Why Bitcoin Cloud Mining is still Profitable?

As the application of Fridrich von Hayek’s central point in Denationalisation of Money, Bitcoin has no central issuers, it is created by a process called mining, which is done by running extremely powerful computers (ASIC devices) that race against other miners in an attempt to guess a specific number. The first miner to guess the number gets to update the blockchain and also receives a reward of newly mined bitcoin-currently the reward is 12.5 Bitcoins.

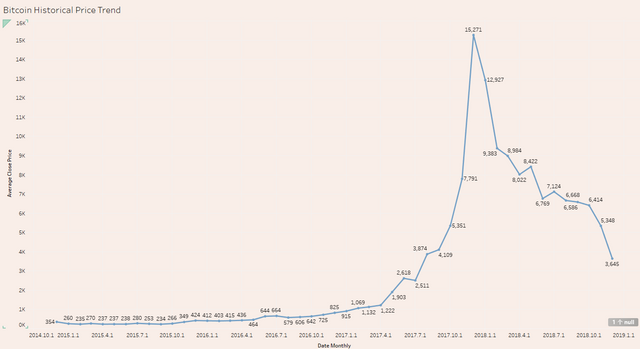

Since its creation in 2008, it has been growing extremely fast but also created many cntroversies, there have been multiple times that the bubble bursts and caused huge price declines in the history (as shown in the above chart).

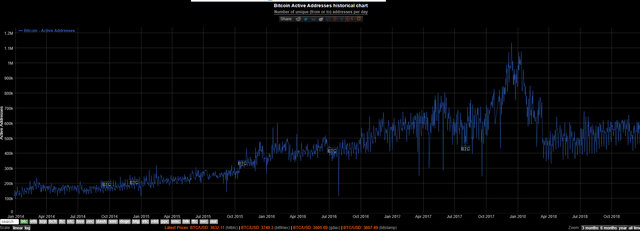

On the other hand, the “Bitcoin Active address” indicates that the number of Bitcoin users has been increasing despite the up and down of Bitcoin price. Based on this trend, we have strong confidence in Bitcoin in the long term.

Mining Vs Buying Bitcoin

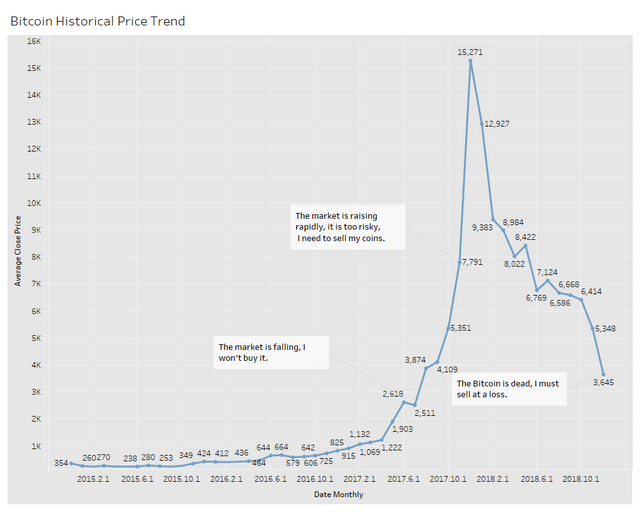

Buying Bitcoin directly is extremely risky as the prices historically have been highly volatile, and fluctuations could result in significant losses for investors, moreover, you need to overcome human weaknesses in finding the perfect selling time, it is difficult to make a right decision.

Compared to buying on the Exchange, the cost of cloud mining is often not obvious and often considered as a long term investment, it is easier to HODL during the rollercoaster ride market time.

When the prices going UP

Cloud mining investoers can share the benefits that bull market brings and the yield is only slightly lower than the buying.

When the prices going DOWN

During the bear market, the miners will shut down some mining rigs that would cause a decline in difficulty, which means the investors are able to mine more coins (approximately 2–3 times than normal), compensating most of the the losses incurred due to prices decreasing. If you HODL the coins until the next bull market cycle, you would most likely earn higher profits.

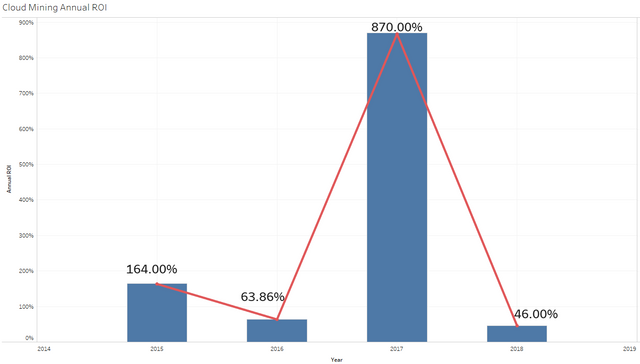

Historical ROI of Bitcoin Cloud Mining

ROI in 2015

At the beginning of 2015, if you purchased an Anteminer S3 with $282 for 1.421Th/s hashpower, assuming that the electricty cost was $0.0465 per kwh, in other words, $0.89 per day. If you sell the mined bitcoin everyday at 8 am, you will get a total revenue of $743.84 by the end of the year, that is 164% of yield.

ROI in 2016

At the beginning of 2016, let us suppose that you can purchase an ANteminer 1Th/s hashpower 300W/T against $218, the electricy cost is the same: $0.0465 per kwh, if you sell the mined coins everyday, your total revenue will be $270 and residual value of $87.21. The total ROI would be 63.86%.

ROI in 2017

The year of 2017 is special, as the ROI was 870%.

ROI in 2018

As of the press time, we estimate a ROI of 46%.

Conclusion

As you can see that the average annual ROI over the past 4 years is around 280%, which is more profitable than most of the investment products available on the market.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/hash-pro-cloud-mining-official-blog/why-bitcoin-cloud-mining-is-still-profitable-a6b6a62f3db5