Fintech startup Glint de-cloaks to offer a multi-currency account and card that supports spending gold

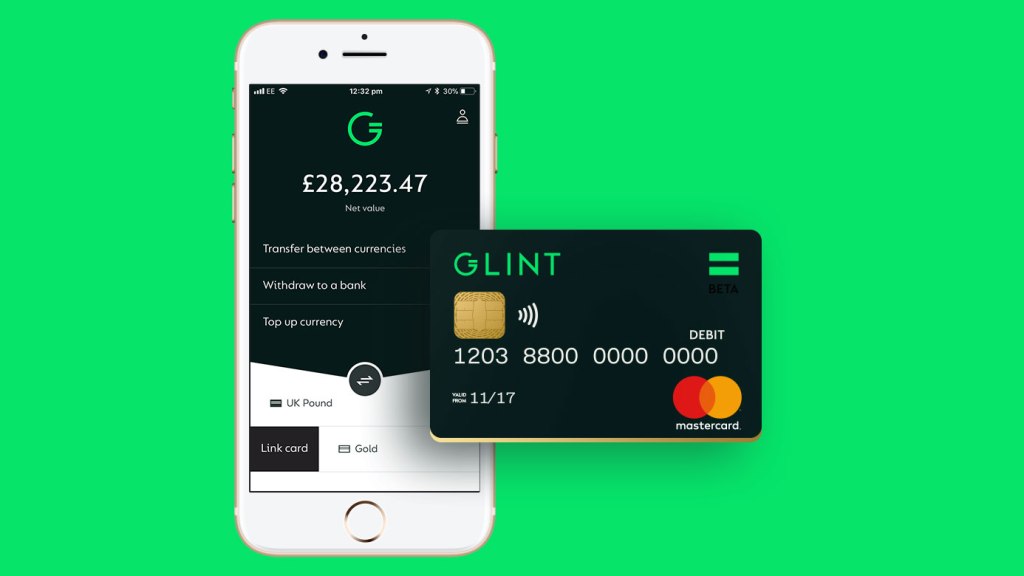

London-based Glint has been pretty stealthy about what it planned to offer, despite several funding rounds and a vague description that it wanted to a create new “global currency” based on gold. Well, today the fintech startup is finally de-cloaking with a staggered launch of its multi-currency account, app and card that does indeed let you store your money in gold and convert it back to fiat currency at the point of payment.

Initially, Glint, which is regulated by the FCA under an e-money institution license, is supporting Sterling and gold, with more currencies to come. Exchange rates between currencies are promised to be “the real exchange rate,” and the Glint card itself is a Mastercard and therefore widely accepted.

To date, Glint has raised £6.1 million. Backers include most recently NEC Capital Solutions (through its venture fund co-operated with Venture Labo Investment) and Tokyo Commodity Exchange, in addition to Bray Capital and a number of angel investors from the banking and asset management industry.