MicroStrategy's Massive Bitcoin Bet: 55,000 More BTC Purchased

In a remarkable move within the cryptocurrency space, MicroStrategy, the business intelligence firm, has just announced the purchase of an additional 55,000 Bitcoins for approximately $5.4 billion. This acquisition brings their total Bitcoin holdings to an eye-watering 386,700 BTC, valued at over $37.9 billion at current market prices. Let's delve deeper into what this means for MicroStrategy, Bitcoin, and the broader market.

Background on MicroStrategy

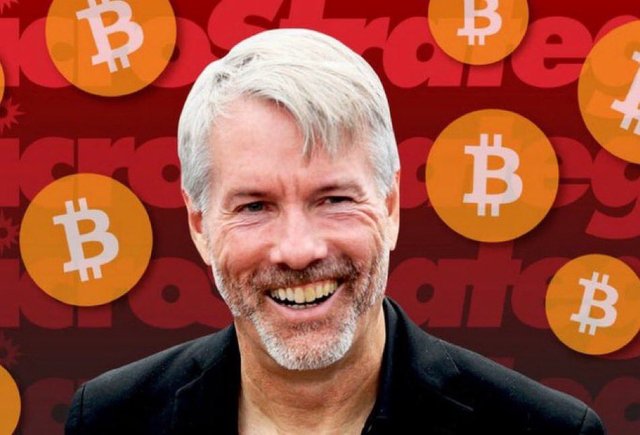

MicroStrategy, traditionally a software company, has pivoted into one of the largest corporate holders of Bitcoin under the leadership of its co-founder Michael Saylor. Here's a brief overview:

- 2020: MicroStrategy began their Bitcoin acquisition strategy as a hedge against inflation.

- Current Holdings: Prior to this purchase, they held 331,200 Bitcoins.

The Recent Acquisition

Purchase Details:

- Amount: 55,000 BTC

- Cost: ~$5.4 billion

- Average Price: Approximately $97,862 per Bitcoin at the time of purchase.

Funding:

- The funds for this purchase likely came from a combination of convertible debt offerings and equity sales, aligning with their previously announced capital raising plans.

Why This Matters

Market Influence: MicroStrategy's aggressive buying could be seen as a vote of confidence in Bitcoin's long-term value, potentially influencing other institutional investors.

Strategic Positioning:

- Hedge Against Inflation: By holding Bitcoin, MicroStrategy positions itself against potential currency devaluation.

- Asset Diversification: Diversifies their treasury holdings beyond traditional financial assets.

Bitcoin's Price Impact: While direct causation is hard to prove, large purchases by entities like MicroStrategy often correlate with increased demand and price movements.

Market Reaction

X Posts Insight:

- The crypto community on X (formerly Twitter) has reacted with a mix of awe and analysis, with many posts highlighting the potential for this purchase to push Bitcoin's price towards or above its all-time highs.

Web Sources Reaction:

- Financial news outlets have reported on this with titles like "MicroStrategy's Bit Bet" or "Saylor's Bitcoin Stash Grows," reflecting the magnitude of this financial decision.

Long-Term Implications

For MicroStrategy:

- This move could significantly impact their balance sheet, especially if Bitcoin's price continues to appreciate.

- It might also solidify their reputation as a crypto-friendly corporation, possibly attracting a new demographic of investors.

For Bitcoin:

- Increases institutional trust and adoption, potentially leading to further legitimization in the financial world.

- Could spur other corporations to follow suit, increasing Bitcoin's demand.

For Investors:

- Investors might see this as a signal to re-evaluate their own portfolios or consider Bitcoin as a significant asset class.

Conclusion

MicroStrategy's latest Bitcoin purchase underscores their commitment to the cryptocurrency as a cornerstone of their treasury strategy. While the immediate market impact remains to be fully seen, this move could have long-lasting effects on both Bitcoin's valuation and corporate adoption of cryptocurrencies.

References:

- Bloomberg - MicroStrategy acquires 55,500 BTC Bitcoin for $5.4 billion

- X (Twitter) - Latest discussions on MicroStrategy's Bitcoin acquisition

Stay tuned for more updates in the world of cryptocurrency, and let's discuss in the comments how this might shape the future landscape of digital currencies and corporate finance.