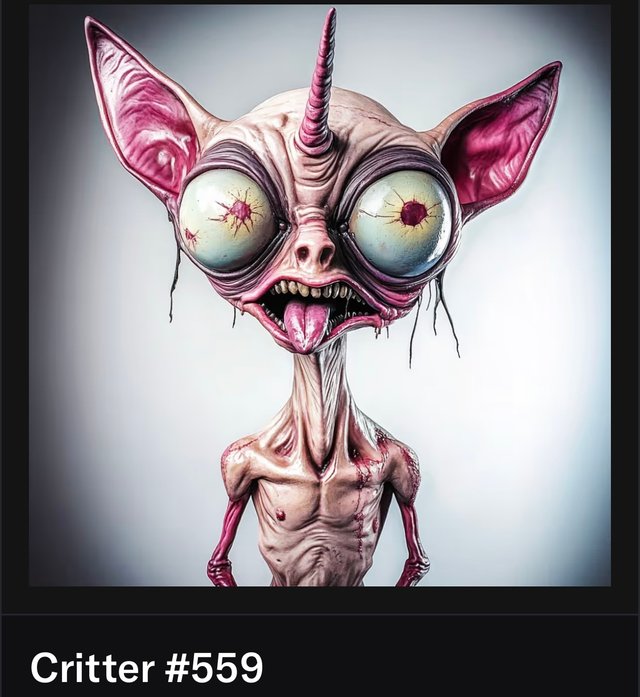

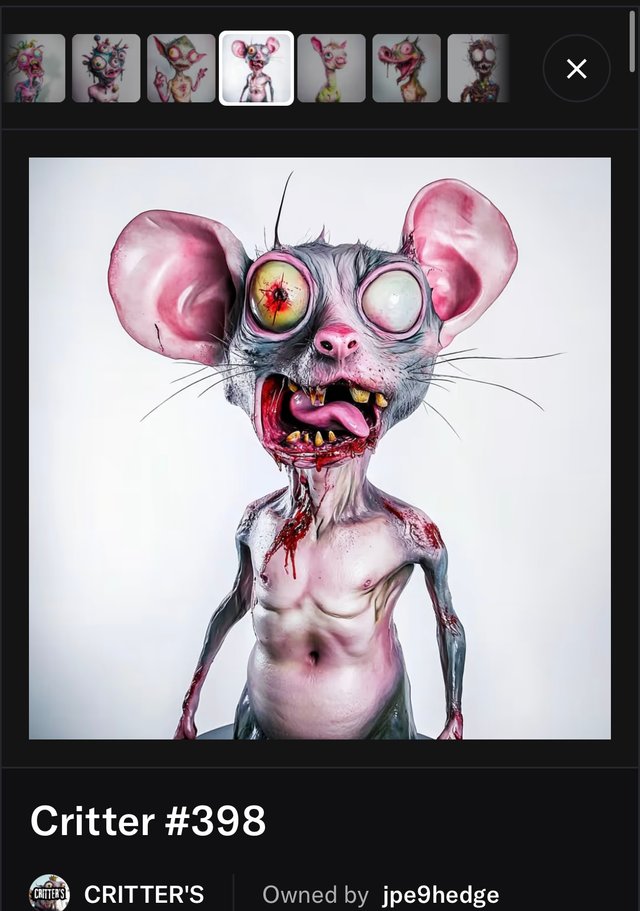

Critter’s cools off after mints respectively at .005~ETH and .001 ETH

Shirts optional at the Critter’s beach.

This summer we have more summer NFT Collections launching on Opensea!

New Networks, New Coins & New friends!

Ethereum’s Epic Dogfight with the Bulls: Ready to Lift Off or About to Get Molly Whopped at $3,100-$3,250 Resistance?

Yo, crypto degens, strap in—it’s 5:56 AM, and Ethereum’s in the middle of a fierce dogfight with the bulls, battling for supremacy in the wild skies of the market. The ETH price chart is looking like a warzone, with bulls and bears throwing haymakers. Is Ethereum about to lift off to new heights, or is it just about to get molly whopped by a critical resistance point around $3,100-$3,250? Let’s unpack this alpha, dive into the charts, and see what’s cooking in the Ethereum ecosystem as of July 14, 2025.

The Setup: Ethereum’s Wild Ride

Ethereum’s been grinding hard, fam. After a brutal bear market and some serious consolidation, ETH has clawed its way back, riding the wave of broader crypto hype. At 5:56 AM CEST, ETH is hovering around $3,050, according to CoinMarketCap, with the bulls trying to flex their bags and push for a breakout. But there’s a catch—a critical resistance point around $3,100-$3,250 is looming like a brick wall. This zone’s been a graveyard for past rallies, and the bears are loading up to defend it like their bags depend on it.

This ain’t just any resistance. The $3,100-$3,250 range has historical weight—multiple rejections in 2021 and 2024, plus heavy liquidity from stop-losses and sell orders. It’s a make-or-break moment for ETH. If the bulls can smash through, we could see Ethereum lift off to $4,000 or beyond. But if they fumble, ETH might get molly whopped back to support levels around $2,800 or lower. Let’s break down the battlefield.

The Bull Case: Ethereum About to Lift Off

The bulls are hyped, and for good reason. Ethereum’s got fundamentals and momentum that could send it to the moon. Here’s why ETH might be about to lift off:

• NFT and DeFi Heat: Ethereum’s still the king of NFTs and DeFi. Despite gas fees making degens cry, platforms like OpenSea and Uniswap are buzzing. The NFT market’s heating up again, with $1.2B in trading volume last month (per DappRadar). Every NFT mint or swap needs ETH, pumping demand like nobody’s business.

• Layer-2 Scaling Solutions: L2s like Arbitrum and Optimism are making Ethereum faster and cheaper. Rollup transactions are up 40% year-over-year, per L2Beat, reducing the gas fee FUD and bringing more users to the network. More adoption = more ETH locked up = price go brrr.

• Staking and EIP-1559: Post-Merge, Ethereum’s proof-of-stake is a beast. Over 30M ETH is staked (that’s 25% of supply, per Etherscan), reducing circulating supply. EIP-1559’s burn mechanism has torched over 4M ETH since 2021, creating deflationary vibes. Less supply + more demand = bullish AF.

• Macro Tailwinds: The crypto market’s riding a wave of optimism. Bitcoin’s testing $60K, and altcoins are pumping. If BTC breaks out, ETH’s beta means it could outpace the king. Plus, with ETF rumors swirling again on X, institutional money might FOMO in.

The bulls are eyeing that $3,100-$3,250 resistance like a boss. If they can flip it into support with strong volume—say, $15B daily on Binance and Coinbase—it’s game on for a run to $3,500 or even $4,000. The RSI on the 4-hour chart is at 60, not overbought, and the MACD’s showing bullish divergence. The stars are aligning for ETH to lift off, fam.

The Bear Case: About to Get Molly Whopped

But hold up—don’t get too cozy with those long positions. The bears are lurking, and that critical resistance point around $3,100-$3,250 could molly whop ETH into next week. Here’s why the bears might rug-pull this rally:

• Historical Rejection Zone: The $3,100-$3,250 range is a fortress. Back in November 2021, ETH got rejected hard at $3,200, and again in Q1 2024. Whale sell walls are stacked, and liquidations could trigger a cascade if ETH tests this zone without enough juice.

• Market FUD: Regulatory noise is real. The SEC’s still sniffing around DeFi and NFTs, and any crackdown could spook the market. Posts on X are buzzing with FUD about potential Ethereum ETF delays, which could tank sentiment.

• Overheated Momentum: ETH’s up 20% in the last two weeks, and the funding rates on futures are creeping up, signaling leverage overload. If the bulls can’t break $3,250 with conviction, a rejection could send ETH tumbling to $2,800 support or even $2,500 if things get ugly.

• Bitcoin Dominance: If BTC stalls or dumps, alts like ETH usually bleed harder. The 200-day moving average at $3,150 is a technical wall, and if Bitcoin dominance spikes, ETH could get molly whopped back to lower support.

The bears are ready to pounce, with short positions building on Bitfinex and OKX. If ETH fails to break $3,250 and volume dries up, we could see a swift correction. The 4-hour chart shows a double-top pattern forming near $3,100, and a bearish RSI divergence ain’t helping. This dogfight could get bloody.

The X Factor: Sentiment and Hype

X is lit with Ethereum chatter at 5:56 AM. Top accounts like @CryptoWhale and @AltcoinSherpa are hyping the breakout potential, but others, like @TheCryptoDog, are warning about a “fakeout” at $3,250. Sentiment’s mixed—50% bullish, 50% cautious, based on recent posts. The NFT crowd’s pumping projects like Pudgy Penguins, which could drive ETH demand, but some degens are calling for a pullback if resistance holds. This noise could sway retail traders, so keep an eye on X for real-time vibes.

What’s Next for Ethereum?

At 5:56 AM, Ethereum’s at a crossroads. The bulls are loading up for a breakout, fueled by fundamentals, L2 adoption, and market hype. If they can smash through that critical resistance point around $3,100-$3,250 with high volume and BTC support, ETH could lift off to $4,000 or higher, maybe even challenging its ATH of $4,800 from 2021. But if the bears hold the line, Ethereum’s just about to get molly whopped, potentially dumping to $2,800 or lower.

For now, keep your eyes on the charts and your ears on X. Watch for a daily close above $3,250 with volume above $15B as a bullish signal, or a rejection with a wick below $3,100 as a bearish red flag. Whatever happens, this dogfight’s got the crypto world on edge.

Stay diamond-handed, fam. Want me to dig into more X posts or run a DeepSearch for fresh alpha? Holler!

Data sourced from CoinMarketCap, DappRadar, L2Beat, Etherscan, and X sentiment analysis as of July 14, 2025, 5:56 AM CEST.

NFT 100% this summer

WAGMI