US Inflation Rises to 2.4% in May — Bitcoin Reacts

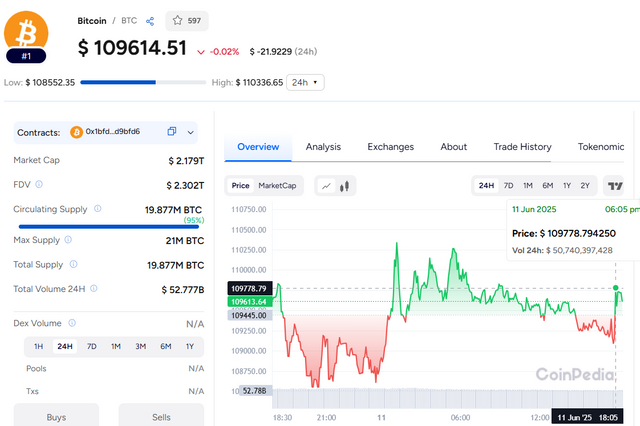

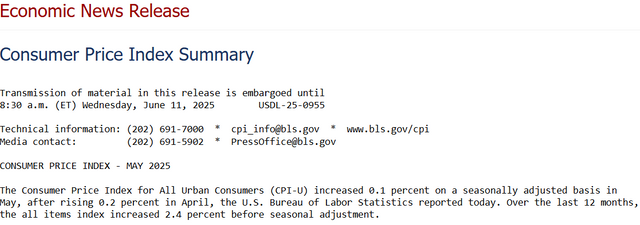

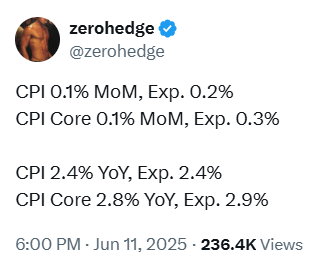

U.S. Consumer Price Index (CPI) rose 2.4% year-over-year in May, the first increase since February. Bitcoin responded quickly, rising to $109,700.

Bitcoin Moves After CPI Report

Bitcoin climbed toward $110,000 after the CPI data was released. The price jump shows that markets had already priced in expectations of higher inflation.

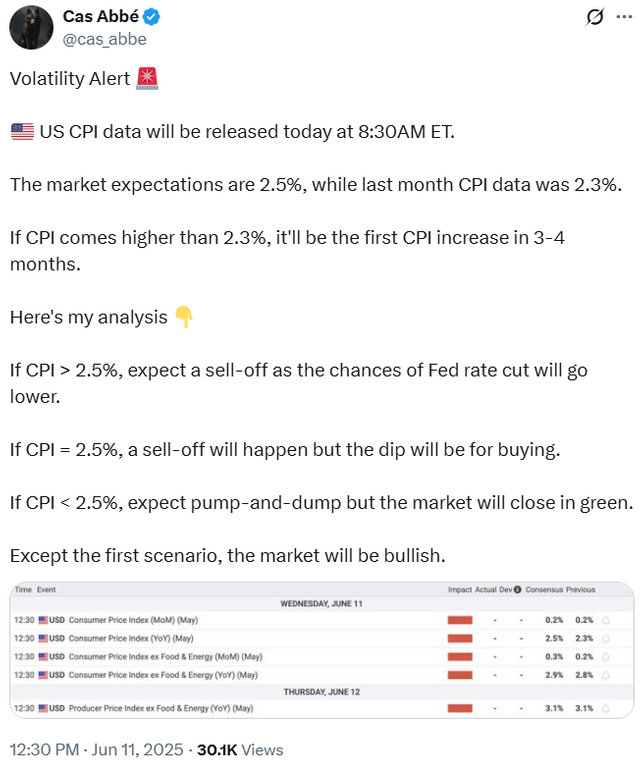

Analyst Cas Abbé had forecasted:

CPI above 2.5% = likely sell-off

CPI at 2.5% = short dip, then recovery

CPI below 2.5% = volatile move, but green close

At 2.4%, the result helped Bitcoin stay bullish.

Focus Shifts to Jobs and PPI Data

With CPI out, attention turns to jobless claims and the Producer Price Index (PPI), both due Thursday. These reports could impact markets ahead of the Federal Reserve meeting next week.

What’s Pushing Inflation?

Analysts point to Trump-era tariffs and rising oil prices. These are starting to affect consumer prices, especially for goods.

“Tariffs and oil costs are pushing prices up,” said analyst Daan Crypto Trades.

Banks had predicted mild headline inflation and steady core inflation — which matched the actual results.

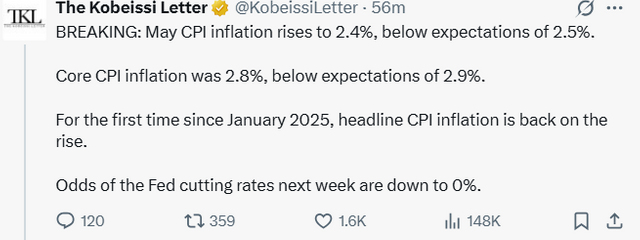

Fed Rate Cut Unlikely

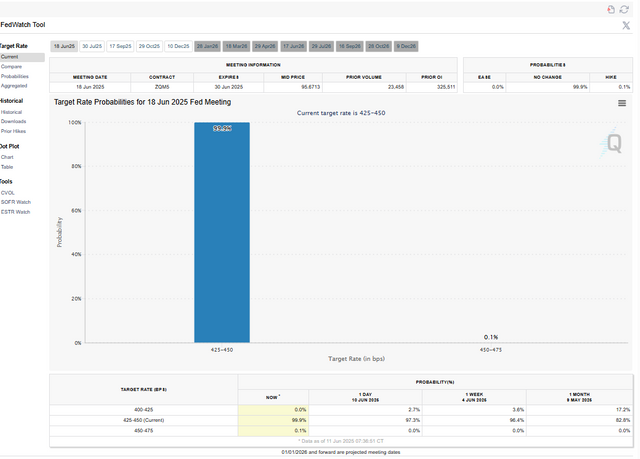

The Fed meets on June 17–18. As per the CME FedWatch Tool, there’s a 99.9% chance interest rates will stay at 4.25%–4.50%.

“The chance of a rate cut is near zero,” noted The Kobeissi Letter.

Fed Chair Jerome Powell has said political factors won’t affect decisions. The goal remains getting inflation down to 2%.

With inflation slightly up and Bitcoin holding strong, markets now wait for Thursday’s data and the Fed's decision next week.