Two Great Tips To Repair or Build Credit Scores

Hey its Edward,

Today I was coming home from church I noticed one of those signs that or by the side of the rode that stated "Credit repair $85" and it got me to thinking, What are they doing for $85 bucks?I have a past financial back ground in Banking and I know that one of the best ways to raise your creditscore is on time payments to any type of credit account that reports to the three major credit bureaus,which are Experian, TransUnion, and Equifax. And I wanted to share with you two great tips that will help you to repair or build your credit.

First of all there are some many things that can factor into your credit report. That is why it is always a good idea to keep an eye on it, not just check it when you really need it, or you may be surprised. You have loans, credit cards, public records, cell phone bills, light bills, water bills, cable bills,.....ect. And you can have things on there that can by all means be a mistake or should not be there at all. One thing I know is that third party companies, meaning collection companies and companies that purchase your debt can be easily handled. To take a page out of the governments book "we can neither confirm nor deny" is always your stance, which leads me into Tip number one.

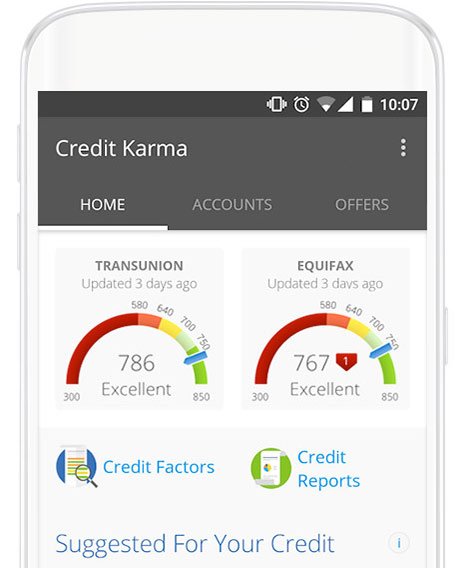

So Tip #1 is to open a Free account with https://www.creditkarma.com/ (Credit Karma). This will give you both your Transunion and Equafax reports. These free reports do not have a negative or positive affect on your credit so you can use it as much as you want to monitor your credit. So the key is to dispute the things that are listed on your report. It does not matter if they are true or not, your job is just to get them removed. Remember your stand point is I have no knowledge of this " I can can neither confirm nor deny" so that leads me into the dispute process.

The process is simple with Credit Karma, you choose what you want to dispute and click dispute, and it's really as simple as that. The company in question has a certain amount of time to respond to the dispute. So one of two things will happen Credit Karma will let you know it has been removed or not removed. In the case that it is not removed you can dispute it again, are choose something else to dispute and come back to the unmoved item later. It's like a ping pong battle or tennis match keep hitting the ball back into there court. And in extreme cases with third party collections send them a letter of dispute say you have no dealings with there company, and to send you documented proof with your signature. Your business is always with the original creditor. So here or a few things on closing on tip #1

- even if the original creditor removes the report, you are still legally liable to that creditor

as long as the time limitations apply. - never confirm debt to a third party collections company , confirming it can make you liable

- Credit Karma will only allow you one dispute at a time, postal mail disputes can bean alternative and always

send certified mail.

So here is Tip #2 using your credit card to pay one ore more monthly bills, in my case my cell phone is automatically drafted off my credit card. I pay the monthly amount due and my cell phone bill is always drafted from that. It builds my credit and shows on time consistent payments, that not only increase my credit score, but my credit card spending limit. So if you don't have a credit card Credit Karma will match you with companies that you have a good chance of being approved for. So in the instance that you get a new card your goal is to only use that card for one bill and one bill only ,that you know will be paid on time all the time.

So in closing these are just a few things that I have used, and helped others to use to get a boost on their credit history, So I sincerely hope this helps somebody out. Also is Credit Karma is a great free tool that will teach you the ropes so take action and check it out.

Have Great Day ;)

Edward

i used the services of a credit repair specialist Creditmasterfix.com to improve my credit score and they did a great job, i now score an amazing 800+ across all three bureaus. They offer fantastic service, i am impressed. ([email protected])