Complete Guide to CoinMarketCap's CMC Fear and Greed Index

Understand how fear and greed drive cryptocurrency prices and learn how to use this powerful tool to optimize your trading decisions.

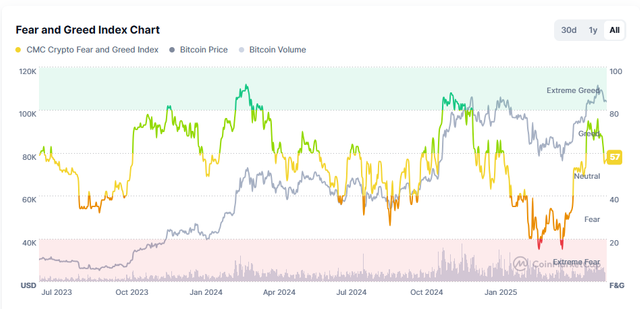

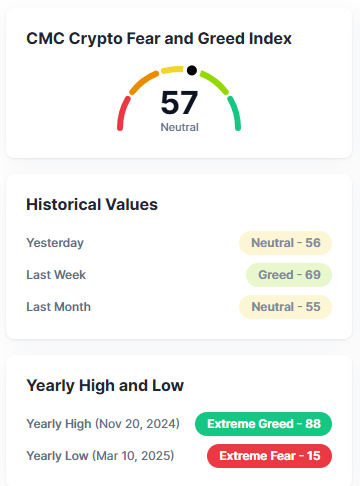

In the fast-paced world of cryptocurrency, investor sentiment can be as influential as fundamental economic data. To decipher this emotional pulse of the market, CoinMarketCap, one of the most influential crypto data platforms, developed a proprietary tool: the CMC Fear and Greed Index. This index, which ranges from 0 to 100, is a vital compass that helps investors understand the prevailing market mood and discern when an asset might be undervalued by fear or overvalued by euphoria.

The CMC Fear and Greed Index is an invaluable tool for any cryptocurrency investor or trader. / CoinMarketCap

What is the CMC Fear and Greed Index and Why is it Crucial?

The CoinMarketCap CMC Fear and Greed Index is a tool designed to measure collective sentiment in the cryptocurrency market. Its scale is intuitive and clear:

A value close to 0 indicates extreme fear: This suggests that investors are very anxious, which often results in massive sell-offs and depressed prices. Historically, these moments can represent buying opportunities for those with a long-term view.

A value close to 100 indicates extreme greed: This signals that investors are euphoric, driving prices upward speculatively. These levels often warn of an overheated market potentially prone to a correction.

Understanding the index's position allows investors to anticipate potential market movements influenced by emotions.

Mastering Sentiment: Strategies for Using the Index

The application of the CMC Fear and Greed Index in your investment strategy can be multifaceted:

Market Sentiment Analysis: The most direct way to use the index is to get a snapshot of the overall mood. If the value is high, excessive greed could indicate that the market is overheated and vulnerable to a correction. Conversely, a low value suggests that fear is driving prices down, which could create interesting buying opportunities for undervalued assets.

The opposite strategy: Many investors apply Warren Buffett's famous adage: "Be fearful when others are greedy and greedy when others are fearful." The CMC Fear and Greed Index is a perfect tool for implementing this philosophy. An index in the extreme greed zone (high values) could be a signal to consider selling or reducing positions, while an index in the extreme fear zone (low values) could indicate an opportune time to buy.

Complementary analysis: It is crucial to remember that CoinMarketCap's CMC Fear and Greed Index is a tool for measuring sentiment, not an infallible oracle. Its greatest value lies in its use in conjunction with other technical and fundamental analysis tools. Combining it with the study of price charts, trading volumes, and macroeconomic news will allow you to make more informed and robust decisions.

CoinMarketCap's CMC Fear and Greed Index is a tool designed to measure collective sentiment in the cryptocurrency market. / CoinMarketCap

The Heart of the Index: How is it Calculated?

The CMC Fear and Greed Index is the result of a sophisticated calculation that integrates five key components, each providing a unique perspective on market sentiment:

Price Momentum: This factor analyzes the price performance of the top 10 cryptocurrencies by market capitalization (excluding stablecoins). It evaluates how these cryptoassets behave relative to each other and in relation to the broader market, indicating whether the momentum is bullish or bearish.

Volatility: The index incorporates data from the Volmex Implied Volatility Indices (BVIV for Bitcoin and EVIV for Ethereum). These indices provide a forward-looking measure of expected volatility for the next 30 days, reflecting market risk expectations.

Derivatives Market: The Put/Call Ratio is examined in the Bitcoin and Ethereum options markets. A higher number of put options compared to calls suggests more bearish sentiment and, therefore, more fear in the market.

Market Composition: This component assesses the relative value of Bitcoin (BTC) in the overall cryptocurrency market. It uses the Stablecoin Supply Ratio (SSR), which measures the ratio of Bitcoin's market capitalization to that of major stablecoins, providing insight into whether capital is flowing into risky assets or stability.

CMC Proprietary Data: CoinMarketCap complements the analysis with its own data. This includes tracking keyword searches, social trends, and user engagement metrics. This data captures sentiment.

Retail sentiment, emerging interest, and new trends that could influence the market.

An Investor's Guide to the Crypto Wave

The CMC Fear and Greed Index is an invaluable tool for any cryptocurrency investor or trader. By quantifying the dominant emotions in the market, it offers a unique perspective that complements technical and fundamental analysis. While it's not a crystal ball, understanding it will allow you to make more rational decisions, avoid falling into emotional traps, and potentially identify opportunities when most are blinded by fear or greed. Use it wisely, in conjunction with your own research, to navigate the exciting, but volatile, world of decentralized finance with greater confidence.

Disclaimer: This article is for educational and informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries a substantial risk of loss. Always conduct your own research and consult a qualified financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.