Navigating Car Insurance in Dubai: Your Essential Guide for 2025

As the sun blazes down on the bustling streets of Dubai, steering through its glamorous roads in 2025 isn't just about having a stylish ride; it hinges on two critical elements: a reliable vehicle and legally compliant car insurance. With the city's rapid evolution, understanding the intricacies of third-party insurance is paramount. Here's your all-in-one guide to answering your most pressing questions and uncovering the smartest strategies to save up to 35% on your third-party car insurance without skimping on essential protection. Full text: https://www.icartea.com/ar/wiki/best-3rd-party-car-insurance-in-dubai-2025.

🚗 Your 3 Most Pressing Questions Answered (2025 Update)

- How to Choose the Cheapest Legally Valid Policy?

For drivers watching their wallets, knowing how to select the most cost-effective, legally valid insurance is key. In 2025, the minimum legal third-party liability coverage in Dubai is AED 400,000. This value safeguards you financially in case you cause damage or injury to another party.

Top 3 Budget-Friendly Third-Party Insurers:

Emirates Insurance: Annual Premium: AED 850; Extra Benefits: Free towing up to 50km.

Oman Insurance: Annual Premium: AED 790; Extra Benefits: 24/7 accident support.

AXA: Annual Premium: AED 920; Extra Benefits: Optional sandstorm damage add-on.

- What's New in Dubai's Insurance Regulations?

With every new year, regulations evolve. In 2025, a few pivotal changes came into play:

Mandatory E-Policy Verification: Digital verification via the RTA app is now a must for every motorist. Ensure you have your policy at your fingertips.

72-Hour Grace Period for Renewals: The RTA accommodates our busy lives, offering a generous grace period for insurance renewals—just remember, driving uninsured still incurs fines.

Increased Penalties for Uninsured Driving: As of this year, being caught without valid insurance carries a AED 1,000 fine plus 12 black points on your license.

- Does Extreme Heat Affect Coverage?

Dubai's relentless summer heat can take a toll on your vehicle. Thus, it's essential that your insurance covers heat-related damages like:

Engine Overheating: Claims can be filed if your car overheats due to temperature spikes—unless negligence is involved.

Sandstorm Risks: Policies must include coverage for damages inflicted by sandstorms, particularly impacting air conditioning systems.

Battery Failures: Policies typically cover battery failures directly due to extreme heat during the sweltering summer months.

🌟 2025's Smartest Ways to Save Money

Achieving substantial savings on your car insurance while maintaining adequate coverage is possible in Dubai. Here are some expert suggestions:

Compare Like a Pro with AI Tools

Utilize digital resources to enhance your insurance comparison process. For example:

Bundle Your Essential Services

Think beyond merely your insurance policy. Bundling services can yield significant discounts:

Combine your insurance with your Salik tag renewal for a discount of AED 45.

Purchase a package that includes annual car wash services with your insurance, gaining 12 complimentary sessions.

Certain insurers provide discounts for booking your annual RTA vehicle inspection through their platform alongside your insurance.

🛡 Special Considerations for UAE Drivers

Dubai's versatile environment demands specific insurance considerations:

Sandstorm Protection Checklist

Considering the frequency of sandstorms in the UAE, it’s prudent to ensure your policy includes:

Windscreen Replacement: Protection against debris damage during dust storms.

Electrical System Coverage: Safeguards sensitive systems against sand damage.

Emergency Accommodation: Coverage for temporary lodging if your vehicle is in repair due to sandstorm damage.

Women & Family Drivers' Benefits

The insurance sector is progressively recognizing the nuances of various driver demographics:

Discounts for Advanced Safety Features: Enjoy up to 28% lower premiums for cars equipped with features like adaptive cruise control.

School-Run Tracking Apps: Some insurers offer a 15% discount to mothers using these apps, reflecting responsible driving habits.

Child Seat Replacement: Policies may cover the cost of child safety seat replacements in the event of an accident.

🔍 Hidden Factors Impacting Your Premium

Your insurance premium isn't just about driving history or car type. Other factors can influence costs:

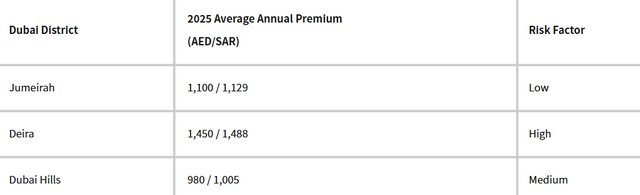

Location-Specific Pricing

Insurance rates in Dubai vary significantly based on your area:

As the city pivots toward sustainability, insurers are adapting:

Lower Base Rates: Electric vehicles usually enjoy premiums that are 22% cheaper than petrol cars.

Charging Station Coverage: Many policies now protect against damages at home or public charging stations.

Battery Protection: Certain policies offer protection against significant battery degradation during the initial five years.

The content above comes from Cartea, the most professional automotive platform in the Middle East. More info at http://www.icartea.com/.