The best place (after crypto) to put your money in 2018 is… iconic nineties & noughties cars

10 tips for rock solid car investments in 2018…

Hello Steemians,

It seems fair to say that 2017 has been the year when crypto and block chain came of age. It was certainly the year in which they entered mainstream consciousness. My own included.

As someone with primarily offline businesses and an unending interest in all things entrepreneurial, I have been fascinated by the way this whole thing has panned out in 2017.

I love the ideology behind crypto and I love the way that anybody with access to a few dollars and an internet connection has been given the opportunity to rapidly increase their wealth over an unprecedentedly short period.

The barriers to entry of the ‘rich club’ are being smashed down before our eyes and as newer versions of these technologies (see Electroneum) give rise to still newer opportunities, the ability to generate wealth will become truly democratised on a global scale.

Excellent.

That said, I firmly believe in balance, in all things. Although I rarely achieve it myself, balance is undoubtedly the key to success and happiness.

And that includes balance in business, investment and wealth creation.

I have always had a fascination with the practice of generating wealth. Not borrowing it. Not stealing it. Not gaining it illegitimately. Simply using your knowledge, experience, effort and instinct to turn a Dollar (or Pound, or Euro or Rupee) into two. And those two into four. Etcetera.

That can be done online, in a myriad of ways, no doubt. Including but clearly not limited to, shrewd and knowledgeable investment in crypto markets.

For me though, there are just as many exciting opportunities offline. Perhaps more exciting.

One area of investment which has long fascinated and enthralled is that of iconic cars.

For me, like many, it’s been a lifelong passion and obsession. Since I could read the adverts in car magazines, I’ve been creating imaginary fleets of classic and performance motors, built around my twin passions for turning a profit and owning/driving enjoying cars. Not in that order. I’d rather own and drive a cool car than sell it at a profit, but if you can do both, why the hell not?

In recent years I’ve been in a position to take action and turn my schoolboy dreams into a constantly evolving reality.

Cars are amazing. Or at least they were until safety requirements, emissions standards and unending ‘luxury’ (read: weight adding) specifications became the norm. The cut off in my mind is generally around the year 2000. After that point, cars have unfortunately had more to do with size, weight, safety and comfort specification than purity of design and driving delight.

There are some exceptions though. In fact it is those exceptions which probably hold the biggest price increase opportunity as generally the market has yet to fully catch in.

In general, the classic car market is a little old school and takes it’s time to come around to new ideas, but there’s no doubt that the last 3 or 4 years have seen a huge turn towards what are now termed ‘modern classics’ or ‘young timers’, lead by pioneers like 4star Classics in the UK and Classic Youngtimers in Holland. That is to say cars from the 1980’s and 90’s.

This has occurred as people in their thirties and fourties become old enough to afford the cars of their childhood dreams, the poster cars of those decades. Although I often agree with those choices, to me the interesting stuff, the cars which really strike the balance between pure enjoyment of ownership and the ability to turn a good profit after a couple of years of ownership, in general were produced from the mid 1990’s onwards.

I think the argument for the growth potential in cars from the mid nineties onwards is further strengthend by this brave new world of crypto derived wealth, which belongs of course primarily to younger people; those who understand it and have the balls to get behind it. And the cars they grew up and fell in love with as kids were from recent history.

Cars represent freedom more clearly, directly and enjoyably than anything else. Except motorbikes, but that’s another story (and a less profitable one).

No other asset can be enjoyed so readily as it grows and stores value; by the way it looks, feels, smells and operates. Few are so nostalgic or so liquid.

Here are my top investment tips for cars that were in manufacture during the period 1990 to 2010. I’ve chosen them for their combination of visual impact, driving enjoyment, marque and/or motorsport credentials, rarity and likelihood of obtaining iconic status.

I’m in London so am viewing the market from a Euro-centric point of view (although have tried to include mainly cars that are internationally renowned) and these are just my thoughts as a buyer, collector and seller of cool cars. In fact, they’re just my thoughts TODAY. By tomorrow I’ll have picked another 10! I’d love to know which cars you’d add to the list…

Audi RS4 B7 – An instantly cool car from launch, in my opinion the B7 era of the Audi RS4 is now at an all time low price point. The B5 which preceeded it is an inferior car by pretty much every metric and yet is now headed into properly big money territory. Very few cars ever made have managed such a strong combination of raw speed, characterful sound, sure footed handling, hewn from rock looks, build quality and practicality. Arguably the best car Audi have ever produced. Look for a low mileage Avant (station wagon) model in blue and you’ll have spent £15k gbp very well indeed. 5% - 10% per annum growth potential.

BMW M3 E36 – For a long time the unloved era of the iconic BMW M3, the E36 shape has recently started to look very pretty indeed and although the E36 M3 had a reputation for being a little soft in terms of it’s driving dynamics, versus the now legendary E30 which preceeded it and E46 which followed, viewed through a 2018 lens these cars are now a very appealing mix. The combination of handling dynamics, lightweight pace, build quality, looks and practicality, especially in EVO spec, now looks very strong indeed at the current price level (although the market has moved significantly over the last 12 months so act now). Avoid the cabriolet. Budget £15k gbp for a decent one and expect 10-15% per annum value growth.

BMW M3 E46 – Too recent (built since 2000) for many to stomach as a classic, the E46 M3 never the less undoubtedly is just that. To me, it straddles the divide between the way performance cars used to be and the way they are now in a way which very few others do. And values are already beginning to demonstrate that. An incredibly capable, but also incredibly involving car which is very at home on the track but also on a fast country road. The rare CSL variant was born into greatness, being an instant icon from launch, and the even rarer CS is maturing into a legend in its own right, but both are now big money. Find a relatively low mileage, relatively unabused standard E46 M3 (non cabrio) for around £15k gbp and you won’t go far wrong in terms of an ownership proposition or as an investment. 5% - 10% per annum growth potential.

BMW Z3M Roadster – In the shadow of it idiosyncratic coupe brother until very recently, time is looking favourably on the Z3M roadster. The more mundane models in the Z3 range are not great and the model will not go down as one of the great BMW’s, but M division managed to do its thing with relatively unpromising raw materials and create a raw, slightly unhinged 2 seater drop top out of a the shell of a ‘hairdressermobile’. Impressive, intense and increasingly cool. Pay £20k gbp and you might see a 10 – 15% per annum gain.

BMW M5 E34 – The meteoric rise in status of this car's baby brother, the E30 M3, has for a long time cast a shadow over the capabilities and appeal of the M5 from the same era. But that does not make the M5 any less capable. It is an extremely cool car. A refined rocket for the autobahn, which carries most of the grace of the M3 with considerably more pace, presence and practicality. Seriously undervalued currently. Spend £10k gbp now and expect to have a £20k car on your hands in 5 years. Just look at prices of its E28 predecessor!

BMW M5 E39 – This one is pretty widely recognised as vintage M Power BMW, with it’s thumping V8 powerplant and sure footed but rowdy dynamics, all wrapped up in a very practical and attractive body. The market seems to see this as the last ‘proper’ M5, so values are rising accordingly, but there’s still room for growth. Spend £15k now and see 10% per year value growth.

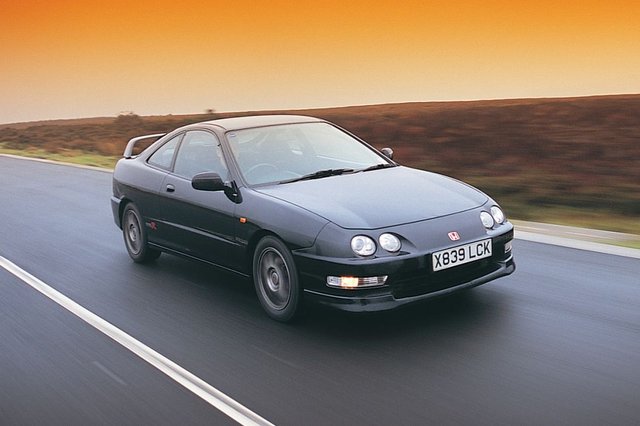

Honda Integra R – Quite simply an icon. The cliché goes that this car is THE best handling front drive car ever. I can’t say whether that’s true as I haven’t driven every front drive car ever, but I do know that this car is amazingly balanced, sharp, agile, grippy and above all, fun. The VTEC engine is also a legend in it’s own right. When people who know cars know that a car is this good, there’s only one way values will go. Spend £10k gbp on a cracker now and expect it to double in 5 years.

Porsche 944 S2 – In my opinion the S2 is the ultimate incarnation of the 944 model. The silhouette is perfectly honed and is aging incredibly well. It is almost the architype sports car shape. The engineering quality is second to none, the engine is a flexible, powerful peach, the rear drive handling is exciting but not scary and to top it off this car is about as practical as a 2+2 sports car can ever be. A superb all rounder with cast iron credentials and 10% / year value growth potential. Budget £10 - £15k gbp

Porsche 911 996 – For so long ‘Porsche people’ have turned their nose up at this era of 911. That’s for two reasons: 1. It was the first water cooled (as opposed to air cooled) 911 2. There was an engine reliability issue for a while. BUT, nearly all cars have now at the IMS bearing fixed by now and the fact is that this is still a classic 911, in the classic mould and with the classic layout. It’s also properly quick in all guises and currently ridiculously cheap for what is an iconic supercar. It is also beginning to look very pretty as time goes on. Turbos and GT3’s (both share the bullet proof race derived Metzger engine) became recognised as bone fide classics a long time ago but the time for the more ‘mundane’ C2, C4 and C4S to shine is now. These are great cars and £20k gbp will buy a decent example of the most practical and capable supercar ever. Expect 10% per annum value growth and lots of pleasure in between

TVR Cerbera – A bit of a wild card this one, but a good investment all the same. TVR is back in business and set to begin trending very soon. These unique cars not only look and sound insane (in a good way) but are rare, brutally quick, boast one of the wildest and coolest interiors ever and have a huge cult following in Europe. Spend £20k gbp and expect 10% growth per year.

(all image rights belong with their original publisher)

Thanks for reading and I look forward to hearing additions to the list!

Congratulations @luckyjim! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @luckyjim! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!