BUIDL Eliminates Complexity in DeFi Staking With Its Buy-Hold-Earn System

The world of decentralized finance (DeFi) is evolving rapidly, yet many users still find the process of staking and earning rewards overly complex. BUIDL is set to change this narrative with its innovative Buy-Hold-Earn system, which simplifies staking while offering unmatched returns. Powered by the BUIDL Autostaking Protocol (BAP), this system is designed to maximize convenience, sustainability, and financial growth for users in the DeFi ecosystem.

What sets BUIDL apart is its commitment to making DeFi accessible for everyone. With no need for manual staking processes, fluctuating APYs, or complex technical steps, BUIDL ensures that even newcomers can participate effortlessly. At the same time, its fixed and sustainable APY, high-frequency rebase rewards, and built-in risk mitigation tools make it an attractive choice for seasoned investors seeking long-term value.

Through its combination of ease, innovation, and reliability, BUIDL is poised to revolutionize the way users interact with DeFi protocols. The Buy-Hold-Earn system redefines the staking experience by eliminating complexity, creating a secure environment, and ensuring consistent portfolio growth for all participants.

How BUIDL Revolutionizes DeFi Staking

Simplifying the Staking Process

One of the main challenges with traditional DeFi protocols is the complicated process of staking tokens. Users are often required to interact with external platforms, manually stake tokens, and monitor fluctuating APYs (Annual Percentage Yields). BUIDL eliminates these barriers by providing an automatic staking system. From the moment users purchase $BUIDL tokens, they are automatically staked within their wallets. There is no need to transfer tokens to a separate platform, making the process safer and more accessible to a broader audience.

The simplicity of this approach ensures that even newcomers to DeFi can participate without any technical expertise. With rebase rewards occurring every 60 minutes, users see their token balances grow automatically, reinforcing the ease and effectiveness of the Buy-Hold-Earn system.

A Sustainable Fixed APY

BUIDL offers a sustainable fixed APY of 526.5%, ensuring predictable returns for token holders. Unlike other protocols that experience wild fluctuations in APY, often leaving investors uncertain about their earnings, BUIDL provides stability. This fixed APY translates to a daily ROI of 0.504%, allowing investors to accurately calculate their potential earnings over time.

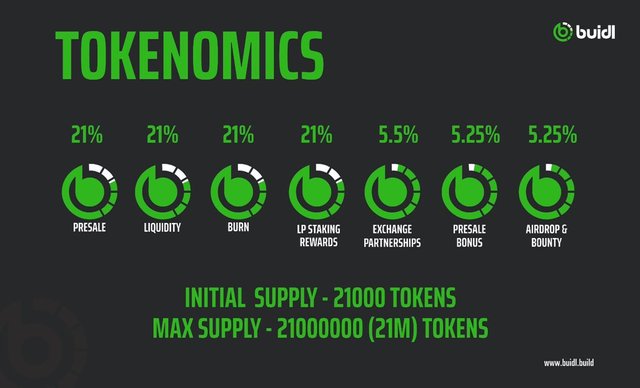

The sustainability of this fixed APY is further reinforced by the project’s tokenomics. With mechanisms like automatic liquidity provision and periodic token burns, BUIDL ensures that its rewards system remains viable for the long term. By maintaining a balanced ecosystem, BUIDL positions itself as a reliable option for both short-term and long-term investors.

Highlighting the Strengths of BUIDL’s DeFi Approach

Automatic Compounding and Rebase Rewards

A standout feature of BUIDL is its automatic compounding mechanism, which boosts the growth of user portfolios without any manual intervention. Rebase rewards are distributed every 60 minutes, giving holders 24 compounding events each day. This frequent distribution not only maximizes earnings but also eliminates the need for users to time their entry or exit points to optimize rewards. It’s a seamless experience that emphasizes convenience and profitability.

In comparison to other protocols that offer rebase rewards every 8 hours, BUIDL stands out as one of the fastest auto-staking solutions in the market. This high-frequency approach ensures that token holders benefit from continuous growth, making BUIDL an attractive choice for anyone seeking consistent returns in the volatile world of crypto.

Risk Mitigation with RFV and BIF

DeFi investments often carry risks due to market volatility. BUIDL addresses this issue through its Risk-Free Value (RFV) fund and BUIDL Insurance Fund (BIF). A portion of trading fees (5% from buys and 6% from sells) is allocated to the RFV fund, which helps sustain staking rewards and provides a safety net for the ecosystem.

Similarly, the BIF ensures investor protection by reducing the impact of sudden price drops or market crashes. With 2% of purchase fees and 3% of sales fees directed to this fund, BUIDL safeguards the interests of its token holders, creating a secure and sustainable environment for long-term growth.

Automatic Liquidity and Token Burn

BUIDL employs an automatic liquidity mechanism that directs 5% of trading fees back into liquidity pools. This continuous addition to liquidity strengthens the token’s market stability and ensures sufficient trading volume to support its APY model. Additionally, BUIDL incorporates an automatic burn feature, where 1% of transaction fees are burned to reduce the token supply over time. This deflationary mechanism helps control inflation and preserves the token’s value.

In summary, BUIDL's Buy-Hold-Earn system removes the complexities of traditional DeFi staking and delivers an effortless, profitable experience for its users. Its sustainable APY, robust tokenomics, and focus on risk mitigation ensure that the project remains a trailblazer in the DeFi industry.

Learn more and update at:

Website: https://buidl.build/

Twitter: https://x.com/buidlbsc

Telegram: https://t.me/buidlbsc

Author:

Username: Caramel Dusk

Profile Link: https://bitcointalk.org/index.php?action=profile;u=3447784

Wallet : 0xCCcDDeeE11fef2A7B41F8DAf83e215b224bdf70f