The Scarcity Signal

Forms of money are used daily, but where does money come from? Money is a communication technology that wasn't spontaneously invented, but evolved out of the human desire to share surplus resources. This desire to communicate led to the creation of barter ledger technology. The sharing of surplus resources forms the basic premise of money. Language, ideas, pictures and books are communication technologies that wouldn't exist without humans and money wouldn't exist either. The action of trading surplus requires an understanding of scarcity. If the scarcity is unknown, then it's impossible to create a fair trade. Technologies communicating scarcity have evolved from barter ledgers, which would record transactions between two individuals, to the medium of money. A good money acts as scarcity signal making it easy for individuals to trade fairly with reduced friction.

A quick internet search will reveal it's well known that money originated out of the act of bartering roughly 8000 years ago. However, origination of bartering isn’t clearly explained. As hunter gatherers, humans relied on gathering food as it was needed for survival. The surplus from this act is where the concept of money originates. In his book Principles of Economics, Carl Menger goes into detail explaining this phenomenon. This surplus produced isn't only a surplus today, but also factors is the sum of individuals needs in the future.

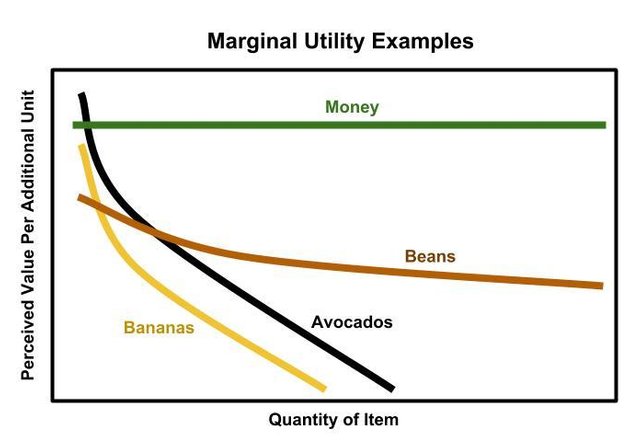

The individual's determination of their surplus stems from the “marginal utility” of the materials or products they own. For example, Avocados have a low marginal utility. To the individual, each of the first three avocados might be equally valuable depending on how they are used. However, the 10th Avocado may not be valued as highly as each of the first three as it would be wasteful to buy avocados that would be rotten before one could get around to eating them. Avocados spoil within a week and so most individuals only buy as many as they need in the next week. Compare this to the marginal utility of dried beans. Beans don't easily spoil and can be stored for years in a cool pantry. For an individual with a long term horizon, beans have high marginal utility. Assuming the individual eats beans regularly, the individual will value the 20th bag only slightly less to the amount he did the 1st bag because the individual knows that 20th bag will be usable and provides almost guaranteed food in the future.

Surplus occurs when the producer’s marginal utility of a product is less than a potential consumer’s. When this difference becomes large enough, an individual will make a conscious decision to make an action to trade. Trading one's surplus requires communication where two individuals or a group of people agree to exchange materials or products. This occurs because both individuals have communicated the value of their end of the trade and becomes a value for value exchange.

To manage surplus 8000 years ago, markets were created to facilitate trade of the surplus. Barter ledgers were created by trusted entities to manage the trades between two individuals or groups. Contrary to popular belief people didn't barter directly; they did so through this trusted 3rd party. The trusted party maintained ledgers of transactions and debts would be tracked. A farmer might agree to trade corn today for meat in the future with another farmer. This agreement would then be recorded by the trusted party.

These ledgers needed to be maintained because there was no acceptable material that would maintain the marginal utility for all individuals involved in the transaction. Eventually commodities such as rare shells, gold and other rare items started to circulate and be used for trade because these items had a high marginal utility for all individuals; it also created a way to transact without the reliance on a trusted 3rd party. These groups of people making transactions in significant numbers are called markets. The large volume of transactions in markets gave individuals confidence that whatever commodity that was used to facilitate trade would maintian a high degree of marginal utlity in the long term. Money was born!

Money tells us that as the price of a product increases, the supply of that product isn't meeting the current demand. The lack of supply signals scarcity from the individuals who demand the product. The high prices are a “scarcity signal” for other potential suppliers (entrepreneurs) to make an effort to supply that same product to make money. As more and more suppliers come into a certain market the price lowers and the scarcity signal becomes fainter.

This scarcity signal is important for the whole market and should not be distorted. A distorted signal is like muffled speech, individuals may find it hard to understand the true scarcity and will make decisions that may not be congruent with reality. A trustless money is important to not distort the scarcity signal; the more people that manage a monetary system the more the managers obfuscate the scarcity signal, confusing the market and creating unintended consequences for market all participants.

Web: http://www.cryptocoach.cc

Memo.Cash: https://memo.cash/profile/16A3J6ZCj3udFABRVc2zRK9fkWMZD5czJ7

Minds: https://www.minds.com/richellis

Yours: https://www.yours.org/@richfromcryptocoach