Thinking differently: What if Steem was a company?

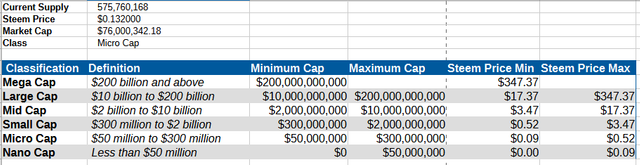

I asked Brave Leo to tell me the market cap thresholds that are used to divide publicly traded companies into classes. Here's what it said.

| Classification | Market Capitalization Range |

|---|---|

| Mega Cap | $200 billion and above |

| Large Cap | $10 billion to $200 billion |

| Mid Cap | $2 billion to $10 billion |

| Small Cap | $300 million to $2 billion |

| Micro Cap | $50 million to $300 million |

| Nano Cap | Less than $50 million |

So then, I made a spreadsheet to see - if the Steem blockchain was a company, what STEEM price thresholds would be needed to land in each class (based on the virtual_supply value).

Here's the result (barring copy/paste errors or silly typos):

| Side note: If Steem was the size of the largest tech companies, it would seemingly be priced well above $347... that's something to shoot for😉. |

|---|

So apparently, Steem would currently qualify as a Micro Cap business, and the next step up is a Small Cap. To reach Small Cap, the STEEM price needs to rise to $0.52.

Basically, we'd need to 4x the price. As shareholders in that hypothetical corporation, what should the community do if we want to spur that growth and sustain the gains as our five-year plan?

We have a shareholder proposal system for a reason. Tech development is good, but it's not the only thing.

Once again, I asked the AI. Here's what it said.

Here are some key steps a micro-cap business can take to transition from a micro-cap to a small-cap company:

Increase Market Capitalization:

- Grow the company's revenue, earnings, and overall financial performance to expand the market capitalization.

- This can be achieved through organic growth, strategic acquisitions, or a combination of both.

- Aim to reach the $300 million market cap threshold to be considered a small-cap company.

Improve Liquidity:

- Increase the trading volume and share float (the number of shares available for public trading) to improve the company's liquidity.

- This can be done by attracting more institutional investors, increasing analyst coverage, and enhancing investor relations efforts.

- Higher liquidity makes the stock more attractive to a broader range of investors.

Strengthen Corporate Governance:

- Implement robust corporate governance practices, such as having an independent board of directors, establishing board committees, and adopting transparent financial reporting.

- This helps build investor confidence and credibility in the company.

Enhance Financial Reporting and Disclosure:

- Ensure timely and comprehensive financial reporting that meets regulatory requirements and industry best practices.

- Provide detailed information about the company's operations, management, and future plans in the financial disclosures.

- This transparency can attract more institutional investors and research coverage.

Expand and Diversify the Business:

- Diversify the company's product or service offerings, customer base, and geographic reach to reduce risk and demonstrate growth potential.

- Pursue strategic partnerships, joint ventures, or acquisitions to expand the business and increase its scale.

Engage with Investors:

- Actively participate in investor conferences, roadshows, and other communication channels to raise the company's profile and attract new investors.

- Maintain regular and transparent communication with existing shareholders to build trust and loyalty.

By focusing on these key areas, a micro-cap company can work towards becoming a small-cap company, which can provide greater access to capital, increased liquidity, and broader investor interest.

And that spurs some questions (some of which I have touched on before):

- Can we make strategic acquisitions with the SPS? i.e. Should the SPS establish a strategic reserve with BTC and/or staked TRX?

- Should we establish something like a board of directors for the SPS? (I once suggested creating a steering committee and hiring a CEO for the SPS.)

- Should the SPS fund strategic partnerships with platforms like Rumble, DLive, BitTorrent, and/or Brave (especially in light of Tron's July Interstellar Heatwave and recent Rumble partnership)?

- Should the SPS hire influencers to blog (or even post embedded Rumble/DLive videos) and participate in comment discussions here?

- Should the SPS hire some quants to give us a robust theory of how and when to apply SBD interest?

All Steem investors are shareholders in a $76 million enterprise. It's decentralized, but it doesn't have to be rudderless.

This is all out of my wheel house, but between the SPS, blockchain rewards, and human ingenuity, we have resources that could be brought to bear for finding the right people.

Do we have leaders with the business chops to choose a direction and start things moving towards Small Cap status and beyond? If not, where do we find them, and how do we bring them here?

And when do we start? IMO, there's no better time then now.

Thoughts?

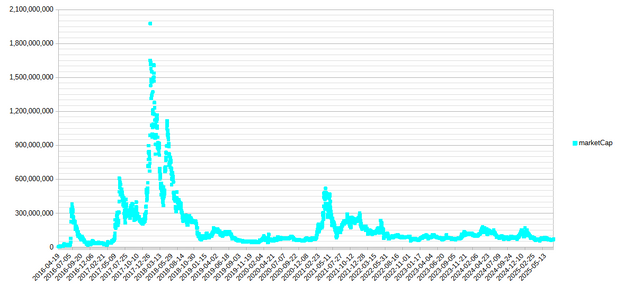

Update (July 11): This reply from @pennsif made me curious. Here's a graph of Steem's historical market cap. Looks to me like Steem has been in the micro cap range for most of its history, but it has transitioned (briefly) all the way from nano cap to mid cap. (historical data from @officialcmc)

Interesting angle.

When I started on Steem it would have been a Small Cap, and then climbed to a Mid Cap for a short spell.

Now alas we have dropped down to a Micro Cap.

In the general stocks and shares world retail investors are generally looking for capital growth, or dividend income.

Capital growth would be the best - but is more difficult to achieve.

Perhaps we can, at least in the interim, shout from the rooftops about the 'dividend income' side of Steem.

That is something we can offer at quite an attractive rate...

There is no external revenue and nothing the chain itself could call profit, so the "passive income" strategies in the current ecosystem don't work like dividends. At best they're purely inflationary, at worst they're purely extractive.

There's an implied assumption that growing to larger market capitalization is a goal of a company. Is it? Does a company care about its stock price? Should it? One reason a company might care about its stock price is that it can issue new shares and use the proceeds of that sale to fund business needs, but it's not clear to me that Steem as a chain can do anything analogous (except to the extent that the reward algorithm is already doing that).

Part of the problem is that there are a lot of misaligned incentives. If we're comparing it to a business, it's like being stuck in too many long-term commitments that don't make sense with the current reality (e.g. lots of debt, overpaid executives with buyout clauses in their contracts, etc.).

To revitalize the business you'd probably want either a "back to basics" initiative to get out from under the cruft of accumulated dead ends, or to chart a bold new course in terms of products/services to find a viable strategy. Either way could involve some potential pain for existing stakeholders.

Yes, yes, and yes. Investors care about growth, so a company should care about growth. If not, it won't have investors. The goal shouldn't be to directly manipulate the price, but rather to rearrange the health of the company so that the stock price goes up as a reflection of the business reality - which, I think, was reflected in my follow-up questions.

I agree that incentives are fundamental, but that shouldn't be an excuse for doing nothing. Beneficiary rewards already make it possible for any entrepreneur to align incentives however they want - almost without limit, but there's been very little experimentation or innovation. What's really needed (IMO) is leadership, vision, and action. If those things are cultivated, incentives will follow.

We don't really have lots of debt, given that "the firm" is only paying ~$0.80 on the dollar right now, and more than 50% of debt is locked up in the SPS, where it cannot be redeemed.

True, but I did specify a 5-year plan. Investors will tolerate short-term pain, if necessary, but even in a turnaround situation the 5-year goal should be targeting growth.

A lot of people think that the "shareholder value" movement in corporate governance has been a problem in that it led to lots of short-term thinking and financial engineering to produce numbers that looked good rather than robust, healthy businesses. Why not just try to build a robust, healthy business directly and treat the stock price as something that can be easily disconnected from long term value by chaotic trading? (Asked partly, but not completely, in a devil's advocate sense).

I agree. But it seems like with the current social dynamics of the chain, the only leadership people seem inclined to follow requires already having lots of money. I can't see any reason why an outsider with lots of money would want to use it to come fix the issues in this ecosystem when they could do literally anything else with their resources. So I think the ecosystem has to try to grow and fix itself from within rather than trying to lure in outsiders.

I was using that as an analogy of the kinds of problems a business could have, not a problem I was saying Steem literally has. Steem has some other problems, like the dominance of the vote-bot business model, the PR landmines that the Hive split seeded into the world that make it harder for the owners of the Steemit stake to take a leadership role without being accused of undermining decentralization, and other things.

Though I'm unfamiliar with all these terms but I would really love to see it grow

chriddi, moecki and/or the-gorilla