BraveNewCoin: Leading Japanese insurer testing a blockchain system for insurance derivatives

Luke Parker || Blockchain Adoption || Insurance || Japan

Sompo Japan Nipponkoa Holdings Inc. recently announced a trial of blockchain technology for derivative products, in collaboration with Soramitsu Co Ltd. The Tokyo-based company is one of largest insurers in Japan.

The insurers biggest subsidiary, Sompo Japan Nipponkoa, had a 27% share of the domestic non-life insurance market by net premiums written in 2015, according to one of the largest international rating agencies, Fitch. The company's 2016 annual report shows overall net premiums written of ¥2,218.4 billion, or US$19.68 billion. Meanwhile, total profit was ¥215.5 billion yen, US$2.14b.

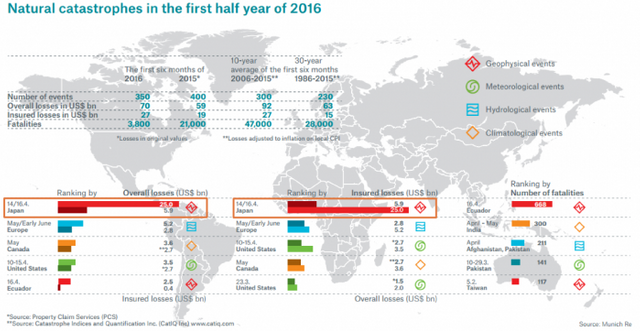

Japan is one of the countries most affected by natural disasters, including tsunamis, floods, typhoons, earthquakes, cyclones and volcanic eruptions. With a population of approximately 127 million, Japan tops the global table for both overall and insured losses. According to a July report by leading reinsurance intermediary, Aon Benfield, global economic losses were US$98b in the first half of 2016, while insured losses were US$30b.

Kumamoto's earthquakes resulted in nearly 160,000 damaged or destroyed structures. The Japanese government estimated total reconstruction cost to be between US$30 and US$42 billion, while Aon Benfield estimates the total insured losses to exceed US$5b. The largest reinsurance company, Munich Re, independently estimated that losses from the two earthquakes totalled US$25 billion, only US$6b of which was insured.

Sompo holdings has already been working on derivative insurance contracts using blockchain technology, such as weather derivative, in collaboration with Soramitsu Co Ltd. The startup only launched in February, and was previously focused on creating a blockchain-based digital identity platform.

The new “Derivative System Using Blockchain Technology” aims to create a service that simultaneously shares data, such as contract details on the blockchain, explains Sompo Holdings. The system can accurately and swiftly carry out every step in the insurance process, “from managing risk aggregation for derivative products to determining whether or not to pay out on claims and implementing procedures to pay compensation.”

Derivative products help companies that have suffered reduced earnings or increased expenses due to natural phenomena. These instruments pay out a fixed amount in response to changes in indices such as temperature or rainfall. It can also pay out when a triggering event such as earthquakes and volcanic eruptions occurs.

Earthquake derivatives and other natural disaster derivatives are usually referred to as “catastrophe derivatives.” They are commonly embedded in insurance companies' “catastrophe bonds” (CAT bonds), which are high-yield debt instruments meant to raise money in case of a catastrophe such as a hurricane or an earthquake.

According to technology research and advisory firm Novarica, these post-event actions happen without regard to specific losses, so there is less need for subjective review. “This means a blockchain implementation can manage a contract, maintain the financial stake, and properly transfer ownership in a secure and transparent way based on the original agreement,” states Vice President of Research and Consulting, Jeff Goldberg.

Sompo Holdings claims that blockchain technology has the potential to enable the provision of highly secure financial services, and improve service efficiency, while controlling system investment costs.

The two companies will also be examining the technology for broader applications in new insurance products.The two companies are not the first to apply blockchain technology to catastrophe derivative products. In June, insurance giant Allianz partnered with Nephila to pilot blockchain smart contract technology for catastrophe bonds and swaps.

“Blockchain technology would increase reliability, auditability and speed for both cat swaps and bonds,” according to Allianz Risk Transfer AG (ART) Chief Underwriting officer, Richard Boyd. “Less manual processing, authentication and verification through intermediaries is required to confirm the legitimacy of payments/transactions to and from the investors,” he explained at the time.

The topic has also been touched on by some of the largest advisory firms and organisations in the world. PricewaterhouseCoopers (PwC) recently challenged the insurance industry to adopt technologies such as blockchain to save millions of dollars. The firm published a report claiming that reinsurers could save up to US$10 billion by implementing this technology.

McKinsey & Company recently published “Blockchain in insurance – opportunity or threat?” The document highlights potential uses in insurance, and asserts that blockchain can address the competitive challenges many incumbents face. The report specifies poor customer engagement, limited growth in mature markets, and the trends of digitization. “We outline the most promising insurance-related use cases in three categories: enabling growth, increasing effectiveness, and reducing cost by automating key processes,” McKinsey wrote. However, the firm also cautioned not all areas of insurance can be improved by blockchains.

A United Nations Research Institute for Social Development (UNRISD) working paper, published in February, describes how a blockchain could be used for climate derivatives. “Imagine a coded blockchain-based script that is activated when two parties send bitcoins to an escrow Bitcoin account that is controlled by the script,” writes Brett Scott. “This smart-contract is programmed to read data from weather agencies, and after a set amount of time releases the bitcoins from the escrow, sending it to a farmer who requires protection against low rainfall. This is a blockchain-based weather derivatives contract.”

Deloitte published a report earlier this year outlining how blockchain-based smart contracts “could provide customers and insurers with the means to manage claims in a transparent, responsive and irrefutable manner." The topics echoed the UNRISD, smart contracts could enforce claims, "triggering payments automatically when certain conditions are met." The blockchain could ensure that only valid claims are paid, and “would know that a claim had already been made."

Global advisory firm Willis Towers Watson, published a report in June that states "blockchain technology may solve many problems the insurance industry faces." The firm also notes smart contracts, which could "increase pricing efficiency and boost direct sales channels." Blockchain would eliminate the need for face-to-face registration, the firm added. "Compliance could also be programmed into the blockchain to automatically verify policy holders, service providers and claims."

This article can be found on our website on this link

According to the BNC indices, at the time of writing:

Steem was trading at $0.49126809

bitcoin was trading at $606.07

i don't think its a good idea.Bankers don't deserve crypto, they'll just fuck it up.

Exciting!

Great piece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Following. Cheers. Stephen