Palladium Network is Redefining Asset-Backed Tokens with Real Estate NFTs

The crypto industry has long promised to disrupt traditional finance by offering open, decentralized, and efficient systems. Yet, one of its recurring challenges has been volatility and the lack of intrinsic backing for most tokens. This is where Palladium Network (PLLD) steps in—a hybrid ecosystem merging real estate–backed NFTs with an automated arbitrage engine, designed to create stability, liquidity, and sustainable growth.

Enter Palladium Network (PLLD)—a groundbreaking hybrid system that merges real-estate–backed NFTs with an automated arbitrage engine. The result is a platform designed to provide stable returns, reduced volatility, and real-world utility for investors. By tokenizing prime properties and directing arbitrage profits into strategic token buybacks, Palladium offers a sustainable, asset-backed approach to crypto investing. This comprehensive guide explores Palladium Network’s mission, architecture, tokenomics, and real-world use cases, giving you an in-depth look at why PLLD is more than just another token—it’s a blueprint for the future of digital assets.

What Is Palladium Network (PLLD)?

Palladium Network (PLLD) is an ERC-20 token operating on the Ethereum blockchain, built to converge tangible real estate value with high-frequency arbitrage strategies. By tokenizing select properties and channeling a portion of arbitrage profits into buybacks of Palladium’s native token (PLLD), the platform provides both tangible asset security and liquidity advantages. This litepaper outlines the tokenization models, buyback mechanism, vesting schedules, and the architectural foundations designed to democratize premium real estate ownership while incentivizing rational market behavior. Palladium converges tangible real estate value with high-frequency arbitrage to produce a more stable and transparent blockchain environment. Through fractional NFTs, investors gain direct access to income-generating properties, while arbitrage-driven buybacks anchor PLLD’s market performance.

The Mission and Vision of Palladium

At its core, Palladium’s mission is to democratize access to premium real estate and stabilize crypto investing by combining transparency, security, and innovation.

- Mission: To create a globally trusted ecosystem where digital investors can access real-world assets without sacrificing liquidity or growth potential.

- Vision: A financial future where blockchain technology and tangible assets work hand in hand—empowering both individual investors and large institutions to participate equally.

By aligning cutting-edge DeFi mechanics with real-world value backing, Palladium fosters long-term sustainability, not just short-term speculation.

How Palladium Works: A Step-by-Step Model

Palladium Network’s hybrid design can be summarized in three interconnected steps:

Step 1: Arbitrage Engine

The platform uses automated arbitrage strategies to capture profits from crypto market inefficiencies.

Unlike risky speculative trading, arbitrage seeks low-risk profit opportunities by exploiting price differences across exchanges and liquidity pools.

Step 2: Real Estate Tokenization

High-quality properties undergo legal, environmental, and financial assessments before entering Palladium’s portfolio.

Properties are housed in Special Purpose Vehicles (SPVs) to maintain legal clarity and compliance.

Investors receive fractional NFTs, each representing ownership in a property, including rights to rental yields and appreciation.

Step 3: Ecosystem Integration with PLLD

Arbitrage profits fund periodic buybacks of PLLD tokens, anchoring token performance.

Investors can trade, stake, or hold PLLD to benefit from both ecosystem growth and real-world backing.

This model creates a feedback loop of value, ensuring that the ecosystem grows sustainably while rewarding active participants.

Real Estate Tokenization: Fractional Ownership for Everyone

Traditionally, investing in high-value real estate has been reserved for the wealthy or institutional players. Palladium changes that through real estate NFTs.

Benefits of Tokenized Real Estate:

- Fractional Ownership – Even small investors can hold shares of premium properties.

- Passive Income – Rental yields are distributed proportionally to NFT holders.

- Liquidity Advantage – Unlike traditional property, tokenized real estate can be traded instantly on blockchain markets.

- Diversification – Exposure to both real estate stability and DeFi growth within one ecosystem.

Example: Palladium has already secured its first property—a scenic mountain cottage near a ski resort. This property will be tokenized and fractionalized, offering investors a direct stake in a high-demand asset class.

Key Benefits of Investing in Palladium Network

Investors are constantly seeking projects that balance innovation with security. Palladium Network delivers on both fronts. Here’s why it stands out as a strong long-term opportunity:

- Tangible Asset Backing – Unlike most cryptocurrencies, PLLD has real-world value linked to tokenized properties. This provides investors with an extra layer of confidence.

- Passive Income Opportunities – Through staking PLLD and owning fractional real estate NFTs, investors earn both on-chain and off-chain rewards.

- Transparency and Reporting – Regular buyback reports, property updates, and arbitrage performance metrics ensure trust and accountability.

- Liquidity and Accessibility – The Poloniex listing and the upcoming PLLD Swap create easy access for global investors.

- Diversified Value Streams – Investors can choose between real estate yields (via NFTs) and arbitrage-driven returns (via PLLD tokens).

This dual-income model makes Palladium a balanced investment that combines security, liquidity, and growth.

How Palladium Compares to Other Projects

Many blockchain projects claim to integrate real assets or offer stable returns—but how does Palladium measure up?

1. Versus Stablecoins

Stablecoins (like USDT or USDC) are pegged to fiat currency, offering stability but no growth potential. Palladium, by contrast, combines stability with profit-sharing, giving investors a way to grow wealth rather than simply preserve it.2. Versus Traditional REITs

Real Estate Investment Trusts (REITs) allow fractional ownership of property, but they are centralized, heavily regulated, and often limited to accredited investors. Palladium’s NFT-based model democratizes access globally while ensuring blockchain-level transparency.3. Versus DeFi Yield Farming

Yield farming offers high returns but comes with extreme volatility and impermanent loss risks. Palladium reduces exposure by anchoring rewards to real estate and arbitrage trading profits—both of which are more sustainable.

In short, Palladium combines the stability of REITs, the transparency of blockchain, and the profitability of arbitrage, setting itself apart from both traditional and digital competitors.

Why Stake PLLD?

Staking is at the heart of Palladium’s community-driven model. By staking PLLD tokens, investors unlock:

- Passive Rewards: Earn additional tokens while strengthening the network.

- Ecosystem Security: Staked tokens help stabilize liquidity and reduce volatility.

- Alignment with Vision: Staking signals confidence in a platform designed to balance innovation with real-world value.

PLLD Gets Listed on Poloniex

A major milestone for Palladium was the official listing of PLLD on Poloniex, one of the most established crypto exchanges worldwide.

This listing delivers:

- Increased Liquidity – Easier entry and exit for both new and seasoned investors.

- Global Reach – Access to a broad international user base.

- Credibility – Listing on a respected platform validates Palladium’s roadmap and long-term commitment.

Poloniex’s recognition underscores Palladium’s vision of building a bridge between digital assets and traditional markets.

PLLD Swap: Seamless Trading for the Community

Another exciting development in Palladium’s roadmap is PLLD Swap, a user-friendly trading service set to launch within 6 to 12 months after the platform’s release.

How PLLD Swap Works:

- Wallet Connection: Users connect via Web3 for secure access.

- Token Selection: Choose tokens and blockchain networks.

- Real-Time Pricing: Transparent display of prices, slippage, and fees.

- Execution: Seamless swap completion with instant crediting of assets.

Benefits:

- Enhanced Liquidity for PLLD and supported tokens.

- Synergy with Arbitrage Engine to maintain stable prices.

- Future Expansion with new tokens, advanced analytics, and loyalty incentives.

- This integration ensures consistent growth and ecosystem cohesion.

Utility of the PLLD Token: More Than Just a Coin

PLLD isn’t just a speculative asset—it’s the keystone of the Palladium ecosystem.

Arbitrage-Backed Value

- Arbitrage profits are used to buy back PLLD, reducing circulating supply and supporting token performance.

- This ensures profit-sharing without inflationary emissions.

Distinction from Real Estate NFTs

- NFT Holders earn rental income and appreciation.

- PLLD Holders benefit from arbitrage-driven buybacks.

- This dual-asset model creates clear, transparent income streams for different investor preferences.

Driving Rational Behavior: Stability Over Speculation

One of Palladium’s most important contributions is its ability to reduce speculation and promote rational market conduct.

- Measured Growth: Value appreciation tied to arbitrage success, not hype.

- Transparency: Regular reports detail arbitrage activity, buyback schedules, and treasury performance.

- Market Maturity: By focusing on sustainable mechanics, Palladium encourages healthier liquidity and reduced volatility.

This makes PLLD not just another crypto project, but a catalyst for blockchain maturity.

Why Palladium Network Matters

Palladium Network (PLLD) represents a new paradigm for blockchain finance. By combining tangible real estate assets with sophisticated DeFi mechanics, it bridges the gap between traditional stability and digital innovation.

Whether you are:

- An investor seeking exposure to real estate-backed digital assets,

- A community member looking to stake and grow wealth passively, or

- A DeFi enthusiast eager for projects with real-world utility,

- Palladium provides a balanced, sustainable, and future-proof opportunity.

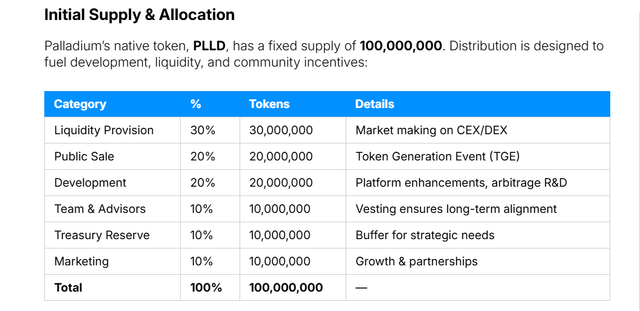

Tokenomics

Palladium’s native token, PLLD, has a fixed supply of 100,000,000. Distribution is designed to fuel development, liquidity, and community incentives:

- Liquidity Provision- 30%- 30,000,000- Market making on CEX/DEX

- Public Sale- 20%- 20,000,000- Token Generation Event (TGE)

- Development- 20%- 20,000,000- Platform enhancements, arbitrage R&D

- Team & Advisors- 10%- 10,000,000- Vesting ensures long-term alignment

- Treasury Reserve- 10%- 10,000,000- Buffer for strategic needs

- Marketing- 10%- 10,000,000- Growth & partnerships

Vesting Schedules

Development (20%)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (e.g., Swap launch, real estate tokenization).

Team & Advisors (10%)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

Treasury Reserve (10%)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

Marketing (10%)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

Buyback Mechanism

Central to Palladium’s sustainability is a profit-sharing buyback system, where a portion of arbitrage returns fund PLLD repurchases:

- Arbitrage Earnings: Profits generated from market inefficiencies are channeled into the buyback pool.

- Periodic Token Buys: At randomized intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

- Supply Reduction: Tokens are transferred to the treasury or retired, effectively shrinking circulating supply and potentially supporting the token’s market value.

Transparent Reporting" Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

Roadmap

Phase 1 (0–6 Months)

- Expand arbitrage coverage to multiple exchanges

- Conduct buybacks from initial trading profits

- Complete preliminary audits

Phase 2 (6–12 Months)

- Launch PLLD Swap

- Roll out first fractional real estate NFTs

- Integrate advanced arbitrage (options, futures)

Phase 3 (12+ Months)

- Diversify global property portfolio

- Implement AI-based arbitrage modules

- Maintain ongoing buybacks and periodic vesting updates

Conclusion

The crypto industry has long struggled to align speculative opportunity with intrinsic value. Palladium Network (PLLD) offers a solution: a hybrid model where real estate tokenization and arbitrage-driven buybacks reinforce one another, creating a transparent, stable, and rewarding ecosystem.

With Poloniex listing, upcoming PLLD Swap, and an ambitious roadmap, Palladium is poised to become a cornerstone project in asset-backed blockchain finance.

Stay connected with us:

- Website: https://plld.net/

- Twitter: https://x.com/DDTechGroup

- Telegram: https://t.me/Palladium_PLLD

- Whitepaper: https://plld.net/whitepaper

- View PLLD on CoinGecko: https://www.coingecko.com/en/coins/palladium-network

Author:

Bitcointalk username: CaspionTorin

Bitcointalk link: https://bitcointalk.org/index.php?action=profile;u=3696881

Wallet Address: 0x2E5444EF0Aa8f86CdEC47A13aA169C08753D2532