The Bitcoin price prediction table has been verified 2 times

Content

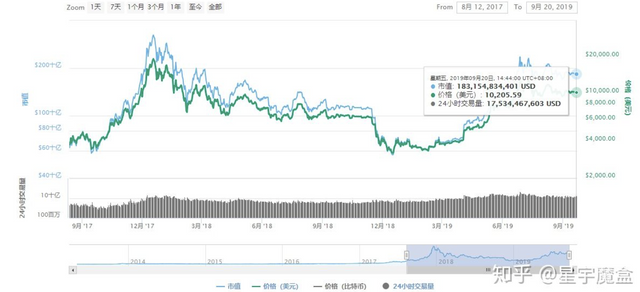

Today is September 20th, and the time is about to enter October. In other words, Bitcoin has to rise by 65% in a month to reach the target price of $16,000. At the same time, the forecast indicates that Bitcoin's market value will be reduced to 40%-46%, far lower than the current 69.3%.

The current mainstream currency market is full of blood. If the prediction is accurate, this also means that the mainstream currency market may eventually usher in an explosion.

Many bigwigs have always emphasized: make money from trends. Spot plus futures double the single long holding, you will outperform 90% of investors in the market. And those speculators who are short-term long-short-term operations, sooner or later, because of one of their own mistakes, they will get off the battlefield in advance and get off.

Some time ago, many people in the community were bearish on Bitcoin. Many people predicted that Bitcoin would fall below US$8,600. Two months later, have you ever seen it fall below US$9,000?

Many people have this concern because of the shadow of the bear market last year. They are worried that Bitcoin will fall like last year?

I think it is unlikely. Last year, various bulls, ghosts and zombies, under the banner of blockchain, cut leeks and fry the blockchain and Bitcoin forcibly, believing that this is a "scam" and a pyramid scheme, which has overdrawn the value of the entire crypto asset market. However, this year is an important year for the price and value of crypto assets to recover. Ether has risen from last year’s lowest of 83 US dollars to around 350 US dollars (the highest price so far); EOS has risen from last year’s 1.59 US dollars to around 8 US dollars (this year) Highest price).

Some time ago, an article about Bitcoin's ten-year price trend has blasted the circle of friends. If you have read this article, I believe you have to marvel at the powerful vitality of Bitcoin. Is Bitcoin's success accidental or inevitable? (Play video)

I think it was born by accident, but its growth is inevitable. Bitcoin is considered by mainstream capital to be worthless and like a "tulip bubble". Its soaring and quintessence is caused by people's investment behavior.

Here, I would like to mention the anonymous coins that were recently removed from the Korean exchange. An article analyzed that these anonymous coins were forced to be removed. Does it mean that there is no market for anonymous coins and will be zero? Someone gave an example. Anonymous coins have been offline twice, but the anonymous coin market has not been bleak, but prices have increased.

What Chang Saijun wants to say is that there are some things that may not be very popular with supervision, but they cannot obliterate their existence. Existence is reasonable. Anonymous coins are in line with the spirit of the blockchain, encryption, decentralization, and trustlessness. We are fed up with a bunch of problems with the creation of the US dollar as a token. That's why Bitcoin appeared.

The reason why Bitcoin can go to this day is reasonable. It can solve problems that the traditional financial world cannot solve. From another perspective, the development and growth of Bitcoin represents public opinion. We do not need a third party and hope to realize the free circulation of value.

Of course, the rationality of Bitcoin is that it is likely to become an ideal store of value. The following is the opinion of a foreign analyst: Bitcoin becomes a store of value and cannot do without these necessary characteristics:

· Durable: not easy to rot or easily destroyed. So wheat is not an ideal store of value

· Portability: Goods must be easy to transport and store to prevent loss or theft and make them convenient for long-distance trade. Therefore, cattle are not as ideal as gold bracelets.

· Fragile: A sample of the product should be interchangeable with another sample of the same amount. There is no alternative, and the coincidence of the demand problem remains unsolved. Therefore, gold is better than diamonds, and diamonds are irregular in shape and quality.

· Verifiable: It must be easy to quickly identify and verify as authentic. Simple verification increases the confidence of its recipients in the transaction and increases the possibility of transaction completion.

· Dividable: Must be easy to subdivide. Although this attribute is not so important in early societies where trade is not frequent, it becomes more and more important as trade flourishes and the number of exchanges becomes smaller and more precise.

· Scarcity: As Nick Szabo said, currency commodities must have "unforgeable costs." In other words, the quantity of goods must not be too large or easy to obtain or produce. Scarcity may be the most important attribute of valuable storage because it utilizes the rare elements that humans desire to collect. It is the source of the original value of the value store.

· Long history: The longer society considers a commodity to be valuable, the more attractive it is as a store of value. In addition to the power of conquest or significant advantages in the other attributes listed above, a long-standing store of value will be difficult to replace by new upstarts.

· Censorship resistance: A new attribute that has become more and more important in the digital society. It has universal surveillance and is a kind of censorship resistance.

It is also worth mentioning that Battk will list Bitcoin futures on September 23. Battk's background is not small, it is a sub-exchange under the American Intercontinental Exchange Group (ICE). Behind it is the strong support of Microsoft, BCG and other giant companies.

Battk launched bitcoin futures and officially opened its physical settlement of bitcoin futures trading, which means that bitcoin transactions are legalized and traditional mainstream funds will vigorously enter the encrypted digital currency market. This is a relatively good news for bitcoin . In addition, the well-known Li Ka-shing also invested in Battk.