Sustainable Crypto Investment: How Buidl Fixed APY Stands Out in the DeFi Market

In an age where financial independence is becoming increasingly attainable through smart cryptocurrency investments, staking protocols have emerged as a cornerstone of decentralized finance (DeFi). Particularly, the fixed Annual Percentage Yield (APY) model has attracted many investors looking for predictable returns. Enter BUIDL, a token designed to revolutionize this landscape with its Buidl Autostaking and Auto-Compounding Protocol (BAP). With a robust and sustainable fixed APY of 526.5%, BUIDL offers a unique investment opportunity that sets it apart from the volatile DeFi market.

This article delves into the intricacies of BUIDL’s innovative staking protocol, explaining how it works, its advantages over conventional staking protocols, and the wide-ranging impact it has on your crypto investment portfolio. Ideal for both seasoned investors and newcomers to DeFi, this guide provides the expertise and clarity you need to make informed decisions.

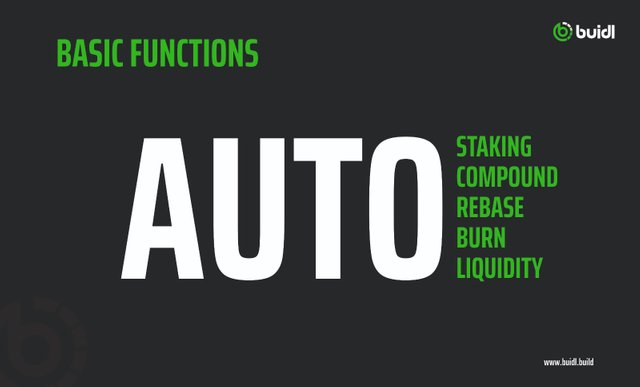

What Makes BUIDL’s Autostaking and Auto-Compounding Protocol Special?

Easy and Secure Staking Mechanism

One of the standout features of BUIDL is its ability to allow for seamless and secure staking directly from your wallet. Once you purchase $BUIDL, staking begins automatically, eliminating the need to transfer your tokens to a separate platform. This user-friendly approach not only saves time but also reduces the potential risks associated with moving assets between various platforms.

Fixed and Predictable Returns

BUIDL guarantees an unparalleled fixed APR, offering a daily Return on Investment (ROI) of 0.504%, which compounds annually to 526.5%. Unlike other DeFi protocols where APYs can fluctuate dramatically, BUIDL provides its holders with fixed returns, thereby eliminating the uncertainty commonly associated with crypto investments.

Understanding the Tokenomics and Utility of BUIDL Token

Detailed Tokenomics Breakdown

BUIDL’s tokenomics are meticulously designed to ensure a sustainable and incentivized ecosystem. The BUIDL token is a BEP-20 token with an elastic supply that rewards holders using a positive rebase formula. Here's a detailed breakdown:

- Initial Supply: 21,000 tokens

- Max Supply: 21,000,000 tokens

- Buy Tax: 13% (Risk Free Value: 5%, Auto Liquidity: 5%, Insured Fund: 2%, Burn: 1%)

- Sell Tax: 15% (Risk Free Value: 6%, Auto Liquidity: 5%, Insured Fund: 3%, Burn: 1%)

Utility in the BUIDL Ecosystem

The BUIDL token is not just for staking; it plays a crucial role in the broader BUIDL ecosystem. It enables decentralized governance, staking, yield farming, and much more, thereby providing multiple utility streams.

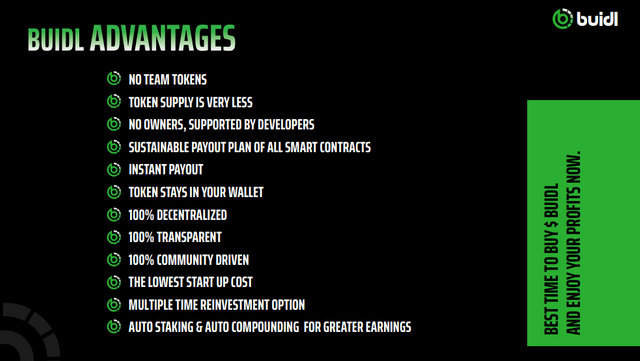

Why Choose BUIDL Over Other Protocols?

Industry-Leading Fixed APY

A significant feature of the BUIDL token is its industry-leading fixed APY of 526.5%. Many other rebase tokens promise exaggerated APYs, sometimes up to 200,000%, but these aren’t sustainable and often lead to severe market volatility. BUIDL’s approach offers a secure, predictable return.

Steady Rebase Rewards

Unlike traditional staking protocols that distribute rebase rewards every 8 hours, BUIDL’s BAP provides hourly rewards. This 60-minute rebase ensures that investors can maximize their returns without having to wait excessively.

Key Features That Ensure Sustainability and Security

Risk-Free Value (RFV) Fund

A notable aspect of the BUIDL protocol is its Risk-Free Value (RFV) fund. A percentage of buy (5%) and sell (6%) fees are funneled into this fund to sustain and back the staking rewards. This ensures long-term stability and sustainability.

Automatic Liquidity and Burn Mechanisms

5% of transaction fees are automatically directed towards liquidity pools, thereby supporting the ecosystem's growth and stability. Additionally, 1% of transaction fees are burned automatically, controlling inflation and potentially increasing the token's value over time.

Innovative Features That Make BUIDL Rug-Proof

Multiple security features are incorporated to make BUIDL rug-proof. For one, there’s no minting code that could allow a developer to create more tokens for themselves. Additionally, essential functionalities like buy/sell fee adjustments and user blacklisting are prohibited, ensuring a safer, more reliable investment.

Anti-Whale Mechanism

To prevent significant market instability, BUIDL has built-in mechanisms limiting large-scale transactions. Holders can only sell up to 1% of the liquidity per transaction, ensuring a balanced and sustainable ecosystem.

How BUIDL Works and Its Benefits for Your Portfolio

By simply holding BUIDL tokens in your wallet, you automatically receive interest every 60 minutes, thanks to the auto-compounding feature. The ease and security of this system make it an attractive option for those looking to grow their portfolio without constant monitoring or complex procedures.

Conclusion

Investing in BUIDL offers a blend of security, sustainability, and predictability unmatched in the current DeFi landscape. With its robust tokenomics, risk-proof protocols, and innovative features, BUIDL sets a new standard for what decentralized finance can offer. Whether you’re a seasoned investor or a newcomer to crypto, BUIDL provides the tools you need to make your investment work smarter, not harder.

If you need update and you can learn more at:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Author:

Forum Username = Neswaen

Profile Link = https://bitcointalk.org/index.php?action=profile;u=3447748

Wallet Address: 0x6aDC3Be487cf39224E0Da8669288E3738ecde93C