关于数字加密货币及区块链技术的推演 - Deduction on digital cryptocurrency and blockchain technology

TCP/IP协议解决了信息交换的问题

区块链技术解决了价值交换的问题

没有一个衍生货币会代替BTC的地位,这就像:朕一日不死,你们始终是太子的道理一样。

如果全体人都承认某个后来的数字币可以用来代替BTC的锚定币地位,那就等于同时在否定这个论点(意味着这个数字币未来也会被其他代替),这是个悖论,无法成立,如果成立,将造成所有数字币失去价值锚点,导致价值坍塌。

基于上面这个理论,再来推演BTC的进程:

1.去中心化,需要不停的有人加入网络,在网络内的人有利可图

2.假设0.1美金,有人无限收BTC,就会导致在0.1以下,马上有大批的套利者加入,然后会有投机的人通过囤币来短期操纵价格

3.随着交易的活跃,越来越多的目光会被吸引进来,这里一定有极少数理解,支持的人,这些人是不会因为价格暴涨卖出的

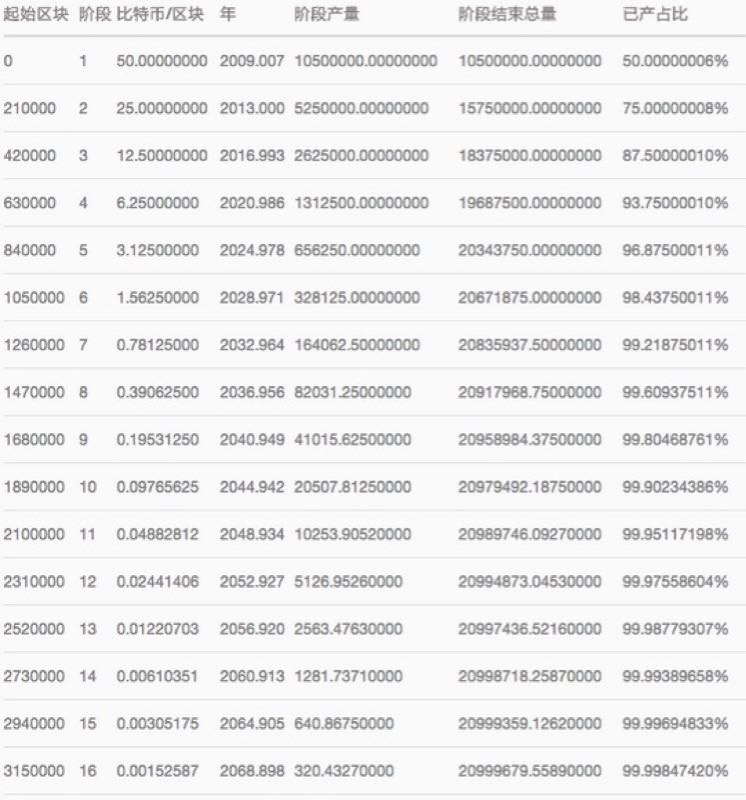

4.由于每4年产出减半的设计,可流通的货币会逐步减少,并慢慢聚集到这些坚定的持币者手里,使每个币的购买成本只能越来越高

5.持续连年的涨幅,会导致越来越多的人加入,头几批肯定是投机客,但随着时间的推移,价格的提升,流动只会越变越少,加上减产,导致持续的通缩,进而继续推动价格上涨。

6.随着市值的扩大,举个例子,当市值只有1000W的时候,只会吸引有5000存款的人,投入10块钱(因为他担心兑换问题),慢慢买的人多了,有1W存款的,买100的,导致每次加入持币者行列的人,所投入的资本越来越大,把整体市值做大后,必然有财团,企业,甚至国家级的资本介入,当然,这是后话。

7.当流动性通缩到一定地步的时候,他的价格波动也将稳定在每年不超过5%的涨跌幅,并且长期看涨(由于各国的增发货币政策,资产轮动策略)

8.这种情况会导致他最终和黄金一样,成为各国法币的锚点品种。

9.基于在目前全球互联网中心化严重的时间点下,区块链的出现是必然结果。

10.如果你使用区块链技术,就会变相承认BTC的价值。

11.流动性的保证:古董,艺术品,珠宝,大家都知道,其实是中产及富人转移大额财产和规避税收的途径,目前多了一个BTC,保值,全球范围兑现,还有长期对法币的上升预期...当BTC的价格趋于稳定后,这些富人的财产将会成为BTC的最大一波助推(目前已经有不少富人在这么做了)

12.BTC天然的隐匿性,为黑市交易,提供了最直接的途径,在整个网络产生监督筛查机制前,这些交易也会为网络提供流动性和买单。

如此预估BTC的价值至少会和黄金等价,达到2017年的8万亿美金水平,而目前他的整体市值只有1000亿美刀,即是说,至少有80倍涨幅。

The following from google translation:

https://translate.google.cn

TCP / IP protocol to solve the problem of information exchange

Blockchain technology addresses the issue of value exchange

No Derivative Currency will take the place of the BTC, which is like: king does not die, you are always the same as Prince Edward.

If everyone admits that a later digital currency can be used to replace BTC's anchoring status, it is equal to denying this argument at the same time (meaning that the digital currency will be replaced by others in the future). This is paradoxical and can not The establishment, if established, will result in the loss of value of all digital currency anchors, resulting in the collapse of value.

Based on the above theory, to deduce the BTC process:

- To be decentralized, there is a need for non-stop accession to the web, where people are profitable

- Suppose $ 0.1, someone unlimited BTC, will result in 0.1 below, immediately a large number of arbitrageurs to join, and then there will be speculators to use the hoarding money to short-term price manipulation

- With the active trading, more and more attention will be attracted, there must be a very small number of people who understand and support, these people will not be sold because of soaring prices

- Due to the design of halving the output every 4 years, the currency that can circulate will gradually decrease and slowly gather in the hands of these strong holders so that the purchase cost of each currency can only be higher and higher

- Continued year-on-year gains will lead to more and more people joining. The first few battles must have been speculators. However, as time goes by, price increases will only make the flow less and less, coupled with a decrease in production, resulting in a sustained Deflation, and thus continue to promote prices.

- As the market value expands, for example, when the market value is only 1000W, it will only attract 5000 depositors and invest 10 bucks (because he is worried about redemption issues). More and more people buy 1W Deposits, buy 100, resulting in each time you join the ranks of the holder, the capital invested in more and more, the overall market value bigger, there must be financial groups, businesses, and even state-level capital involved, of course, this After the words.

- When liquidity deflates to some degree, his price volatility will also stabilize at up to 5% per year, with long-term bullishness (due to additional monetary policies and asset rotation strategies in various countries)

- This situation will eventually lead him to become the anchor species for all countries, just like gold.

- The emergence of a blockchain is an inevitable result, based on the moment when the global Internet is currently at a serious global level.

- If you use blockchain technology, you will recognize the value of BTC in disguise.

- Liquidity Guarantee: Antiques, art and jewelry, as we all know, are in fact a way for middle-class and wealthy people to transfer large amounts of property and tax evasion. Currently, there is an extra BTC, hedging, cashing out on a global scale and long-term The rise of the French currency is expected ... As the price of BTC stabilizes, the wealth of these rich people will become the biggest boost to BTC (many wealthy people are already doing so)

- The natural hidden nature of the BTC provides the most direct route for black market transactions. These transactions also provide liquidity and payouts to the network before the entire network generates its oversight and screening mechanism.

So estimated that the value of BTC will be at least equal to the gold, reaching 8 trillion US dollars in 2017, while his overall market value of only 1000 billion US dollars knife, that is to say, at least 80 times the increase.