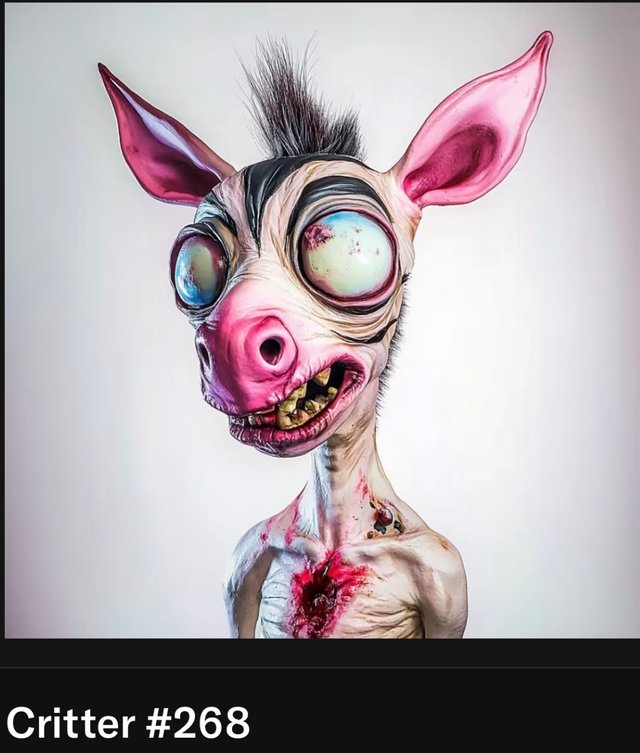

Ethereum & Opensea NFT Collections

Critter’s NFT Collection is still holding strong at a floor of .002 eth.

Bit less than five bucks gets you one of these devilysh fuckle fugglers’

If you’ve ever asked yourself “why am I this way”

Stop.

Look no farther for an NFT or 20 NFTS.

Wugh spooks!

This sort of collection gives a vibe off of comfort, odd comfort.

Like it almost looks like some sort of collection that would be on Ronin Blockchain as well.

BTC is flying off the handle at 200,000 Banana from the banana foundation nearing 250,000 Bananas at a potential huge price run.

That means more Critter’s.

Let’s talk about how NFTs are straight-up frontrunning the Bitcoin bull brigade, acting as the ultimate catalysts for BTC’s price to go parabolic. These non-fungible gems are more than just JPEGs—they’re the spark lighting up the crypto market, and Bitcoin’s eating the gains like a whale on a dip. Let’s dive into this alpha and unpack why NFTs are the real MVPs for BTC’s next leg up.

NFTs: The OG Flex of the Blockchain

NFTs, fam, are those one-of-a-kind digital assets living rent-free on the blockchain—think rare art, dank memes, virtual land, or collectibles that scream “I’m unique, bruh.” Unlike Bitcoin, our fungible king, NFTs are all about that exclusivity and provenance flex. They blew up in 2021 like a gas war on Ethereum, with projects like CryptoPunks and Bored Apes mooning harder than a leveraged long. DappRadar clocked the NFT market at a spicy $25B in sales that year—pure insanity! This wasn’t just a pump-and-dump; it was a full-on vibe shift, onboarding normies to Web3 and making blockchain the coolest kid on the block.

NFTs Leading the Bitcoin Bull Brigade

The Bitcoin bull brigade? That’s the squad of degens, whales, and HODLers pushing BTC to new ATHs during those glorious bull runs. NFTs, while mostly chilling on Ethereum, are the hype lords setting the stage for Bitcoin to yeet to the stratosphere. Here’s the lowdown on how they’re leading the charge:

- Onboarding Noobs to the Crypto Game: NFTs are the ultimate red pill for newbies. From artists minting dope creations to celebs and brands jumping in, NFTs are bringing mad FOMO. That Beeple drop at Christie’s for $69M? Straight-up iconic. To cop these tokens, normies gotta stack some crypto first, and Bitcoin’s often the gateway drug. More noobs buying BTC = more demand, fam.

- Cross-Chain Vibes: Yeah, NFTs mostly run on ETH, but Bitcoin’s the big daddy of crypto—the reserve asset everyone respects. When NFT markets get lit, the whole crypto space catches fire. Degens diversify their bags, and BTC gets love as the ultimate HODL. Back in ’21, while NFTs were pumping, Bitcoin went from $29K to nearly $69K in a single year. Coincidence? Nah, that’s market synergy, bro.

- Hype Cycles and Moon Energy: NFTs thrive on FOMO and speculative heat—think YOLO buys on OpenSea during a gas spike. That energy spills over to BTC, juicing up market sentiment. When apes and punks are selling for millions, degens get that itch to ape into Bitcoin too, pushing it closer to the moon.

- Big Money and Infra Plays: The NFT craze got institutions like Visa and Sotheby’s dipping their toes in Web3. That’s a massive W for crypto legitimacy. When suits start vibing with blockchain, they often park their capital in BTC as the safest bet. Plus, NFT hype pushes dev on scaling solutions like Lightning Network, making Bitcoin even more of a beast.

NFTs Juicing Up Bitcoin’s Price

NFTs aren’t just riding Bitcoin’s coattails—they’re straight-up pumping its price. Here’s the 411:

• Liquidity Tsunami: NFT marketplaces are like fiat-to-crypto ATMs. To grab that shiny Bored Ape, you gotta swap your USD for crypto, and that means more liquidity flooding the market. Bitcoin, being the most liquid asset, slurps up those inflows like a vacuum. Check the charts—NFT bull runs always spike BTC trading volume on Coinbase and Binance.

• Wealth Effect, Baby: When some degen flips a Punk for 100 ETH, they’re ballin’. What do they do with those gains? Reinvest in the king—Bitcoin. Chainalysis data shows NFT wallets often stack more BTC after big sales, driving demand and sending prices to the stars.

Buy link: https://opensea.io/collection/critter-s

Critter’s community on X: https://x.com/critters_club?s=21&t=ux0odA-1fIa85zAi5kf1iQ