Why Bond Investors Are More Afraid Of The Coronavirus Outbreak

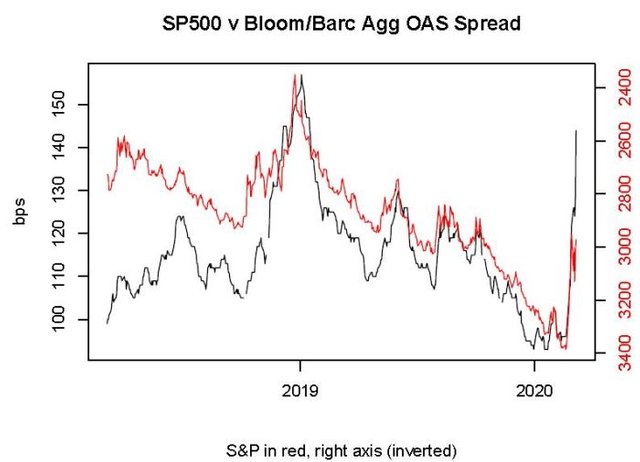

On Friday I tweeted a picture from our daily chart pack, and mused that either credit is too negative or stocks are not negative enough.

SP 500 Vs Bloom/Barc Agg OAS Spread  SP 500 Vs Bloom/Barc Agg OAS Spread

SP 500 Vs Bloom/Barc Agg OAS Spread

I spent the weekend thinking about why the bond guys seem to be so negative about the effects of the COVID-19 virus compared to the stock guys. Equity investors tend to tell me things like “well, the fundamentals are pretty sound” (ignoring the role that multiples play in stock market levels), which sometimes manifests in super-dumb things like Larry Kudlow’s admonition a few thousand points ago that people should buy the dip. (By the way, all those folks who bought the dip because Larry said so…will the government make them whole? Didn’t think so. Rule to remember: never take the advice of someone who has a vested interest in the outcome.)

Meanwhile, bond investors had put bond yields at all-time lows. This is especially amazing compared to the levels that yields reached in the Global Financial Crisis; back then, a housing bubble was in the process of imploding and, since shelter is a major part of core inflation it was a done deal that inflation was going to plunge, and far (Core CPI eventually got as low as 0.6%, although it didn’t get very low at all ex-housing). So low nominal yields made sense.

But today, this does not seem to be in the offing. Core inflation is more likely to accelerate with the effects of the supply shock, unless the virus gets so bad that we really do have a major demand shock. And even then it should not fall very far. So the message from the bond market is super negative on growth, and stocks are only a little off their all-time highs (at least, until today. Right now S&P futures are -4%, although a lot of that has to do with the collapse of energy prices thanks to the disintegration of OPEC+). So again, I wonder, why?

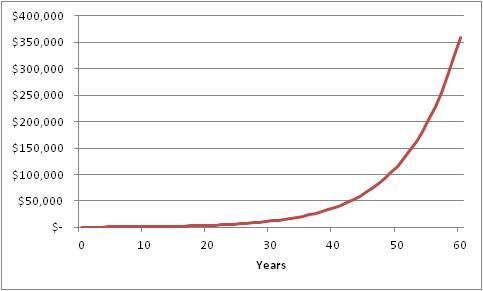

After long thought I think it is because bond investors understand much more viscerally the power of compound interest. Compound interest is the concept that money grows not linearly, but exponentially over time. If I start with $400 and grow it at 12% per year, here is what it becomes.

Money Log Chart  Money Log Chart

Money Log Chart

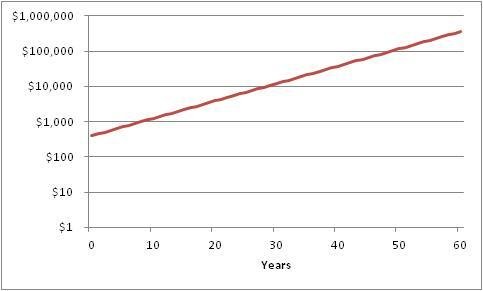

So that little $400 ends up being a really big pile of money after 60 years! From little acorns do mighty oak trees grow, and all of that. But equity folks don’t love this chart because the first 20 years look incredibly uninteresting, not at all like Tesla (NASDAQ:TSLA). Now, if we look at this in log scale, it looks much more boring but this next chart says the same thing: stuff is compounding at 12%.

Equity Chart  Equity Chart

Equity Chart

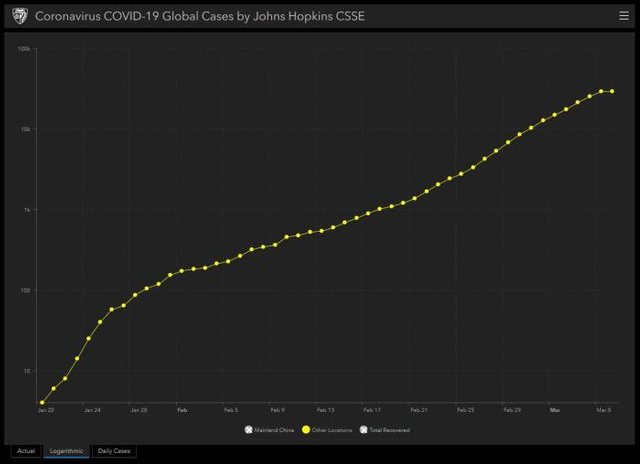

And that chart actually looks kinda similar to this chart, sourced here.

Coronavirus Global Cases  Coronavirus Global Cases

Coronavirus Global Cases

This is a plot of COVID-19 cases outside of China, and the left axis is log scale. What this chart says is that there is no sign that the rate of growth of cases of COVID-19 is slowing. In fact, its spread has been remarkably consistent since the beginning of February. Roughly, the number of cases in the U.S. has been growing at around 12% per day. Which means that the chart looks a whole lot like the chart of $400 turning into $360,000 over 60 years, except that now it is 400 cases (Friday’s figure) turning into 360,000 cases over 60 days.

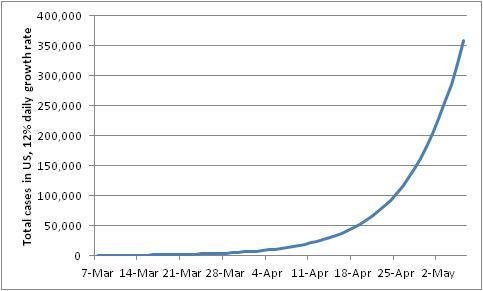

Total Cases In US - Daily Growth Rate  Total Cases In US - Daily Growth Rate

Total Cases In US - Daily Growth Rate

So when people say “the flu kills more people than this virus,” I know they’re equity folks. They see 400 cases and compare to 36,000 flu deaths and scoff. But that just tells me they don’t appreciate the power of compounding.

Yes, COVID-19 hasn’t killed 36,000 Americans yet. But the flu kills that many per year despite the fact that (a) it isn’t generally communicable for very long outside of the period when the carrier has symptoms—which is why it’s okay to go back to school when you’re fever-free for 24 hours, (b) it has a pretty low fatality rate in the 1-2% range, and (c) almost everyone is inoculated against the flu. COVID-19 beats the flu on all three of those metrics.

That doesn’t mean that this bug will kill everyone, but it does mean that it is fairly likely to kill more than the flu unless something changes with the rate of exponential growth. By the end of May, the same growth rate would mean more than 6 million Americans have gotten the virus, which means a couple hundred thousand would die.

This is not a prediction, and I really hope that the rate of contagion slackens and the survival rate increases. I don’t know what would cause that to happen: I am not an epidemiologist. I’m just a bond guy, and I understand compounding.

In investments, compounding is your friend. In disease, compounding is your enemy.