Bitcoin: From Two Pizzas to a Trillion-Dollar Consensus

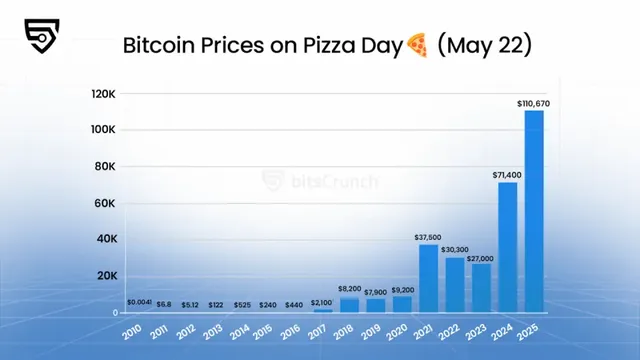

Bitcoin Hits $110,000 All-Time High on Pizza Day: A 15-Year Journey from 41 Dollars to 11 Billion

As Bitcoin price breaches $110,000, setting a new record, May 22nd—the annual "Pizza Day"—once again draws attention to a historic moment 15 years ago: the pizza worth $1.1 billion in today's terms.

1. The Genesis of Value Enlightenment

In 2010, the Bitcoin network was in its "primitive era":network hashing power was less than one-trillionth of today's, exchanges didn't exist, and holders were mostly geeks and tech enthusiasts. When Laszlo posted on the forum offering Bitcoin for pizza, the "value anchoring" of cryptocurrencies was still nonexistent.

On May 22, 2010, American programmer Laszlo Hanyecz bought two Papa John's pizzas with 10,000 BTC, marking Bitcoin's first real-world payment use. Then, 10,000 BTC were worth ~$41, or $0.0041 per coin.

Fifteen years later, at Bitcoin's $110,000 price, those pizzas would be worth a staggering $1.1 billion. This figure isn't just a milestone in Bitcoin's early days; it reveals crypto's epic shift from a fringe experiment to a global asset.

2. Bitcoin's Price Trajectory Over 15 Years

From $0.0041 to $110,000, key cycles and drivers in Bitcoin's development are visible through annual May 22nd price data from bitsCrunch.com.

Technological Maturation (2010-2013): From concept to initial adoption, Bitcoin proved decentralized currency's viability.

- May 2011: Price hit $6.8 as Silk Road's emergence showcased anonymous payment potential.

- May 2013: Price surpassed $122, driven by Cyprus debt crisis fueling its "safe-haven" narrative, with 5,400% annual growth.

Speculative Frenzy (2014-2017): Volatility attracted global attention but exposed market immaturity.

- 2014: Mt.Gox hack caused price to halve from $525 to $240 (2015), the first major risk education.

- 2017: Ethereum's smart contracts and Lightning Network drove recovery to $2,100 in May, surging to $19,783 in December during the ICO boom.

Institutional Recognition (2018-2021): Traditional finance embraced Bitcoin as a digital asset.

- 2021: Price hit $37,500 as Tesla and El Salvador added BTC to balance sheets.

- 2024: US spot ETF approval, 4th halving, and global fiat inflation pushed price to $71,400, with 217% annual returns.

3. Structural Shifts Behind the All-Time High

With a $2.1 trillion market cap (surpassing Amazon), Bitcoin's value logic has evolved:

- Strengthened macro-hedging properties

- Regulatory clarity in US/EU crypto markets

- Institutional on-ramps via Coinbase, BlackRock, etc.

Laszlo's 10,000 BTC was once mocked as a "foolish trade," but today it embodies the Austrian school's "subjective value theory": value stems from collective consensus, not physical form. In 15 years, Bitcoin has evolved from a geek forum experiment to a "free currency" for hundreds of millions—its price chart is a history of humanity's evolving understanding of decentralized finance.

4. Conclusion: Consensus Creates Value

The annual #PizzaDay trend on social media has become more than a memorial; it's a symbol of crypto community cohesion.

At $110,000, Pizza Day represents crypto's cultural totem: a reminder that technological innovation starts with tiny practices. As Satoshi embedded in the Genesis Block, "The Times 03/Jan/2009 Chancellor on brink of second bailout"—Bitcoin's mission may be to realize the free ideals behind those two pizzas 15 years ago.

And we are all participants in this history, witnessing and shaping the future of digital currency

.webp)

.webp)