BTC Morning Update Technical Analysis 6/21/2018 -- crypt0s3nsh1 --

Greetings traders, my name is crypt0s3nsh1 and I'm here to give you a morning run down for Bitcoin. Remember to feel free to comment in the section below as I am open to ideas and always willing to learn & network. Also if you like what you see please upvote below! Now let's get to it:

DISCLAIMER: NOT FINANCIAL ADVISE. This is just my TA of how I see the market. Please thread lightly.

You can contact me:

Steemit: @s3nsh1

Twitter: https://twitter.com/crypto_s3nsh1

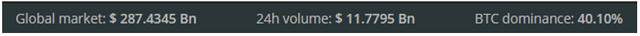

Global market cap down a few Bn, 24hr volume still low trending between 10-12Bn since Saturday. From the chart below, we can see we capped at a high of about 460Bn from the Apr run with a low at around 250Bn. We are much closer to than bottom than people think. Take note that we have been posting lower lows since January though so it's safe to expect if we do get one more dip we could dip below the 250Bn market cap. But the last time we've seen below 250Bn market cap was in November 22nd last year. Remember, both volume and prices declining can be interpreted as bullish. IF we do make a new year ATL (below 6K) it's possible to see a sudden surge in volume giving back life to the market. Because I do believe most people are on the sidelines waiting for an entry.

On another note, we should also realize that in Q1 of 2018 we have already produced 96% of the total volume in 2017 for BTC. Yes, this 2nd quarter we have most definitely slowed down in volume because of bearish sentiment but we can only dream what BTC will be like if we do make it over 1trillion market cap. We just have to look at the big picture. 57% of the total BTC volume comes from Japan and they are only 1.7% of the global population. Even just Intel corp has a bigger market cap than the whole crypto space.

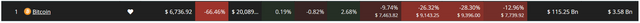

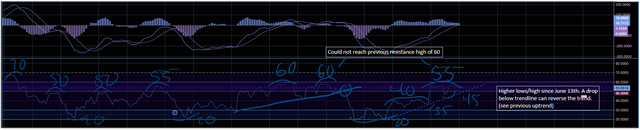

We can see green only past hr and week and slightly red over the past day indicating bulls are weakening at the 6.8K range.

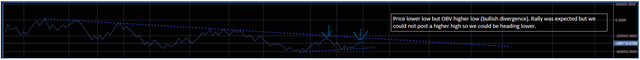

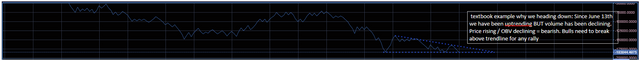

Volume declining as the price is rising can be interpreted as bearish. (More people are interested in buying at lower prices)

Summary:

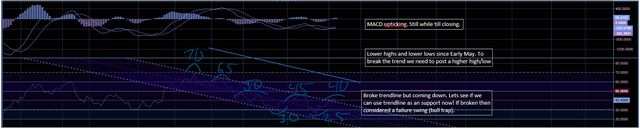

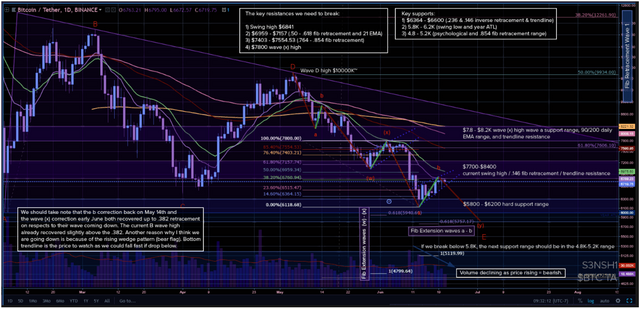

** SEE MORE DETAILED PICTURE BELOW **

- 1st in marketcap // 1st in 24hr volume

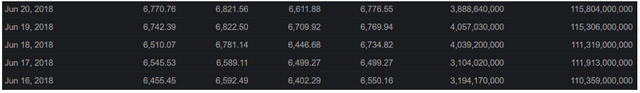

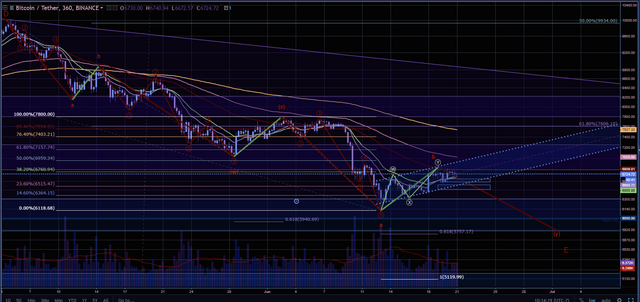

- Swing high: $6841 // Swing Low: $6320

- Daily 90EMA: $8007 // 55EMA: $7590 // 21EMA: $6974

- Red candle as expected after a spinning time and hammer. On the hourly bears are getting rejected at the 90EMA (~6.6K). We see volume trend down after posting the swing high though indicating that the bulls are weakening. We need to hold above previous day low ($6551) for any possible recovery of a new high this weekend.

Key resistances to break:

- Swing high $6841

- $6959 - $7157 (.50 - .618 retracement of wave a and daily 21 EMA)

- $7403 - $7554.53 (.764 - .854 fib retracement of wave a)

- $7800 (wave (x) high/wave a start)

Key supports:

- $6364-$6600 (.236 & .146 fib retracement of wave a & bottom trendline of the rising wedge)

- $5.8K- $6.2K (swing low and year ATL)

- $4.8K - $5.2K (psychological 5K and .854 fib retracement range)