Search for bitcoin that surpasses the stock when the economic sky is gloomy

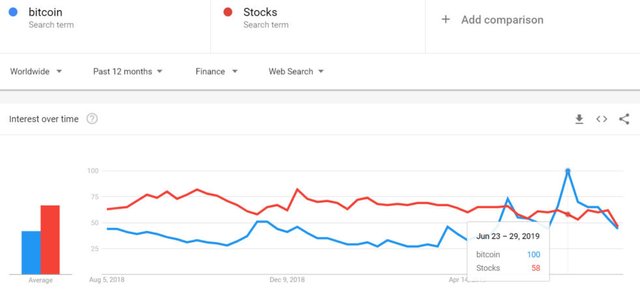

What people search on the internet can often be a good indicator of potential investment trends. According to Google Trends, there are now more people interested in bitcoin than stocks.

Bitcoin passes stocks on the search front

For the first time since the end of 2017, bitcoin searches on Google have surpassed searches for stocks. For most of 2018 when bitcoin and electronic money were difficult in the bear market, looking for higher stocks. But when the BTC started to increase in April and May this year, the trend changed for the digital money.

655/5000

In the week from June 23 to June 29, bitcoin overshadowed stocks at an interest rate of 100 compared to the 58 of the traditional asset class. The average for the last month is also in bitcoin's territory, with a score of 79 to 76.

Geographically, most stock searches originate from the US and Canada and it is very likely that people are looking for individual stocks instead of common forms. However, the trend may indicate a change in the model of broader interest in electronic money assets as a means of investment.

The top five countries most interested in bitcoin over the past month are Brazil, Turkey, Nigeria, Germany and Argentina.

The economic crisis is deepening

There may be some basic factors that promote this search trend. First, bitcoin has been paying close attention to politics by all the wrong reasons. Facebook has clearly induced managers, who have brought fear to all digital assets. Bitcoin was also mentioned last month by US President Trump in a tweet that most industry observers view it as a sign of rising prices despite potential negative sentiment.

It is undeniable that global economic woes are escalating as the memories of the recent financial crisis begin to return. Once again, the United States is leading financial tension with the escalating trade war with China. The collapse has since been felt across Asia as neighboring countries began to wonder if they would be the next target for Trump's tariffs.

Britain's Brexit created an unstable economic cloud that lasted more than two years when fighting between incompetent politicians delayed the process and prevented any opportunity to move forward. As a result, GBP has dropped to an unprecedented low for several years.

The problem of escalating debt in most developed countries may also be pushing people to study bitcoin as a way for them to find ways to counter their own currencies while worrying about a crisis. other finance.