Chinese Banking System – Update 1: $ 410 Billion IS NOT ENOUGH!!!

I want to keep you up-to-date as fast as i can with the on going situation in good old Communist China. :-)

Today we good and bad news for our now well-known Chinese Banana Trader Guy from my first article haha. I like him ^^

The Chinese Central Bank aka PBOC injected $ 410 Billion in its Banking System. Whoooooooooott?? So i almost got my predicted $ 1 Trillionen for the Banking System.

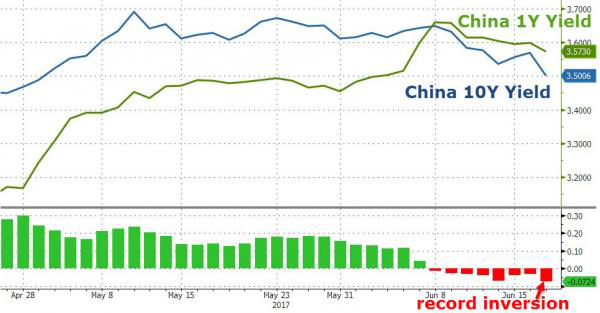

But the Chinese Bond Yields took a hard hit with a record yield inversion, which shows that the mother of all aka GROWTH is slowing and not even all these hundreds of millions are helping them anymore in their efforts to hold the system together.

Not to forget, after the population growth of China in the last decades and getting hard working young well-educated communist-trained people in the workforce-> The other leg is crumbling, COMMODITY PRICES are FALLING and FALLING DOWN either.

Source: National Bureau of Statistics (NBS), Axiom Capital Research.

AND average Price Changes of New Homes, by Tiered-Cities, are also going down, which shows a prolonged slump in the Chinese Housing Market is taking shape. Thats very bad.

So ähm??? Just 1 GOOD NEWS and 3 VERY BAD NEWS for our Chinese Banana Trader :-(

BE AWARE AND TRADE ACCORDINGLY.

Yours

Simon the Ravager

Dasheroni & Anarcho-Capitalist

China is dumping the US assets and they have to do it as carefully as they can to avoid crashing the whole market too quickly and be left holding the bag (in this case, the US dollar). They have a huge housing problem as they have built so many new houses and new communities that are like ghost towns.

Unemployment is also an issue as even if it is only 3.97% that is still creeping towards 1 million people. As well as the US dollar buying power is decreasing they must be concerned about who makes up for the descreased US buying power.

The Chinese central bank is certainly doing a balancing act.

Socially 700k -900k unemployed people can't be a good situation, especially in Asian culture where being a respectable, working citizen is the standard for things like respect, social acceptance and getting married. Clif High in some of his videos has mentioned a "white paper" from China regarding BTC and crypto's in a manner of, the government setting up each community with BTC. Imagine what would happen if they did?

The housing market in China, combined with a massive housing bubble in Canada, the Student loan and auto loan issues in the USA could kick off a crash that makes 2008 look like a birthday party!

Even worse in my opinion is that governments often react by increasing their own false economies, like the army, that's how it's done here in Vietnam. Or the agricultural industry like in Canada where milk quota prices and machinery prices are ridiculous compared to the projected income of crops whose worth is dropping.

China has been stockpiling commodities for years as a way of ridding itself of the US dollar, so hopefully, instead of increasing it's military more, which is huge already, they will focus on infrastructure projects and put some of the sand and gravel they've purchased over the years to use.

With the huge populations of China and India and many other Asian countries power is really shifting.

Will they take the red pill or the blue pill? If they go full on into crypto the EXPLOSION would be unimaginable! They have to do something to sustain their economic growth, could they use crypto's to drive the final spike into the dollar?

https://tradingeconomics.com/china/forecast I used this site for some of my information, FYI.

Peace and happiness from Vietnam!

haha they just need to go into DASH ^^

With all the mining going on there and the interest in alternatives to the dollar it won't be long until they are making their own coins a la ripple.

meep

Nice info