Maximizing Returns with Cavada Staking and Liquidity Rewards

For the savvy crypto investor, the world of decentralized finance (DeFi) offers a myriad of ways to grow your digital assets. Two of the most popular methods are through staking and liquidity provision, which can earn token rewards known as APY (Annual Percentage Yield). This blog post will explore how you can optimize your crypto-portfolio growth by harnessing the power of Cavada Staking and Liquidity Rewards.

Introduction to the Staking and Liquidity Landscape

Before we jump into the specifics of Cavada, let’s level-set. Staking is the act of depositing funds into a smart contract on a blockchain network to engage in ‘voting’ or validating transactions, and in return, you earn rewards. This method is used to support the security and operations of a blockchain network, and it's a popular way for crypto holders to earn a passive income on their assets.

Liquidity provision, on the other hand, is the act of supplying liquidity to an Automated Market Maker (AMM) – the most popular example being Uniswap – in the form of a token pair. By doing so, you allow for seamless token swaps, and in return, you get a share of the trading fees. This has been revolutionized with the concept of liquidity farming, allowing the generation of additional tokens beyond trading fees as a reward for providing liquidity.

What is Cavada and Its Role in the Crypto Ecosystem?

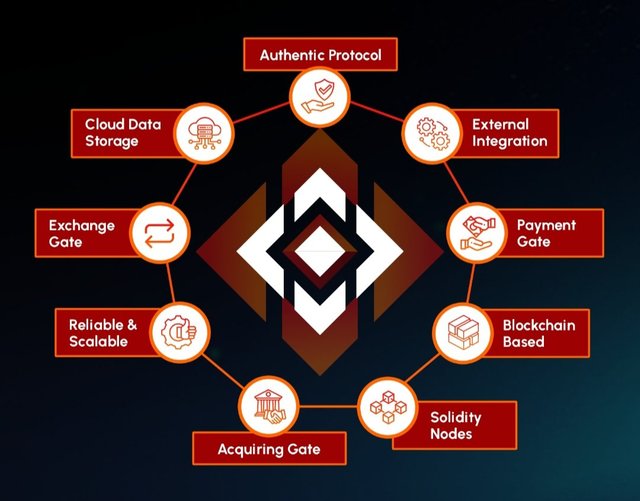

Cavada is a multifaceted platform that has emerged in the DeFi space, offering staking and liquidity rewards that are enticing to investors looking to grow their digital assets. It’s more than just another blockchain project; Cavada has a grand vision of bridging traditional and decentralized financial systems. The project has a strong emphasis on user experience and a commitment to building a robust and sustainable platform.

Powered by a strong community and supported by cutting-edge technology, Cavada seeks to provide a range of financial services including staking, yield farming, governance, and decentralized lending.

Staking with Cavada – The Benefits and How-Tos

Staking with Cavada comes with its set of attractive benefits. By staking your Cavada tokens, you can:

Earn passive income, often at a higher rate than traditional savings accounts.

Help secure the Cavada network through proof-of-stake validation.

Participate in the governance of the protocol, having a voice in the platform’s future decisions.

To begin staking with Cavada, you would typically do the following:

Acquire Cavada tokens through an exchange or by providing liquidity.

Choose a staking service. Cavada may offer its own native staking wallet or platform, or you may use a third-party service. Transfer your tokens to the staking platform you’ve chosen.

Follow the platform’s instructions for staking your tokens.

The rewards you earn from staking are often determined by the amount you have staked, the duration of your stake, and the overall network participation. Cavada may publish its staking rewards on its website or on-chain, so you can track your estimated earnings in real-time.

Cavada's staking ROI potential might vary, but it's typically competitive within the DeFi space, offering a compelling case for long-term growth in your investment.

Liquidity Rewards with Cavada – All You Need to Know

Liquidity rewards are Cavada's way of incentivizing users to provide liquidity in its ecosystem, ensuring there’s enough liquidity to support the trading volume of its native token and possibly other tokens in the network. This activity facilitates a more seamless user experience and efficient AMM operations.

To participate in liquidity mining with Cavada, you would:

Obtain equal amounts of the token pair you want to provide liquidity for. For instance, if you wish to provide liquidity for a pool that includes Cavada and Ethereum, you would need an equal value of both tokens.

Deposit your token pair in a compatible liquidity pool or AMM such as Uniswap or Sushiswap. With Cavada, you may have the option to provide liquidity directly on its platform.

Your share of the pool, represented as liquidity tokens, will start earning trading fees and potential liquidity rewards.

Cavada liquidity mining often employs yield farming strategies, where you can stake the liquidity provider (LP) tokens to earn additional rewards, sometimes in Cavada’s own native token. The APY for liquidity mining can be lucrative, especially for early adopters or for those who provide liquidity to pools with less competition.

Tips for Maximizing Your Staking and Liquidity Rewards

Here are some strategies to help you make the most out of Cavada's staking and liquidity rewards programs:

Diversify Your Staking Pools:

Spread your risk by staking your Cavada tokens across different staking pools or by providing liquidity to various token pairs.Stay Informed:

Keep an eye on Cavada's official channels, as well as community forums, to stay updated on new staking and liquidity opportunities.Balance the Reward-Risk Ratio:

While the promise of high rewards can be tempting, make sure to evaluate the associated risks. Some high-yield strategies can come with significant volatility.Reinvest Your Rewards:

Reinvesting your staking and liquidity rewards into additional opportunities can compound your overall earnings over time.A Case Study: Successful Cavada Staking and Liquidity Mining in Action

To bring these tips to life, let’s look at a hypothetical investor, Dana, who discovers Cavada early in its development. By carefully staking her Cavada tokens and providing liquidity in pools that promise good returns, Dana sees her investment grow substantially over a year. She reinvests her rewards into new opportunities, compounding her initial investment, and becomes an active participant in the Cavada community, which allows her to shape platform development and direction.

Cavada Staking and Liquidity Rewards offer an exciting path for crypto investors, providing both the potential for substantial returns and the opportunity to support the growth of a promising DeFi platform. By understanding the intricacies of staking and liquidity rewards, staying informed on market conditions, and following prudent investment strategies, you can build a robust portfolio with Cavada at its core.

Are you ready to start with Cavada? Visit their website at https://cavada.org to begin exploring your options and maximizing your crypto-ROI. And remember, as with any investment, always do your research and only invest what you can afford to lose. The crypto market is known for its volatility, but with the right knowledge and approach, the potential for growth is endless.

Now that you’re equipped with the knowledge to take your DeFi game to the next level, it's time to dive in and start earning those rewards. Whether you’re a seasoned investor or a newcomer to the world of DeFi, there's never been a better time to explore Cavada's staking and liquidity opportunities and chart a path toward financial freedom in the decentralized realm.

#Cavada #crypto #bitcoin #tron #eth #bnb

More information

Website: https://cavada.org/

Whitepaper: https://cavada.gitbook.io/cavada-whitepaper/

Telegram: https://t.me/cavadachat

Twitter: https://twitter.com/cavadadao

Discord: https://discord.gg/zS8Quje7

Facebook: https://www.facebook.com/cavadadao

Instagram: https://www.instagram.com/cavadadao

User name: Lovtiek

https://bitcointalk.org/index.php?action=profile;u=2243938

Bsc Wallet: 0x50926468328d73Fe5897af1C9452888Bd8c61341

Poa Link: https://bitcointalk.org/index.php?topic=5479300.msg63388612#msg63388612