The Best Mobile Finance Apps

If you are like any other person, you will have to use your smartphone at least 50 times a day - check everything from business messages and emails to weather forecasts and so on. But many people also realize that smartphones can help us to use the money wisely ... things like managing money, spending money on plans and even making financial decisions. It's a lot easier with today's personal finance applications.

However, not every financial application is worth downloading and using. You will not have to think twice about managing your financial resources through smartphones with a personal finance application list below.

Mint: Best application for managing money

Free application from Intuit Inc (The company behind QuickBooks and TurboTax software) is an integrated source of money planning, tracking spending, and helping you make money wisely. You can connect all your bank accounts and credit card accounts, as well as your monthly expenses, so all your financial resources will be in one place - this is convenient. It is much easier to log in to many different sources.

Mint lets you know when your bill is due, the amount you owe and what you can pay. This application also sends you a payment reminder so you do not have to pay a late fee. Based on your spending habits, Mint also offers advice so you can control your money more effectively. In addition, this application also gives you a credit rating as your credibility when someone lends you another mortgage.

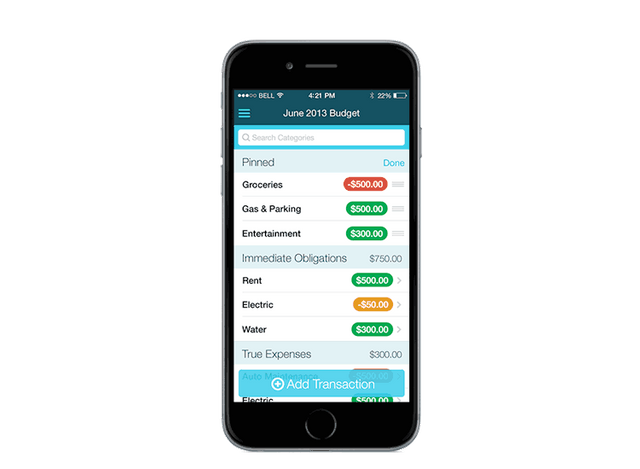

You Need a Budget: Best App for Debt Elimination

You Need a Budget (YNAB) can be the single most expensive spending application you have ever used. YNAB helps you get rid of all your savings to cover expenses, repayment and "roll over" with unwanted expenses. This application is based on a principle that each of your coins has its own purpose.

The You Need a Budget application does not create a spending list around currencies you do not own. It forces you to spend within your own real income. If you spend too much money, YNAB offers advice on what you should change to balance your spending. The "accountability partner" feature helps you spend less. Although users pay a small fee per month or per year for YNAB, the service and support of this app is worth the money. Online classes with faculty directly answering your questions are also a service of this application. In fact, YNAB is so effective that the average user pays $ 500 in the first month.

Wally: The best app to track your spending

If you're the kind of person who likes to spend your money, it's just like spending money on the job, and you'll love the free Wally app. Instead of having to manually record your spending at the end of the day (end of month or year end), Wally lets you take a picture of yourself. In addition, if you use location tracking, Wally also adds that information to memory, leaving you with a few tedious tasks. Wally is a streamlined, easy-to-use application. This app is a reliable choice if you want to know where your money goes.

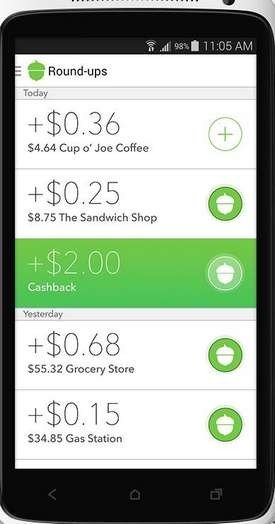

Acorns: Best application for easy savings

Would you like to take advantage of the good financial behavior of automation? If this phrase sounds complicated then the application of Acorns is not hard to understand at all. Basically, each time you spend through a card that is connected to the Acorns application, Acorns will round up to the next highest unit of currency, subtracting the funds and automatically deducting the investment. The list includes the low cost swap funds you have selected based on your choice of risk.

Acorns make your money go away without making you lose a lot of money - many users say they almost never realize the amount of money they are getting. Do not like to earn an extra $ 300 or $ 500 or even $ 1500 in your investment account each year? The service is free for students and costs $ 1 a month for other people.

Conclude

Today, with the development of technology, we always find the support to make life easier, even in a sensitive area such as personal finance. With the 4 applications I have introduced above, I hope that the management of your financial management will flow smoothly.

IOS

Mint: https://itunes.apple.com/us/developer/mint-com/id300238553

YNAB: https://itunes.apple.com/us/app/ynab-you-need-a-budget/id1010865877?mt=8

Wally: https://itunes.apple.com/us/app/wally-lite-personal-finance/id610314677?mt=8

Acorms: https://itunes.apple.com/us/app/acorns-invest-spare-change/id883324671?mt=8

Android

Mint: https://play.google.com/store/apps/details?id=com.mint&hl=vi

YNAB: https://play.google.com/store/apps/details?id=com.youneedabudget.evergreen.app&hl=en_US

Acorms: https://play.google.com/store/apps/details?id=com.acorns.android&hl=en_US

Vote/Upvote/Resteem

Thanks a lot.

Hi @phungminhtuan, you have received an upvote from

phungminhtuan. I'm the Vietnamese Community bot developed by witness @quochuy and powered by community SP delegations.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by phungminhtuan from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.